Blackberry 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(h) Recently issued pronouncements – Under Staff Accounting Bulletin 74, the Company is required to disclose certain

information related to new accounting standards which have not yet been adopted due to delayed effective dates.

In June 2001, the Financial Accounting Standards Board (FASB) issued SFAS No. 141, Business Combinations,

and SFAS No.142, Goodwill and Other Intangible Assets. These standards are substantially consistent with the

Canadian standards CICA 1581 and CICA 3062, respectively.

In August 2001, the FASB issued SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets,

which include intangible assets and goodwill. SFAS No. 144 requires that long-lived assets be reviewed for impairment

whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future

net cash flows expected to be generated by the asset. An impairment charge is recognized if the carrying amount

exceeds the fair value of the asset. SFAS No. 144 also modifies the accounting and disclosure rules for discontinued

operations. SFAS No. 144 is effective for fiscal years beginning after December 15, 2001. The Company is currently

assessing the impact of SFAS No. 144 on its consolidated financial position and results of operations.

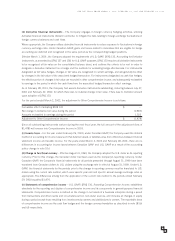

FOR THE YEARS ENDED MARCH 2, 2002, FEBRUARY 28, 2001 AND FEBRUARY 29, 2000

5

3