Blackberry 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

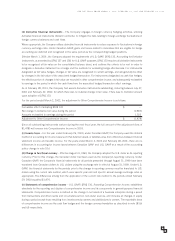

Funding from TPC for the “first project”totalled $3,900 and is repayable in the form of royalties of 2.2% on gross

product revenues resulting from the project. The Company is obligated to pay royalties on all project revenues up

to February 28, 2003, after which time the royalty base is expanded to include revenues from certain additional

products, and royalties will continue to be paid up to a maximum of $6,100.

The second agreement with TPC is a three year research and development project (the “second project”) under

which total contributions from TPC will be a maximum of $23,300. This contribution will be repayable in the form

of royalties of 2.2% on gross product revenues resulting from the second project. The Company is obligated to pay

royalties on all project revenues up to February 28, 2007, after which time the royalty base is expanded to include

revenues from certain additional products. Royalties will continue to be paid up to a maximum of $39,300.

The Company has recorded $1,575 on account of TPC royalty repayment expense with respect to the first project

(2001 – $999). No amounts have been recorded with respect to the second project as the conditions for repayment

have not yet been met.

The Company also qualifies for investment tax credits (“ITC’s”) on eligible expenditures on account of scientific

research and experimental development.

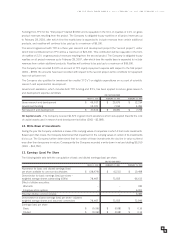

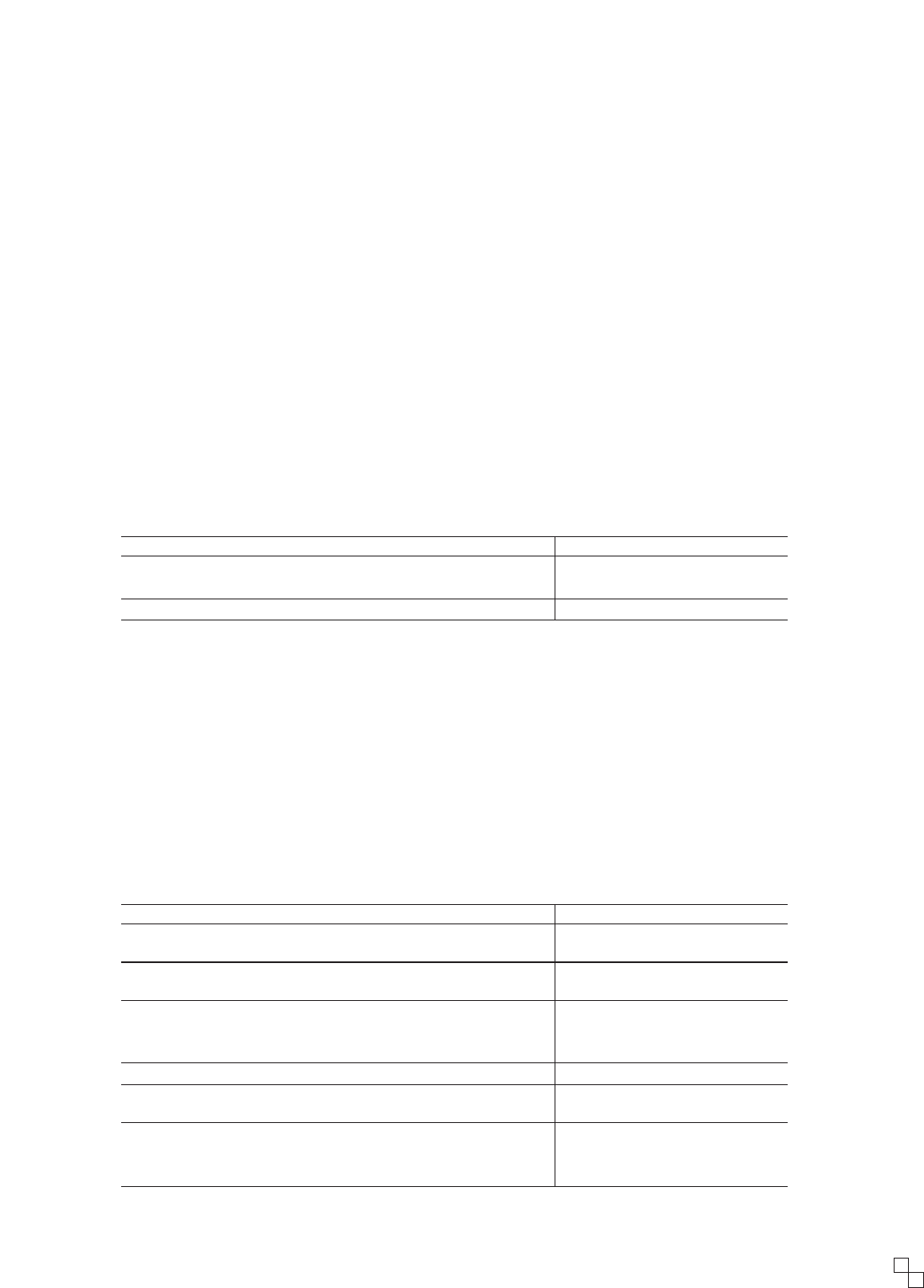

Government assistance, which includes both TPC funding and ITC’s, has been applied to reduce gross research

and development expense as follows:

FOR THE YEAR ENDED

MARCH 2, 2002 FEBRUARY 28, 2001 FEBRUARY 29, 2000

Gross research and development $ 49,517 $ 25,675 $ 12,234

Government funding 12,071 7,394 4,496

Net research and development $ 37,446 $ 18,281 $ 7,738

(b) Capital assets –The Company received $1,672 in government assistance which was applied towards the cost

of capital assets used in research and development activities (2001 –$2,585).

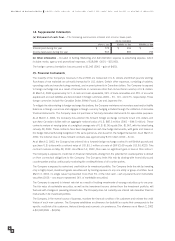

12. Write-Down of Investments

During the year the Company undertook a review of the carrying values of companies in which it had made investments.

Based upon that review, the Company determined that impairment in the carrying values of certain of its investments

did occur. The Company further determined that for certain of these investments the decline in value suffered

was other than temporary in nature. Consequently the Company recorded a write-down in values totalling $5,350

(2001 –$14,750).

13. Earnings (Loss) Per Share

The following table sets forth the computation of basic and diluted earnings (loss) per share.

FOR THE YEAR ENDED

MARCH 2, 2002 FEBRUARY 28, 2001 FEBRUARY 29, 2000

Numerator for basic and diluted earnings (loss)

per share available to common stockholders $ (28,479) $ (6,211) $ 10,498

Denominator for basic earnings (loss) per share –

weighted average shares outstanding (000’s) 78,467 73,555 66,613

Effect of dilutive securities:

Warrants –– 180

Employee stock options ––6,203

Potential dilutive common shares: ––6,383

Denominator for diluted earnings (loss) per share –adjusted

weighted average shares and assumed conversions 78,467 73,555 72,996

Earnings (loss) per share

Basic $ (0.36) $ (0.08) $ 0.16

Diluted $ (0.36) $ (0.08) $ 0.14

FOR THE YEARS ENDED MARCH 2, 2002, FEBRUARY 28, 2001 AND FEBRUARY 29, 2000

9

2