Blackberry 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

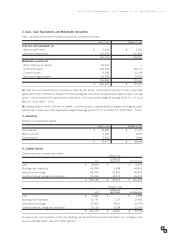

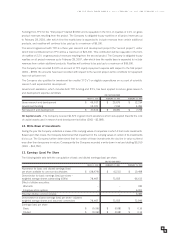

SHARE CAPITAL

COMMON SHARE

COMMON SHARES PURCHASE WARRANTS TOTAL

Balance as at February 28, 1999 $ 99,873 $ –$ 99,873

Issued for cash 196,744 –196,744

Exercise of options 1,791 –1,791

Warrant issued – 370 370

Financing costs (9,887) –(9,887)

Income tax reduction resulting from financing costs 4,370 –4,370

Balance as at February 29, 2000 292,891 370 293,261

Public offering 610,664 –610,664

Exercise of options 4,887 –4,887

Financing costs (30,462) –(30,462)

Income tax reduction resulting from financing costs 12,664 –12,664

Balance as at February 28, 2001 890,644 370 891,014

Exercise of options 1,491 –1,491

Common shares issued on acquisition of subsidiary 6,325 –6,325

Common shares repurchased pursuant to Normal

Course Issuer Bid (4,080) –(4,080)

Balance as at March 2, 2002 $ 894,380 $ 370 $ 894,750

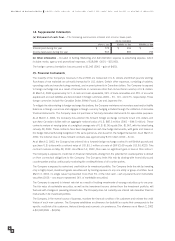

During the year ended March 2, 2002 the Company repurchased 370 common shares pursuant to its Normal

Course Issuer Bid at a cost of $5,525. The amount in excess of the carrying value of the common shares of $1,445

was charged to retained earnings. All common shares repurchased by the Company pursuant to its Normal

Course Issuer Bid have been cancelled.

During the year ended February 28, 2001, the Company issued 135 common shares in exchange for 139 common share

purchase warrants and no cash consideration.

During the year ended February 29, 2000, the Company issued a common share purchase warrant which entitles

the holder to acquire 75 common shares for $20.83 each from August 17, 2000 to August 17, 2004. This transaction

was a non-cash transaction. The Company determined that the fair value of the warrant was $370 using the

Black-Scholes option pricing model which assumes an expected life of one year, volatility of 60%, risk free interest

rate of 4.5% and no expected dividend yield.

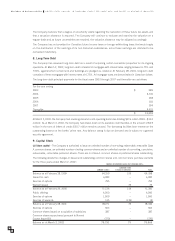

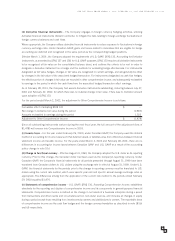

(b) Stock option plan – The Company has an incentive stock option plan for all of its directors, officers and employees.

The option exercise price is the fair market value of the Company's common shares at the date of grant. These options

generally vest over a period of five years after which they are exercisable for a maximum of ten years after the grant

date. As at March 2, 2002, there were 10,086 options outstanding with exercise prices ranging from $2.43 to

$119.80. Options issued and outstanding for 2,475 shares are vested as at March 2, 2002. There are 1,614 shares

available for future grants under the plan.

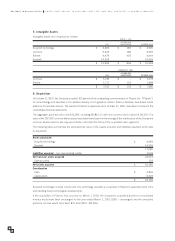

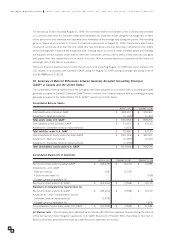

A summary of option activity since February 28, 1999 is shown below:

OPTIONS OUTSTANDING

WEIGHTED AVERAGE

NUMBER (IN 000’S) EXERCISE PRICE

Balance as at February 28, 1999 6,483 $ 3.35

Granted during the year 1,821 $ 19.12

Exercised during the year (826) $ 3.00

Cancelled during the year (235) $ 8.36

Balance as at February 29, 2000 7,243 $ 7.19

Granted during the year 1,767 $ 52.16

Exercised during the year (1,018) $ 6.29

Cancelled during the year (72) $ 38.03

Balance as at February 28, 2001 7,920 $ 17.04

Granted during the year 2,978 $ 21.83

Exercised during the year (515) $ 3.71

Cancelled during the year (297) $ 27.92

Balance as at March 2, 2002 10,086 $ 18.81

FOR THE YEARS ENDED MARCH 2, 2002, FEBRUARY 28, 2001 AND FEBRUARY 29, 2000

7

2