Blackberry 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

(r) Government assistance

The Company has received no government assistance in fiscal

2008, 2007 and 2006.

Assistance related to the acquisition of capital assets used

for research and development is credited against the cost

of related capital assets and all other assistance is credited

against related expenses as incurred.

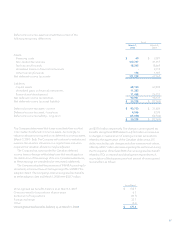

(s) Statements of comprehensive income (loss)

SFAS 130 Reporting Comprehensive Income, establishes

standards for the reporting and display of comprehensive

income and its components in general-purpose financial

statements. Comprehensive income is defined as the change

in net assets of a business enterprise during a period from

transactions and other events and circumstances from

non-owner sources, and includes all changes in equity

during a period except those resulting from investments by

owners and distributions to owners. The reportable items of

comprehensive income are cash flow hedges as described

in note 18, and changes in the fair value of investments

available-for-sale as described in note 4. Realized gains or

losses on available-for-sale investments are reclassified into

earnings using the specific identification basis.

(t) Earnings per share

Earnings per share is calculated based on the weighted

average number of shares outstanding during the year.

The treasury stock method is used for the calculation of the

dilutive effect of stock options.

(u) Stock-based compensation plans

The Company has stock-based compensation plans, which

are described in note 11(b).

Effective March 5, 2006, the Company adopted the

provisions of SFAS 123(R) Share-Based Payment. Under

the provisions of SFAS 123(R), stock-based compensation

expense is estimated at the grant date based on the award’s

fair value as calculated by the Black-Scholes-Merton (“BSM”)

option-pricing model and is recognized rateably over the

vesting period. The BSM model requires various judgmental

assumptions including volatility, forfeiture rates and expected

option life. If any of the assumptions used in the BSM model

change significantly, stock-based compensation expense may

differ materially in the future from that recorded in the current

period.

recurring engineering contracts is recognized as specific

contract milestones are met. The attainment of milestones

approximates actual performance.

Shipping and handling costs

Shipping and handling costs charged to earnings are

included in Cost of sales where they can be reasonably

attributed to certain revenue; otherwise they are included in

Selling, Marketing and Administration.

Multiple-element arrangements

The Company enters into transactions that represent

multiple-element arrangements which may include any

combination of hardware, service and software. These

multiple-element arrangements are assessed to determine

whether they can be separated into more than one unit

of accounting or element for the purpose of revenue

recognition. When the appropriate criteria for separating

revenue into more than one unit of accounting is met and

there is vendor specific objective evidence of fair value for

all units of accounting or elements in an arrangement, the

arrangement consideration is allocated to the separate units

of accounting or elements based on each unit’s relative fair

value. This vendor specific objective evidence of fair value is

established through prices charged for each revenue element

when that element is sold separately. The revenue recognition

policies described above are then applied to each unit of

accounting.

(q) Research and development

Research costs are expensed as incurred. Development costs

for BlackBerry devices and licensed software to be sold,

leased or otherwise marketed are subject to capitalization

beginning when a product’s technological feasibility has

been established and ending when a product is available

for general release to customers pursuant to SFAS 86

Accounting for the Costs of Computer Software to be Sold,

Leased, or Otherwise Marketed. The Company’s products

are generally released soon after technological feasibility has

been established and therefore cost incurred subsequent to

achievement of technological feasibility are not significant

and have been expensed as incurred.