Blackberry 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

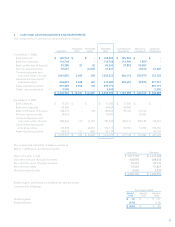

Investments with continuous unrealized losses for less than

and greater than 12 months and their related fair values were

as follows:

Less than 12 months 12 months or more Total

As at March 1, 2008 Fair Value Unrealized

losses Fair Value Unrealized

losses Fair Value Unrealized

losses

Government sponsored enterprise notes $ 11,520 $ 67 $ - $ - $ 11,520 $ 67

Commercial paper and corporate bonds 199,726 36 10,648 18 210,374 54

Asset-backed securities 6,820 2 6,694 12 13,514 14

Auction-rate securities 37,326 3,230 - - 37,326 3,230

Bank certificates of deposit 30,175 2 - - 30,175 2

$ 285,567 $ 3,337 $ 17,342 $ 30 $ 302,909 $ 3,367

Less than 12 months 12 months or more Total

Fair Value Unrealized

losses Fair Value Unrealized

losses Fair Value Unrealized

losses

As at March 3, 2007

Government sponsored enterprise notes $ 15,057 $ 6 $ 241,635 $ 2,677 $ 256,692 $ 2,683

Commercial paper and corporate bonds 25,440 3 227,775 3,128 253,215 3,131

Asset-backed securities - - 60,060 802 60,060 802

Bank certificates of deposit 12,118 10 - - 12,118 10

$ 52,615 $ 19 $ 529,470 $ 6,607 $ 582,085 $ 6,626

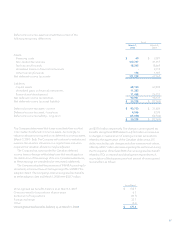

Auction-rate securities account for $3.2 million of the total

$3.4 million unrealized losses. Auction-rate securities are

debt instruments with long-term nominal maturity dates for

which the interest rates are reset through a dutch auction

process, typically every 7, 28 or 35 days. Interest is paid at

the end of each auction period, and the auction normally

serves as the mechanism for securities holders to sell their

existing positions to interested buyers. As at March 1, 2008,

the Company held $55.0 million in face value of auction

rate securities, all of which carry AAA ratings. Included in

this amount are $40.5 million in face value of auction rate

securities that are experiencing failed auctions as a result of

more sell orders than buy orders, and these auctions have

not yet returned to normal operations. The interest rate for

these securities has been set at the maximum rate specified

in the program documents (a predetermined basis points

spread over LIBOR), and interest continues to be paid every

28 days as scheduled. As a result of the lack of continuing

liquidity in these securities, the Company has adjusted the

reported value to reflect an unrealized loss of $3.2 million,

which the Company considers temporary and is reflected

in other comprehensive income. In valuing these securities,

the Company used a multi-year investment horizon and

considered the underlying risk of the securities and the

current market interest rate environment. The Company has

the ability and intent to hold these securities until such time

that market liquidity returns to normal levels and does not

consider the principal or interest amounts on these securities

to be materially at risk at this time. As there is uncertainty as

to when market liquidity for auction-rate securities will return

to normal, the Company has classified the failing auction-rate

securities as long-term investments on the balance sheet. As

at March 1, 2008, the Company does not consider these long-

term investments to be other-than-temporarily impaired.

The additional unrealized losses of $0.2 million for

investment grade debt securities were related to changes in

interest rates and overall market conditions. The Company

believes that it is probable that it will be able to collect all

amounts due according to the contractual terms of the

investments. The Company has the ability and intent to

hold these investments until there is a recovery of fair value

which may be at maturity. As a result, the Company does

not consider these investments to be other-than-temporarily

impaired as at March 1, 2008.

A Structured Investment Vehicle (“SIV”) is a fund that

seeks to generate investment returns by purchasing high

grade long-term fixed income instruments and funding those

purchases by issuing short-term debt instruments. In late

2007, widespread illiquidity in the market has prevented SIVs

from accessing necessary funding for ongoing operations.

As at March 1, 2008, the Company held $40.0 million face

value of SIV securities that were negatively impacted by the