Blackberry 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

2. ADOPTION OF ACCOUNTING POLICY

Accounting for Uncertainty in Income Taxes

In July 2006, the FASB issued FIN 48 Accounting for

Uncertainty in Income Taxes. FIN 48 clarifies the accounting

for uncertainty in tax positions subject to SFAS 109

Accounting for Income Taxes. FIN 48 provides a recognition

threshold and a mechanism to measure and record tax

positions taken, or expected to be taken during the filing of

tax returns. The mechanism is a two-step process in which the

tax position is evaluated for recognition on “a more likely than

not” basis that it will be sustained upon examination. If step

one is satisfied the position is then evaluated to determine

the amount to be recognized in the financial statements.

It also provides guidance on derecognition, classification,

interest and penalties, interim period accounting, disclosure

and transition. The cumulative effect of the application of

FIN 48 resulted in the Company reclassifying $25.9 million

from current taxes payable to non-current taxes payable for

uncertain tax positions not expected to be resolved within

one year. There was no cumulative effect adjustment to the

Company’s fiscal 2008 opening retained earnings.

3. RECENTLY ISSUED PRONOUNCEMENTS

Fair Value Measurements

In September 2006, the FASB issued SFAS 157 Fair Value

Measurements. SFAS 157 clarifies the definition of fair value,

establishes a framework for measurement of fair value, and

expands disclosure about fair value measurements. SFAS 157

is effective for fiscal years beginning after November 15, 2008

except as amended by FSP SFAS 157-1 and FSP SFAS 157-2

and the Company will be required to adopt the standard

in the first quarter of fiscal 2010. The Company is currently

evaluating what impact, if any, SFAS 157 will have on its

consolidated financial statements.

On December 20, 2007, the Board of Directors adopted

a Deferred Share Unit Plan (the “DSU Plan”) under which

each independent director will be credited with Deferred

Share Units (“DSUs”) in satisfaction of all or a portion of the

cash fees otherwise payable to them for serving as a director

of the Company. At a minimum, 50% of each independent

director’s annual retainer will be satisfied in the form of DSUs.

The director can elect to receive the remaining 50% in any

combination of cash and DSUs. Within a specified period

after such a director ceases to be a director, DSUs will be

redeemed for cash with the redemption value of each DSU

equal to the weighted average trading price of the Company’s

shares over the five trading days preceding the redemption

date. Alternatively, subject to receipt of shareholder approval,

the Company may elect to redeem DSUs by way of shares

purchased on the open market or issued by the Company.

DSUs are accounted for as liability-classified awards under

the provisions of SFAS 123(R). These awards are measured at

their fair value on the date of issuance, and remeasured at

each reporting period, until settlement.

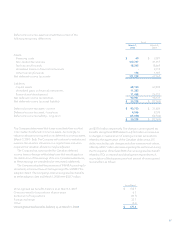

(v) Warranty

The Company provides for the estimated costs of product

warranties at the time revenue is recognized. BlackBerry

devices are generally covered by a time-limited warranty for

varying periods of time. The Company’s warranty obligation

is affected by product failure rates, differences in warranty

periods, regulatory developments with respect to warranty

obligations in the countries in which the Company carries

on business, freight expense, and material usage and other

related repair costs.

The Company’s estimates of costs are based upon

historical experience and expectations of future return rates

and unit warranty repair cost. To the extent that the Company

experiences increased or decreased warranty activity, or

increased or decreased costs associated with servicing those

obligations, revisions to the estimated warranty liability would

be required.

(w) Advertising costs

The Company expenses all advertising costs as incurred.

These costs are included in Selling, marketing and

administration.