Blackberry 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

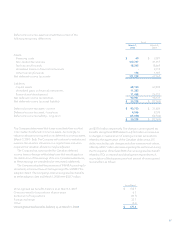

will likely result in extended maturities and/or a pro-rata

distribution of proceeds from the income and principal

payments on the assets underlying the securities. Given the

uncertainty of the restructuring at this time, the Company

cannot determine the potential impact that a restructuring

will have on the value of these securities and has classified

these securities as long-term investments. The Company may

recognize additional impairment charges on these securities

if the restructuring is unsuccessful or there is an other-than-

temporary deterioration in the value of the underlying assets.

The remaining $15.0 million face amount of SIV holdings

were sold by the Company subsequent to March 1, 2008

for a realized loss of $1.8 million. This loss is included in

the other-than-temporary impairment charge as described

above and these securities have been classified as short-term

investments as of March 1, 2008.

changes in market conditions and has recognized through net

income an other-than-temporary impairment charge of $5.6

million on these securities for the year ended March 1, 2008.

In determining the value for these securities, the Company

has considered available evidence including changes in

general market conditions, specific industry and individual

company data, the length of time and the extent to which

the fair value has been less than cost, the financial condition,

the near-term prospects of the individual investment and the

Company’s intent and ability to hold the debt securities.

One of the programs with a $25.0 million face amount

included in the total $40.0 million of SIV holdings has been

placed with an enforcement manager to be restructured or

sold at the election of each senior note holder. The Company

has elected to participate in the restructuring of the securities.

The Company believes that the anticipated restructuring

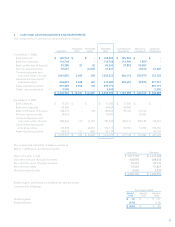

5. INVENTORY

Inventory is comprised as follows:

March 1,

2008 March 3,

2007

Raw materials $ 167,185 $ 121,439

Work in process 239,610 141,938

Finished goods 9,233 8,413

Provision for excess and obsolete inventory (19,761) (15,883)

$ 396,267 $ 255,907

6. CAPITAL ASSETS

Capital assets are comprised of the following:

March 1, 2008

Cost Accumulated

amortization Net book

value

Land $ 54,085 $ - $ 54,085

Buildings, leaseholds and other 327,645 46,708 280,937

BlackBerry operations and other information technology 436,681 225,061 211,620

Manufacturing equipment, research and development equipment,

and tooling 167,618 95,448 72,170

Furniture and fixtures 150,911 63,768 87,143

$ 1,136,940 $ 430,985 $ 705,955