Blackberry 2002 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 ANNUAL REPORT RESEARCH IN MOTION LIMITED

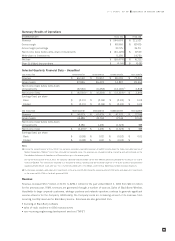

Summary Results of Operations

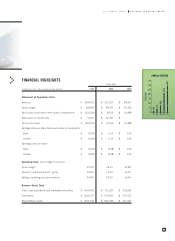

OPERATING HIGHLIGHTS FISCAL 2002 FISCAL 2001

Revenue $ 294,053 $ 221,327

Gross margin $ 98,560 $ 87,475

Gross margin percentage 33.5% 39.5%

Net income (loss) before write-down of investments $ (23,129) $8,539

Write-down of investments 5,350 14,750

Net loss $ (28,479) $ (6,211)

Basic & diluted loss per share $ (0.36) $ (0.08)

Selected Quarterly Financial Data – Unaudited

2002 FISCAL YEAR FOURTH QUARTER THIRD QUARTER SECOND QUARTER FIRST QUARTER

Revenue $ 66,132 $ 70,857 $ 80,059 $ 77,005

Gross margin 27,826 26,472 14,897 29,365

Net income (loss) before write-down

of investments (8,550) (6,258) (12,169)(1) 3,848

Net income (loss) $ (8,550)(1) $ (6,258) $ (17,519)(2) $ 3,848

Earnings (loss) per share

Basic $ (0.11) $ (0.08) $ (0.22) $ 0.05

Diluted $ (0.11) $ (0.08) $ (0.22) $ 0.05

2001 FISCAL YEAR FOURTH QUARTER THIRD QUARTER SECOND QUARTER FIRST QUARTER

Revenue $ 90,079 $ 61,629 $ 42,521 $ 27,098

Gross margin 34,486 23,704 17,144 12,141

Net income (loss) before write-down

of investments 8,280 1,496 (1,625) 388

Net income (loss) $ (6,470)(2) $ 1,496 $ (1,625) $ 388

Earnings (loss) per share

Basic $ (0.08) $ 0.02 $ (0.02) $ 0.01

Diluted $ (0.08) $ 0.02 $ (0.02) $ –

Notes:

(1) During the second quarter of fiscal 2002, the Company recorded a bad debt provision of $6,900 to write down the trade receivable balance of

Motient Corporation (“Motient”) to its then estimated net realizable value. The provision was charged to selling, marketing and administration on the

Consolidated Statement of Operations and Retained Earnings in the second quarter.

During the fourth quarter of fiscal 2002, the Company collected trade receivable monies from Motient previously provided for, resulting in an income

amount of $3,950. This amount was recorded as a reduction to selling, marketing and administration expense in the fourth quarter and represented

approximately $0.03 per share after tax. This is further described later in this MD&A under Selling, Marketing and Administration Expenses.

(2) The Company recorded a write-down of its investments in the amount of $5,350 during the second quarter of 2002 and a write-down of its investments

in the amount of $14,750 in the fourth quarter of 2001.

Revenue

Revenue increased $72.7 million or 32.9% to $294.1 million for the year ended March 2, 2002 from $221.3 million

for the previous year. RIM’s revenues are generated through a number of sources. Sales of BlackBerry Wireless

Handhelds to large corporate customers, strategic partners and network operators continue to generate significant

revenue streams for the Company. Additionally, the Company earns an increasing amount of its revenues from

recurring monthly revenues for BlackBerry service. Revenues are also generated from:

• licensing of BlackBerry software

• sales of radio modems to OEM manufacturers

• non-recurring engineering development services (“NRE”)

9