Blackberry 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

The Company is exposed to market and credit risk on

its investment portfolio. The Company reduces this risk by

investing in liquid, investment grade securities and by limiting

exposure to any one entity or group of related entities. As at

March 1, 2008, no single issuer represented more than 9% of

the total cash, cash equivalents and investments (March 3, 2007

- no single issuer represented more than 9% of the total cash,

cash equivalents and investments).

Market values are determined for each individual security

in the investment portfolio. The Company assesses declines

in the value of individual investments for impairment to

determine whether the decline is other-than-temporary. The

Company makes this assessment by considering available

evidence, including changes in general market conditions,

specific industry and individual company data, the length of

time and the extent to which the fair value has been less than

cost, the financial condition, the near-term prospects of the

individual investment and the Company’s ability and intent to

hold the debt securities to maturity. As of March 1, 2008, the

Company has recorded a $5.6 million other-than-temporary

impairment on specific SIV holdings. See “Liquidity and

Capital Resources – Structured Investment Vehicle”.

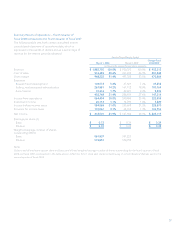

sells to a variety of customers, three customers comprised

19%, 14% and 10% of trade receivables as at March 1, 2008

(March 3 , 2007 – two customers comprised 23% and 13%).

Additionally, three customers comprised 21%, 15% and 12%

of the Company’s fiscal 2008 annual sales (fiscal 2007 annual

sales – four customers comprised 19%, 14%, 11% and 11%).

The Company is exposed to credit risk on derivative

financial instruments arising from the potential for

counterparties to default on their contractual obligations.

The Company mitigates this risk by limiting counterparties

to highly rated financial institutions and by continuously

monitoring their creditworthiness. The Company’s exposure

to credit loss and market risk will vary over time as a function

of currency exchange rates. The Company measures its

counterparty credit exposure as a percentage of the total

fair value of the applicable derivative instruments. Where the

net fair value of derivative instruments with any counterparty

is negative, the Company deems the credit exposure to that

counterparty to be nil. As at March 1, 2008, the maximum

credit exposure to a single counterparty, measured as a

percentage of the total fair value of derivative instruments

with net unrealized gains was 40% (March 3, 2007 – nil,

March 4, 2006 – 46%).