Blackberry 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

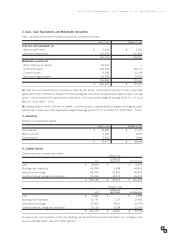

As at March 2, 2002, the Company has entered into forward foreign exchange contracts to sell U.S. dollars and

purchase Canadian dollars with an aggregate notional value of U.S. $87.5 million (2001 – $44.5 million). These

contracts mature at varying dates, with the latest being January 29, 2003. These contracts have been designated

as cash flow hedge instruments, with gains and losses on the hedge instruments being recognized in the same

period as, and as part of, the hedged transaction. As at March 2, 2002, the notional loss on these forward

contracts was approximately $1.5 million (2001 – $ nil).

The majority of the Company’s cash, cash equivalents and marketable securities are denominated in U.S. dollars

as at March 2, 2002.

Interest Rate

Cash, cash equivalents and marketable securities are invested in certain instruments of varying short-term maturities;

consequently the Company is exposed to interest rate risk as a result of holding investments of varying maturities up to

one year. The fair value of marketable securities, as well as the investment income derived from the investment portfolio,

will fluctuate with changes in prevailing interest rates. The Company does not currently use interest rate derivative

financial instruments in its investment portfolio.

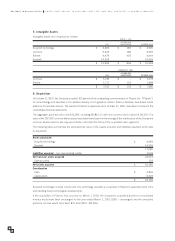

Credit and Customer Concentration

The Company is undergoing significant external sales growth internationally and the resulting growth in its customer

base in terms of both numbers and in some instances increased credit limits. The Company, in the normal course of

business, monitors the financial condition of its customers and reviews the credit history of each new customer. The

Company establishes an allowance for doubtful accounts that corresponds to the specific credit risk of its customers,

historical trends and economic circumstances. The Company also places insurance coverage for a portion of its foreign

trade receivables with Export Development Corporation.

While the Company sells to a variety of customers, two customers comprised 16% and 15% of trade receivables as at

March 2, 2002. Additionally, two customers comprised 17% and 11% of the Company’s sales for the current fiscal year.

Forward-Looking Statements

Forward-looking statements are made pursuant to the “safe harbor”provisions of the United States Private Securities

Litigation Reform Act of 1995. When used herein, words such as “intend”and similar expressions are intended to

identify forward-looking statements. Forward-looking statements are based on assumptions made by and information

available to Research In Motion Limited. Investors are cautioned that such forward-looking statements involve risks and

uncertainties. Important factors that could cause actual results to differ materially from those expressed or implied by

such forward-looking statements are detailed below and in RIM’s periodic reports filed with the United States Securities

and Exchange Commission, the Ontario Securities Commission and other regulatory authorities.

Risk Factors

Important risk factors that could cause actual results, performance or achievements to be materially different from

those expressed or implied by these forward-looking statements include:

• Continued acceptance of RIM’s products and successful development and introduction of new products

• Ability to manage growth

• Significant fluctuations of quarterly revenues and operating results

• Intense competition

• Failure to keep up with rapid technological change

• Changes in the macroeconomic environment

• Fluctuations in foreign exchange rates and interest rates

• Dependence on third-party networks to provide service

• Shortage of components or failure by manufacturers to produce quality products on time

• Dependence on intellectual property rights to protect RIM’s technology

• Claims of infringement of third-party intellectual property rights

RESEARCH IN MOTION LIMITED 2002 ANNUAL REPORT

1

4