Blackberry 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

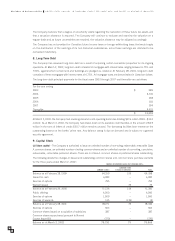

The Company believes that a degree of uncertainty exists regarding the realization of those future tax assets and

that a valuation allowance is required. The Company will continue to evaluate and examine the valuation on a

regular basis and as future uncertainties are resolved, the valuation allowance may be adjusted accordingly.

The Company has not provided for Canadian future income taxes or foreign withholding taxes that would apply

on the distribution of the earnings of its non-Canadian subsidiaries, since these earnings are intended to be

reinvested indefinitely.

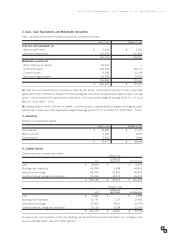

8. Long-Term Debt

The Company has assumed long-term debt as a result of acquiring certain real estate properties for its ongoing

operations. At March 2, 2002, long-term debt consisted of mortgages with interest rates ranging between 6.75% and

7.90%, against which certain land and buildings are pledged as collateral. At February 28, 2001, long-term debt

consisted of three mortgages with interest rates at 6.75%. All mortgage loans are denominated in Canadian dollars.

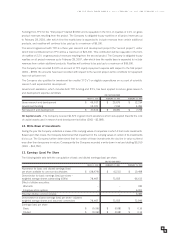

The long-term debt principal payments for the fiscal years 2003 through 2007 and thereafter are as follows:

For the year ending

2003 $ 385

2004 6,310

2005 168

2006 181

2007 194

Thereafter 5,021

$ 12,259

At March 2, 2002, the Company had revolving demand credit operating bank lines totalling $37.6 million (2001–$13.0

million). As at March 2, 2002, the Company had drawn down on its available credit facilities in the amount of $6.9

million in the form of letters of credit; $30.7 million remains unused. The borrowing facilities bear interest on the

outstanding balance at the banks’ prime rate. Any balance owing is due on demand and is subject to a general

security agreement.

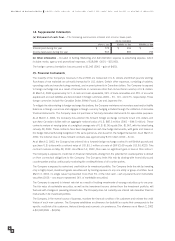

9. Capital Stock

(a) Share capital –The Company is authorized to issue an unlimited number of non-voting, redeemable, retractable Class

A common shares, an unlimited number of voting common shares and an unlimited number of non-voting, cumulative,

redeemable, retractable preferred shares. There are no Class A common shares or preferred shares outstanding.

The following details the changes in issued and outstanding common shares and common share purchase warrants

for the three years ended March 2, 2002:

NUMBER OF COMMON SHARES OUTSTANDING (000’s)

COMMON SHARE

COMMON SHARES PURCHASE WARRANTS TOTAL

Balance as at February 28, 1999 64,259 139 64,398

Issued for cash 6,082 –6,082

Exercise of options 795 – 795

Warrant issued – 75 75

Balance as at February 29, 2000 71,136 214 71,350

Public offering 6,000 – 6,000

Exercise of options 1,000 –1,000

Exercise of warrants 135 (139) (4)

Balance as at February 28, 2001 78,271 75 78,346

Exercise of options 503 – 503

Common shares issued on acquisition of subsidiary 387 – 387

Common shares repurchased pursuant to Normal

Course Issuer Bid (370) –(370)

Balance as at March 2, 2002 78,791 75 78,866

RESEARCH IN MOTION LIMITED UNITED STATES DOLLARS, IN THOUSANDS EXCEPT PER SHARE DATA, AND EXCEPT AS OTHERWISE INDICATED.

2

6