Blackberry 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 1, 2008

40

Stock Split

The Company declared a 3-for-1 stock split of the Company’s

outstanding common shares on June 28, 2007. The stock split

was implemented by way of a stock dividend. Shareholders

received two common shares of the Company for each

common share held. The stock dividend was paid in the

second quarter of fiscal 2008. All share, earnings per share

and stock option data for the current fiscal year and prior

comparative periods reflects this stock dividend.

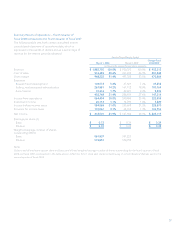

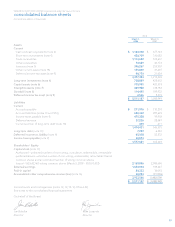

Selected Quarterly Financial Data

The following table sets forth RIM’s unaudited quarterly

consolidated results of operations data for each of the

eight most recent quarters, including the quarter ended

March 1, 2008. The information in the table below has

been derived from RIM’s unaudited interim consolidated

financial statements that, in management’s opinion, have

been prepared on a basis consistent with the Consolidated

Financial Statements and include all adjustments necessary

for a fair presentation of information when read in

conjunction with the Consolidated Financial Statements.

RIM’s quarterly operating results have varied substantially

in the past and may vary substantially in the future.

Accordingly, the information below is not necessarily

indicative of results for any future quarter.

Net Income

The Company’s net income increased by $225.1 million to

$412.5 million, or $0.73 basic EPS and $0.72 diluted EPS, in the

fourth quarter of fiscal 2008, compared to $187.4 million, or

$0.34 basic EPS and $0.33 diluted EPS, in the fourth quarter of

fiscal 2007.

The $225.1 million increase in net income in the fourth

quarter of fiscal 2008 reflects primarily an increase in gross

margin in the amount of $470.9 million, which was partially

offset by an increase of $138.0 million in the Company’s

research and development expenses and sales and marketing

programs.

The weighted average number of shares outstanding

was 561.8 million common shares for basic EPS and 573.9

million common shares for diluted EPS for the quarter ended

March 1, 2008 compared to 557.2 million common shares for

basic EPS and 570.8 million common shares for diluted EPS for

the comparable period last year. Both the weighted average

number of shares outstanding and the basic and diluted EPS

for both the fourth quarter of fiscal 2008 and fourth quarter of

fiscal 2007 reflects the 3-for-1 stock split implemented by way

of a stock dividend in the second quarter of fiscal 2008.

Common Shares Outstanding

On April 11, 2008, there were 563.8 million common shares,

15.3 million options to purchase common shares and 5,000

Restricted Share Units outstanding.

Fiscal Year 2008 Fiscal Year 2007

Fourth

Quarter Third

Quarter Second

Quarter First

Quarter Fourth

Quarter Third

Quarter Second

Quarter First

Quarter

(in thousands, except per share data)

Revenue $ 1,882,705 $ 1,672,529 $ 1,372,250 $ 1,081,911 $ 930,393 $ 835,053 $ 658,541 $ 613,116

Gross margin $ 968,222 $ 847,872 $ 704,417 $ 560,070 $ 497,358 $ 452,631 $ 370,085 $ 337,728

Research and development,

Selling, marketing and

administration,and Amortization 403,768 357,978 311,464 276,212 256,454 228,087 190,582 175,851

Investment income (20,114) (23,816) (18,984) (16,447) (14,794) (12,666) (12,606) (12,051)

Income before income taxes 584,568 513,710 411,937 300,305 255,698 237,210 192,109 173,928

Provision for income taxes 172,067 143,249 124,252 77,085 68,314 62,018 51,957 45,084

Net income $ 412,501 $ 370,461 $ 287,685 $ 223,220 $ 187,384 $ 175,192 $ 140,152 $ 128,844

Earnings per share (1)

Basic $ 0.73 $ 0.66 $ 0.51 $ 0.40 $ 0.34 $ 0.32 $ 0.25 $ 0.23

Diluted $ 0.72 $ 0.65 $ 0.50 $ 0.39 $ 0.33 $ 0.31 $ 0.25 $ 0.22

Research and development $ 104,573 $ 92,150 $ 88,171 $ 74,934 $ 67,321 $ 61,184 $ 55,846 $ 51,822

Selling, marketing and administration 267,881 238,175 197,943 177,483 167,112 146,569 116,283 107,958

Amortization 31,314 27,653 25,350 23,795 22,021 20,334 18,453 16,071

$ 403,768 $ 357,978 $ 311,464 $ 276,212 $ 256,454 $ 228,087 $ 190,582 $ 175,851

Notes:

(1) Basic and diluted earnings per share reflect the 3-for-1 stock split implemented by way of a stock dividend that was paid in the second

quarter of fiscal 2008.