Blackberry 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

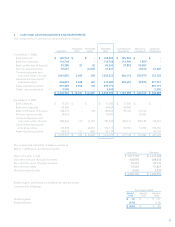

is included in Manufacturing equipment, research and

development equipment, and tooling.

For the year ended March 1, 2008, amortization expense

related to capital assets was $133,048 (March 3, 2007 -

$93,497; March 4, 2006 - $62,678).

March 3, 2007

Cost Accumulated

amortization Net book

value

Land $ 39,509 $ - $ 39,509

Buildings, leaseholds and other 217,941 29,560 188,381

BlackBerry operations and other information technology 304,778 159,739 145,039

Manufacturing equipment, research and development equipment,

and tooling 117,958 66,553 51,405

Furniture and fixtures 106,592 43,347 63,245

$ 786,778 $ 299,199 $ 487,579

As at March 1, 2008, the carrying amount of assets under

construction is $93,886 (March 3, 2007 - $15,741). Of this

amount, $63,878 (March 3, 2007 - $6,809) is included in

Buildings, leaseholds and other; $20,420 (March 3, 2007 -

$6,579), is included in BlackBerry operations and other

information technology; and $9,588 (March 3, 2007 - $2,353)

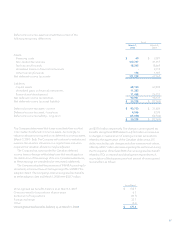

7. INTANGIBLE ASSETS

Intangible assets are comprised of the following:

March 1, 2008

Cost Accumulated

amortization Net book

value

Acquired technology $ 59,675 $ 29,749 $ 29,925

Licenses 94,444 32,410 62,034

Patents 399,232 21,203 378,029

$ 553,350 $ 83,362 $ 469,988

March 3, 2007

Cost Accumulated

amortization Net book

value

Acquired technology $ 58,639 $ 19,183 $ 39,456

Licenses 90,811 68,177 22,634

Patents 87,630 11,538 76,092

$ 237,080 $ 98,898 $ 138,182

On December 21, 2007, the Company entered into a patent

assignment and license agreement to acquire a portfolio of

patents for GSM/UMTS technologies. The purchase price

was 120 million Euros or $172 million. On February 28, 2008,

the Company entered into a patent assignment and license

agreement to acquire a portfolio of patents for speech coding

technology. The purchase price was $90 million. The acquired

patents were recorded as Intangible assets and are being

amortized over their estimated useful lives.

For the year ended March 1, 2008, amortization expense

related to intangible assets was $44,318 (March 3, 2007 -

$32,858; March 4, 2006 - $23,195). Total additions to intangible

assets in fiscal 2008 were $376,123 (2007 - $85,111).

Based on the carrying value of the identified intangible

assets as at March 1, 2008 and assuming no subsequent

impairment of the underlying assets, the annual amortization

expense for the next five fiscal years is expected to be as

follows: 2009 - $67 million; 2010 - $49 million; 2011 - $41

million; 2012 - $35 million; and 2013 - $33 million.

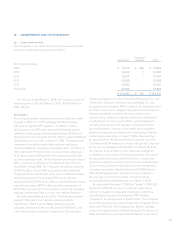

8. BUSINESS ACQUISITIONS

During the third quarter of fiscal 2008, the Company purchased

the assets and intellectual property of a company. The

transaction closed on November 19, 2007. The impact of this

acquisition was not material to the Company’s consolidated

operating results in fiscal 2008.