Blackberry 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

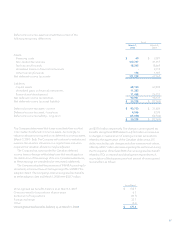

The weighted-average fair value of stock options granted

during the year was calculated using the BSM option-pricing

model with the following assumptions:

For the year ended

March 1,

2008 March 3,

2007 March 4,

2006

Number of options granted (000’s) 2,518 1,752 2,733

Weighted-average Black-Scholes value of each option $ 47.11 $ 16.63 $ 12.39

Assumptions:

Risk-free interest rate 4.3% 4.8% 4.1%

Expected life in years 4.6 4.4 4.0

Expected dividend yield 0% 0% 0%

Volatility 41% - 57% 44% - 55% 60%

The Company has not paid a dividend in the previous ten

fiscal years and has no current expectation of paying cash

dividends on its common stock. The risk-free interest rates

utilized during the life of the stock option are based on a U.S.

Treasury security for an equivalent period. The Company

estimates the volatility of its common stock at the date of

grant based on a combination of the implied volatility of

publicly traded options on its common stock, and historical

volatility, as the Company believes that this is a better

indicator of expected volatility going forward. The expected

life of stock options granted under the plan is based on

historical exercise patterns which the Company believes are

representative of future exercise patterns.

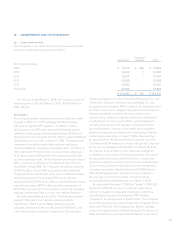

Restricted Share Unit Plan

RSUs are redeemed for either common shares issued by the

Company, common shares purchased on the open market

or the cash equivalent on the vesting dates established by

the Company. Compensation expense is recognized upon

issuance of RSUs over the vesting period. The Company

recorded $33 of compensation expense with respect to RSUs

in the year ended March 1, 2008.

The Company issued 5,000 RSUs in the year ended

March 1, 2008 and there were 5,000 RSUs outstanding as at

March 1, 2008 (March 3, 2007 – nil).

Deferred Share Unit Plan

Under the DSU Plan, each independent director will be

credited with DSUs in satisfaction of all or a portion of the

cash fees otherwise payable to them for serving as a director

of the Company. Grants under the DSU Plan replace the stock

option awards that were historically granted to independent

members of the Board of Directors. DSUs will be redeemed

for cash with the redemption value of each DSU equal to the

weighted average trading price of the Company’s shares

over the five trading days preceding the redemption date.

Alternatively, subject to receipt of shareholder approval,

the Company may elect to redeem DSUs by way of shares

purchased on the open market or issued by the Company.

DSUs are accounted for as liability-classified awards under

the provisions of SFAS 123(R). These awards are measured at

their fair value on the date of issuance, and remeasured at

each reporting period, until settlement.

DSUs are to be awarded on a quarterly basis in future

years. The Company issued 8,926 DSUs in the year ended

March 1, 2008. The Company had a liability of $965 in relation

to the DSU plan as at March 1, 2008.