Blackberry 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

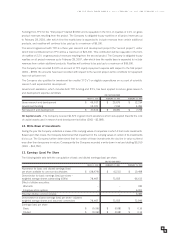

7. Income Taxes

The difference between the amount of the provision for (recovery of) income taxes and the amount computed by

multiplying income before taxes by the statutory Canadian rate is reconciled as follows:

MARCH 2, 2002 FEBRUARY 28, 2001 FEBRUARY 29, 2000

Expected Canadian tax rate 41.2% 44.0% 44.6%

Expected tax provision (recovery) $ (15,785) $ 1,549 $ 7,156

Differences in taxes resulting from:

Manufacturing and processing activities 1,801 (1,095) (1,067)

Utilization of tax loss carryforwards ––(838)

Increase in valuation allowance 1,530 3,245 –

Non-deductible portion of unrealized capital losses 1,013 3,245 –

Foreign tax rate differences (3,192) 2,080 –

Enacted tax rate changes 2,960 ––

Other differences 1,810 707 287

$ (9,863) $ 9,731 $ 5,538

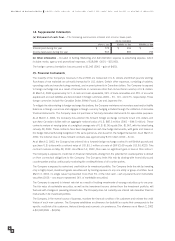

The provision for income taxes consists of the following:

MARCH 2, 2002 FEBRUARY 28, 2001 FEBRUARY 29, 2000

Income (loss) before income taxes:

Canadian $ (46,845) $ (2,485) $ 16,036

Foreign 8,503 6,005 –

$ (38,342) $ 3,520 $ 16,036

Provision for (recovery of) income taxes:

MARCH 2, 2002 FEBRUARY 28, 2001 FEBRUARY 29, 2000

Current

Canadian $ 6,756 $ 2,296 $ 1,888

Foreign 302 2,424 –

Future

Canadian (17,283) 5,011 3,650

Foreign 362 ––

$ (9,863) $ 9,731 $ 5,538

The tax effects of significant temporary differences are as follows:

MARCH 2, 2002 FEBRUARY 28, 2001

Assets

Financing costs $ 6,856 $ 11,779

Non-deductible reserves 5,004 3,245

Research and development incentives 17,726 4,286

Tax losses 15,100 –

Other tax carryforwards 2,450 1,507

47,136 20,817

Less: valuation allowance 5,870 3,245

41,266 17,572

Liabilities

Capital assets 12,668 5,561

Net future income tax assets $ 28,598 $ 12,011

FOR THE YEARS ENDED MARCH 2, 2002, FEBRUARY 28, 2001 AND FEBRUARY 29, 2000

5

2