Blackberry 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

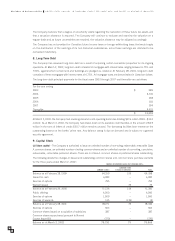

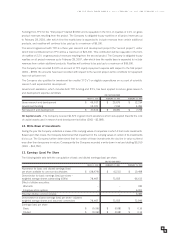

The weighted average characteristics of options outstanding as at March 2, 2002 are as follows:

OPTIONS OUTSTANDING (000’S) OPTIONS EXERCISABLE (000’S)

WEIGHTED AVERAGE

NUMBER REMAINING WEIGHTED AVERAGE NUMBER WEIGHTED AVERAGE

RANGE OF EXERCISE PRICES OUTSTANDING LIFE IN YEARS EXERCISE PRICE OUTSTANDING EXERCISE PRICE

$2.43 - $3.62 2,290 4.7 $ 2.69 1,506 $ 2.57

$3.88 - $5.66 1,609 3.6 4.15 246 4.31

$5.93 - $8.78 752 4.0 7.72 139 7.70

$8.97 - $11.56 257 4.1 9.98 78 9.79

$13.55 - $20.29 1,633 6.4 16.78 28 17.70

$20.82 - $30.95 1,564 6.0 24.53 123 25.73

$31.29 - $46.82 788 5.6 37.49 110 40.05

$47.02 - $70.44 868 5.6 51.92 178 51.79

$71.68 and over 325 5.6 86.73 67 86.68

Total 10,086 5.1 $ 18.81 2,475 $ 12.07

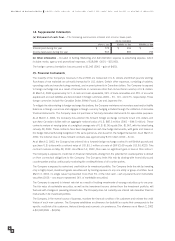

10. Commitments and Contingencies

(a) Lease commitment –The Company is committed to annual lease payments under operating leases for premises

as follows:

For the year ending

2003 $2,014

2004 1,470

2005 1,365

2006 1,317

2007 1,345

Thereafter 788

$8,299

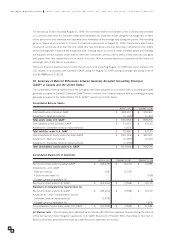

(b) Contingency – In 1999, the Company was served with a complaint alleging that certain of the Company’s products

infringe a patent held by Glenayre Technologies Inc. (“Glenayre”). This matter was resolved during the current year

in the Company’s favour by the Courts by way of summary dismissal and Glenayre has abandoned its rights to file

an appeal of this finding.

During the current fiscal year, the Company filed a complaint against Glenayre Electronics, Inc. (“GEI”) alleging that it had

engaged in acts of patent and trademark infringement, dilution, unfair competition and false advertising in connection

with the development, marketing and sale of wireless handheld products. This matter has now been settled.

During the current fiscal year, the Company was served with a complaint filed by NTP, Inc. (“NTP”) alleging that

the Company infringes on eight of its patents. Based on information examined to date, the Company believes NTP’s

complaint is unsubstantiated. The likelihood of loss and the ultimate amount, if any, are not determinable at this

time. Accordingly, no amount has been recorded in these financial statements.

From time to time, the Company is involved in other claims in the normal course of business. Management assesses

such claims and where considered likely to result in a material exposure and where the amount of the claim is

quantifiable, provisions for loss are made based on management’s assessment of the likely outcome. The Company

does not provide for claims that are considered unlikely to result in a significant loss, claims for which the outcome is

not determinable or claims where the amount of the loss cannot be reasonably estimated. Any settlements or awards

under such claims are provided for when reasonably determinable.

11. Government Assistance

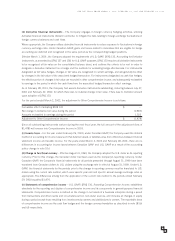

(a) Current expense –The Company has entered into two project development agreements with Technology

Partnerships Canada (“TPC”), which provide partial funding for certain research and development projects.

RESEARCH IN MOTION LIMITED UNITED STATES DOLLARS, IN THOUSANDS EXCEPT PER SHARE DATA, AND EXCEPT AS OTHERWISE INDICATED.

2

8