Blackberry 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

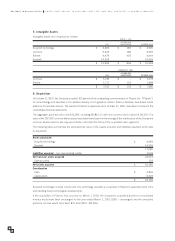

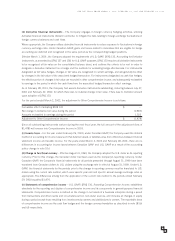

(b) Derivative financial instruments –The Company engages in foreign currency hedging activities, utilizing

derivative financial instruments (forward contracts), to mitigate the risks relating to foreign exchange fluctuations on

foreign currency balances and cash flows.

Where appropriate, the Company utilizes derivative financial instruments to reduce exposure to fluctuations in foreign

currency exchange rates. Under Canadian GAAP, gains and losses related to derivatives that are eligible for hedge

accounting are deferred and recognized in the same period as the corresponding hedged positions.

Effective March 1, 2001, the Company adopted the requirements of U.S. GAAP, SFAS 133, Accounting for Derivative

Instruments, as amended by SFAS 137 and 138, for U.S. GAAP purposes. SFAS 133 requires all derivative instruments

to be recognized at fair value on the consolidated balance sheet, and outlines the criteria to be met in order to

designate a derivative instrument as a hedge and the methods for evaluating hedge effectiveness. For instruments

designated as fair value hedges, changes in fair value are recognized in current earnings, and will generally be offset

by changes in the fair value of the associated hedged transaction. For instruments designated as cash flow hedges,

the effective portion of changes in fair value are recorded in other comprehensive income, and subsequently reclassified

to earnings in the period in which the cash flows from the associated hedged transaction affect earnings.

As at February 28, 2001, the Company had several derivative instruments outstanding, maturing between July 27,

2001 and February 22, 2002, for which there was no material change in fair value. There was no transition amount

upon adoption of SFAS 133.

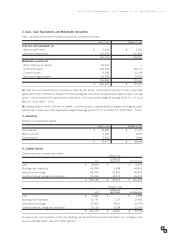

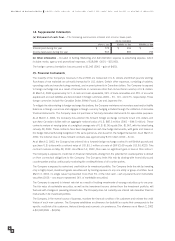

For the period ended March 2, 2002, the adjustment to Other Comprehensive Income is as follows:

Cumulative effect of adopting SFAS 133 $ –

Net change in derivative fair value during the period (2,803)

Amounts reclassified to earnings during the period 1,325

Adjustment to Other Comprehensive Income $ (1,478)

Since all outstanding instruments mature during the next fiscal year, the full amount of the adjustment (loss of

$1,478) will reverse into Comprehensive Income in 2003.

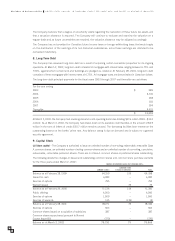

(c) Income taxes –For the year ended February 29, 2000, under Canadian GAAP, the Company used the deferral

method of accounting for income taxes such that deferred assets or liabilities arise from differences between financial

statement income and taxable income. For the years ended March 2, 2002 and February 28, 2001, there are no

differences in accounting for income taxes between Canadian GAAP and U.S. GAAP as a result of the accounting

policy change in note 1(k).

(d) Change in functional currency –Effective August 31, 1999, the Company adopted the U.S. dollar as its reporting

currency. Prior to this change, the Canadian dollar had been used as the Company’s reporting currency. Under

Canadian GAAP, the Company’s financial statements for all periods presented through August 31, 1999 have been

translated from Canadian dollars to U.S. dollars using the exchange rate in effect at August 31, 1999. Under U.S.

GAAP, the financial statements for the periods prior to the change in reporting currency must be translated to U.S.

dollars using the current rate method, which uses specific year end and specific annual average exchange rates as

appropriate. The differences arising from the application of the current rate method to the periods ended February

29, 2000 equalled $1,474.

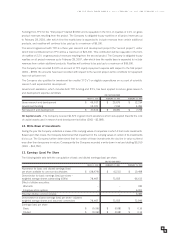

(e) Statements of comprehensive income –U.S. GAAP, SFAS 130, Reporting Comprehensive Income, establishes

standards for the reporting and display of comprehensive income and its components in general-purpose financial

statements. Comprehensive income is defined as the change in net assets of a business enterprise during a period

from transactions and other events and circumstances from non-owner sources, and includes all changes in equity

during a period except those resulting from investments by owners and distributions to owners. The reportable items

of comprehensive income are the cash flow hedges and the foreign currency translation as described in note 18 (b)

and (d) respectively.

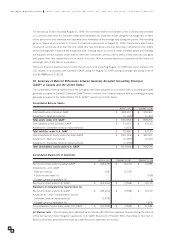

FOR THE YEARS ENDED MARCH 2, 2002, FEBRUARY 28, 2001 AND FEBRUARY 29, 2000

3

3