Blackberry 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 1, 2008

30

as a process designed by, or under the supervision of,

the Company’s principal executive and principal financial

officers and effected by the Company’s Board of Directors,

management and other personnel to provide reasonable

assurance regarding the reliability of financial reporting and

the preparation of financial statements for external purposes

in accordance with U.S. GAAP and includes those policies and

procedures that:

• pertain to the maintenance of records that in reasonable

detail accurately and fairly reflect the transactions and

dispositions of the assets of the Company;

• provide reasonable assurance that transactions are

recorded as necessary to permit preparation of

financial statements in accordance with U.S. GAAP, and

that receipts and expenditures of the Company are

being made only in accordance with authorizations of

management and directors of the Company; and

• provide reasonable assurance regarding prevention

or timely detection of unauthorized acquisition, use or

disposition of the Company’s assets that could have a

material effect on the financial statements.

Because of its inherent limitations, internal control over

financial reporting may not prevent or detect misstatements.

Projections of any evaluation of effectiveness to future

periods are subject to the risks that controls may become

inadequate because of changes in conditions, or that the

degree of compliance with the policies or procedures may

deteriorate.

Management assessed the effectiveness of the Company’s

internal control over financial reporting as of March 1, 2008.

In making this assessment, management used the criteria set

forth by the Committee of Sponsoring Organizations of the

Treadway Commission (COSO) in Internal Control-Integrated

Framework. Based on this assessment, management believes

that, as of March 1, 2008, the Company’s internal control over

financial reporting was effective.

The Company’s independent auditors have issued an

audit report on the Company’s internal control over financial

reporting. This report is included with the Consolidated

Financial Statements.

Changes in Internal Control Over Financial Reporting

During the fiscal year ended March 1, 2008, no changes

were made to the Company’s internal control over financial

reporting that have materially affected, or are reasonably

likely to materially affect, the Company’s internal control over

financial reporting.

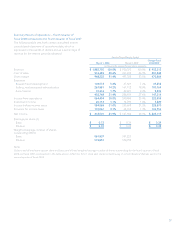

Summary Results of Operations – Fiscal 2008 Compared to

Fiscal 2007 and Fiscal 2006

Fiscal year ended March 1, 2008 compared to the fiscal year

ended March 3, 2007

Revenue

Revenue for fiscal 2008 was $6.01 billion, an increase of $2.97

billion, or 97.9%, from $3.04 billion in fiscal 2007.

A comparative breakdown of the significant revenue

streams is set forth in the following table:

Fiscal 2008 Fiscal 2007 Change - Fiscal

2008/2007

Number of devices sold 13,780,000 6,414,000 7,366,000 114.8%

ASP $ 346 $ 346 — 0.0%

Revenues

Devices $ 4,768,610 79.4% $ 2,215,951 73.0% $ 2,552,659 115.2%

Service 860,641 14.3% 560,116 18.4% 300,525 53.7%

Software 234,388 3.9% 173,187 5.7% 61,201 35.3%

Other 145,756 2.4% 87,849 2.9% 57,907 65.9%

$ 6,009,395 100.0% $ 3,037,103 100.0% $ 2,972,292 97.9%