Blackberry 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RESEARCH IN MOTION LIMITED

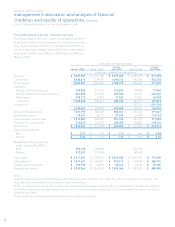

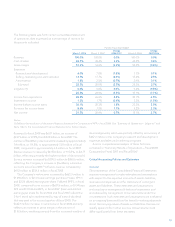

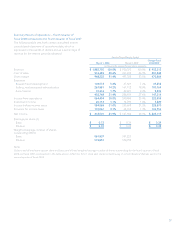

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 1, 2008

28

been settled, additional lawsuits, including purported

class actions and additional derivative actions, may be

filed relating to the Company’s stock option granting

practices. The amount of time to resolve any such lawsuits

is unpredictable, and defending against such lawsuits

could require significant additional attention and resources

that could otherwise be devoted to the operation of the

Company’s business. In addition, an unfavorable outcome

in any such litigation could have a material adverse effect

on the Company’s business, financial condition and results

of operations.

• The Company could incur significant liabilities in

connection with any litigation relating to its stock option

granting practices, which liabilities may not be covered

by insurance. In addition, the Company has indemnity

obligations (including for legal expenses) for former and

current directors, officers and employees, which are

described in greater detail in the Management Information

Circular.

• As noted above, in connection with the Restatement, the

Company has applied judgment in choosing whether to

revise measurement dates for prior stock option grants.

While the Company believes it has made appropriate

judgments in determining the correct measurement

dates for its stock option grants in connection with the

Restatement, the issues surrounding past stock option

grants and financial statement restatements are complex

and guidance in these areas may continue to evolve. If new

guidance imposes additional or different requirements or

if the SEC or the OSC disagrees with the manner in which

the Company has accounted for and reported the financial

impact, there is a risk the Company may have to further

restate its prior financial statements, amend its filings with

the SEC or the OSC (including the Consolidated Financial

Statements and this MD&A), or take other actions not

currently contemplated. Additionally, if the SEC or the

OSC disagrees with the manner in which the Company has

accounted for and reported the financial impact of past

option grants, there could be delays in subsequent filings

with the SEC or the OSC.

• The Company may face challenges in hiring and retaining

qualified personnel due to the Restatement, the

investigations relating to the Company and any potential

tax consequences to employees who received grants of

stock options with incorrect accounting measurement

dates. In addition, restrictions on the Company’s ability

to grant stock options to new employees under its policy

on granting equity awards, which provides for quarterly

grants of stock options except in limited and exceptional

circumstances, may make it more difficult for the Company

to attract new employees. The loss of the services of any

of the Company’s key employees or challenges in hiring

new employees could have a material adverse effect

on its business and growth prospects. In addition, the

Company may receive claims by employees who may be

subject to adverse tax consequences as a result of errors in

connection with stock option grants.

Impact of Accounting Pronouncements Not Yet

Implemented

Fair Value Measurements

In September 2006, the FASB issued SFAS 157 Fair Value

Measurements. SFAS 157 clarifies the definition of fair value,

establishes a framework for measurement of fair value, and

expands disclosure about fair value measurements. SFAS 157

is effective for fiscal years beginning after November 15, 2008

except as amended by FSP SFAS 157-1 and FSP SFAS 157-2

and the Company will be required to adopt the standard

in the first quarter of fiscal 2010. The Company is currently

evaluating what impact, if any, SFAS 157 will have on its

consolidated financial statements.

The Fair Value Option for Financial Assets and Financial

Liabilities - Including an Amendment of SFAS 115

In February 2007, the FASB issued SFAS 159 The Fair Value

Option for Financial Assets and Financial Liabilities - Including

an Amendment of SFAS 115. SFAS 159 permits entities to

measure many financial instruments and certain other items

at fair value that currently are not required to be measured