Blackberry 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

common shares for diluted EPS for year ended March 1, 2008

compared to 556.1 million common shares for basic EPS and

571.8 million common shares for diluted EPS for the same

period last year. Both the weighted average number of shares

outstanding and the basic and diluted EPS for year ended

March 1, 2008 and year ended March 3, 2007 reflects the

3-for-1 stock split implemented by way of a stock dividend

that was paid in the second quarter of fiscal 2008.

Fiscal year ended March 3, 2007 compared to the fiscal year

ended March 4, 2006

The fiscal year ended March 3, 2007 comprised 52 weeks

compared to the 53 weeks for the fiscal year ended

March 4, 2006. The consolidated statement of operations

information below for the fiscal year ended March 4, 2006

has been restated. See “Restatement of Previously Issued

Financial Statements” and Note 4 to the consolidated

financial statements for the fiscal year ended March 3, 2007.

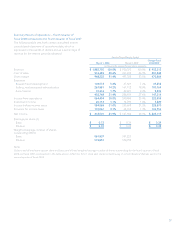

Revenue

Revenue for fiscal 2007 was $3.04 billion, an increase of

$971.3 million, or 47.0%, from $2.07 billion for fiscal 2006.

A comparative breakdown of the significant revenue

streams is set forth in the following table:

denominated assets and liabilities, and the related timing of

these transactions, held by Canadian entities that are subject

to tax in Canadian dollars.

Management expects the Company’s fiscal 2009 effective

tax rate to be approximately 30%, which reflects enacted

future Canadian federal income tax rate reductions.

The Company has not provided for Canadian income

taxes or foreign withholding taxes that would apply on the

distribution of the earnings of its non-Canadian subsidiaries,

as these earnings are intended to be reinvested indefinitely

by these subsidiaries.

Net Income

Net income was $1.29 billion, or $2.31 basic EPS and

$2.26 diluted EPS, in fiscal 2008 compared to net income of

$631.6 million, or $1.14 basic EPS and $1.10 diluted EPS, in

fiscal 2007.

The $662.3 million increase in net income in fiscal 2008

reflects primarily an increase in gross margin in the amount

of $1.42 billion, which was offset in part by an increase of

$467.2 million in the Company’s investments in research and

development expenses and sales and marketing programs.

The weighted average number of shares outstanding was

559.8 million common shares for basic EPS and 572.8 million

Fiscal 2007 Fiscal 2006 Change - Fiscal

2007/2006

Number of devices sold 6,414,000 4,043,000 2,371,000 58.6%

ASP $ 346 $ 356 $ (10) (2.7%)

Revenues

Devices $ 2,215,951 73.0% $ 1,439,674 69.7% $ 776,277 53.9%

Service 560,116 18.4% 383,021 18.5% 177,095 46.2%

Software 173,187 5.7% 156,556 7.6% 16,631 10.6%

Other 87,849 2.9% 86,594 4.2% 1,255 1.4%

$ 3,037,103 100.0% $ 2,065,845 100.0% $ 971,258 47.0%