Blackberry 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Research and Development

Research and development expenditures increased by

$37.3 million to $104.6 million, or 5.6% of revenue, in the

quarter ended March 1, 2008 compared to $67.3 million,

or 7.2% of revenue in the fourth quarter of fiscal 2007.

The majority of the increases during the fourth quarter of

fiscal 2008 compared to the fourth quarter of fiscal 2007

were attributable to salaries and benefits, new product

development costs, office and related staffing infrastructure

costs and travel.

Selling, Marketing and Administration Expenses

Selling, marketing and administrative expenses increased by

$100.8 million to $267.9 million, or 14.2% of revenue, for the

fourth quarter of fiscal 2008 compared to $167.1 million, or

18.0% of revenue for the comparable period in fiscal 2007.

The net increase of $100.8 million was primarily attributable

to increased expenditures for marketing, advertising and

promotion expenses including additional programs to

support new product launches as well as salary and benefit

expense primarily as a result of increased personnel. Other

increases were attributable to travel expenses and office

and related staffing infrastructure costs. The increase also

includes legal, accounting and other professional costs

incurred by the Company in the fourth quarter of fiscal

2008 as well as other costs incurred by the Company under

indemnity agreements in favor of certain officers and

directors of the Company, in each case in connection with the

Review, the Restatement, regulatory investigations relating

to the Company’s historical option granting practices and

related matters.

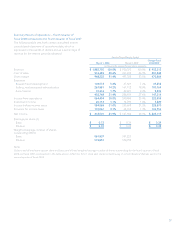

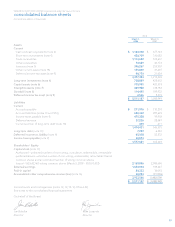

Research and Development, Selling, Marketing and

Administration, and Amortization Expense

The table below presents a comparison of research and

development, selling, marketing and administration, and

amortization expenses for the quarter ended March 1, 2008

compared to the quarter ended March 3, 2007. The Company

believes it is meaningful to also provide data for the third

quarter of fiscal 2008 given the quarterly increases in revenue

realized by the Company during fiscal 2008.

Three Month Fiscal Periods Ended

March 1, 2008 December 1, 2007 March 3, 2007

$% of

Revenue $% of

Revenue $% of

Revenue

Revenue $ 1,882,705 $ 1,672,529 $ 930,393

Research and development $ 104,573 5.6% $ 92,150 5.5% $ 67,321 7.2%

Selling, marketing and administration 267,881 14.2% 238,175 14.2% 167,112 18.0%

Amortization 31,314 1.7% 27,653 1.7% 22,021 2.4%

$ 403,768 21.4% $ 357,978 21.4% $ 256,454 27.6%

Amortization

Amortization expense relating to certain capital and all

intangible assets other than licenses increased by $9.3 million

to $31.3 million for the fourth quarter of fiscal 2008 compared

to $22.0 million for the comparable period in fiscal 2007. The

increased amortization expense primarily reflects the impact

of amortization expense with respect to capital and certain

intangible asset expenditures incurred primarily during fiscal

2007 and the first three quarters of fiscal 2008.

Investment Income

Investment income increased by $5.3 million to $20.1 million

in the fourth quarter of fiscal 2008 from $14.8 million in the

comparable period of fiscal 2007. The increase primarily

reflects the increase in cash and cash equivalents, short-term

investments and long-term investments when compared

to the prior year’s quarter. See also “Liquidity and Capital

Resources”.

Income Taxes

For the fourth quarter of fiscal 2008, the Company’s income

tax expense was $172.1 million resulting in an effective tax

rate of 29.4% compared to an income tax expense of

$68.3 million and an effective tax rate of 26.7% for the same

period last year. The Company’s effective tax rate reflects

the geographic mix of earnings in jurisdictions with different

tax rates. The fourth quarter fiscal 2008 tax provision was

impacted by the enactment of Canadian federal income

tax rate reductions in the fourth quarter of fiscal 2008 on

the Company’s deferred tax asset and liability balances and

current tax liability balances.