Blackberry 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 1, 2008

42

and long-term investments, net of the costs of acquisitions

in the amount of $421.7 million. For the prior fiscal year,

cash flow used in investing activities was $364.6 million and

included capital asset additions of $254.0 million, intangible

asset additions of $60.3 million, business acquisitions in

the amount of $116.2 million offset in part by transactions

involving the proceeds on sale or maturity of short-term

investments and long-term investments, net of the costs

of acquisition, amounting to $65.9 million. The increase

in capital asset spending was primarily due to increased

investment in renovations to existing facilities, expansion

and enhancement of the BlackBerry Infrastructure and

computer equipment purchases. The increase in intangible

asset spending was associated with two patent assignment

and license agreements to acquire portfolios of patents for

a total of $262.3 million. All acquired patents were recorded

as Intangible assets and are being amortized over their

estimated useful lives.

Financing Activities

Cash flow provided by financing activities was $80.4 million

for fiscal 2008 and was primarily provided by the proceeds

from the exercise of stock options in the amount of

$62.9 million, as well as the voluntary payments of CAD

$7.5 million each made by the co-CEOs. The cash flow

used in financing activities in fiscal 2007 in the amount of

$153.7 million was primarily attributable to the repurchase of

3.2 million common shares in the amount of $203.9 million

pursuant to the Company’s Common Share Repurchase

Program, offset in part by the proceeds from the exercise of

stock options in the amount of $44.5 million.

Investing Activities

During the fiscal year ended March 1, 2008, cash flow

used in investing activities was $1.15 billion and included

capital asset additions of $351.9 million and intangible asset

additions of $374.1 million, as well as transactions involving

the proceeds on sale or maturity of short-term investments

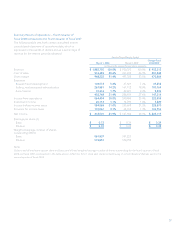

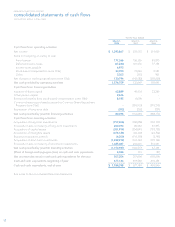

Fiscal Year Ended

March 1, 2008 March 3, 2007 Change-Fiscal

2008/2007

Net income $ 1,293,867 $ 631,572 $ 662,295

Amortization 177,366 126,355 51,011

Deferred income taxes (67,244) 101,576 (168,820)

Stock-based compensation 33,700 19,063 14,637

Changes in:

Trade receivables (602,055) (254,370) (347,685)

Other receivables (34,515) (8,300) (26,215)

Inventory (140,360) (121,238) (19,122)

Accounts payable 140,806 47,625 93,181

Accrued liabilities 383,020 119,997 263,023

Income taxes payable 406,243 83,310 322,933

All other (14,069) (9,921) (4,148)

Cash flows from operating activities $ 1,576,759 $ 735,669 $ 841,090

recognize additional impairment charges on these securities

if the restructuring is unsuccessful or there is an other-than

temporary deterioration in the value of the underlying assets.

The remaining $15.0 million face amount of SIV holdings

were sold by the Company subsequent to March 1, 2008 for a

realized loss of $1.8 million. This loss is included in the other-

than-temporary impairment charge as described above and

these securities have been classified as short-term investments

as of March 1, 2008.

Fiscal year ended March 1, 2008 compared to fiscal year

ended March 3, 2007

Operating Activities

Cash flow provided by operating activities was $1.58 billion

in fiscal 2008 compared to cash flow provided by operating

activities of $735.7 million in the preceding fiscal year,

representing an increase of $841.1 million. The table below

summarizes the key components of this net increase.