Blackberry 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

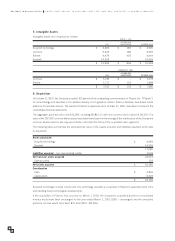

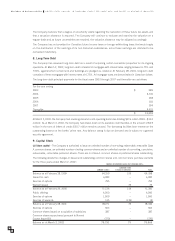

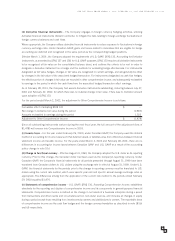

5. Intangible Assets

Intangible assets are comprised as follows:

MARCH 2, 2002

ACCUMULATED

COST AMORTIZATION NET BOOK VALUE

Acquired technology $ 2,685 $ 185 $ 2,500

Licences 9,645 186 9,459

Patents 4,479 435 4,044

Goodwill 14,395 –14,395

$ 31,204 $ 806 $ 30,398

FEBRUARY 28, 2001

ACCUMULATED

COST AMORTIZATION NET BOOK VALUE

Licences $ 5,195 $ – $ 5,195

Patents 2,717 232 2,485

$ 7,912 $ 232 $ 7,680

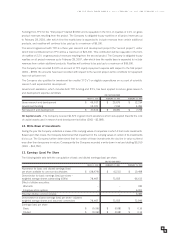

6. Acquisition

On October 31, 2001, the Company acquired 100 percent of the outstanding common shares of Plazmic Inc. (“Plazmic”)

for its technology and expertise in the wireless delivery of rich graphics content. Plazmic develops Java-based media

platforms for wireless devices. The results of Plazmic’s operations since October 31, 2001 have been included in the

consolidated financial statements.

The aggregate purchase price was $16,186, including $9,861 of cash and common stock valued at $6,325. The

value of the 387,353 common shares issued was determined based on the average of the market price of the Company’s

common shares over the two-day period before and after the terms of the acquisition were agreed to.

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date

of acquisition:

Assets purchased

Acquired technology $ 2,685

Goodwill 14,395

17,080

Liabilities assumed – non-cash working capital 1,046

Net non-cash assets acquired 16,034

Cash acquired 152

Net assets acquired $16,186

Consideration

Cash $9,861

Capital stock 6,325

$16,186

Acquired technology includes current and core technology. Goodwill is comprised of Plazmic’s assembled work force

and resulting future technological developments.

If the acquisition of Plazmic had occurred on March 1, 2000, the Company’s unaudited proforma consolidated

revenue would have been unchanged for the year ended March 2, 2002 (2001 –unchanged) and the unaudited

proforma net loss would have been $31,316 (2001 –$8,236).

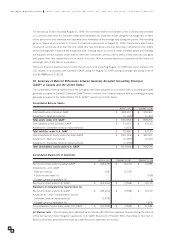

RESEARCH IN MOTION LIMITED UNITED STATES DOLLARS, IN THOUSANDS EXCEPT PER SHARE DATA, AND EXCEPT AS OTHERWISE INDICATED.

2

4