Blackberry 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

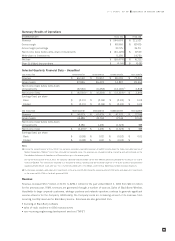

The Company’s selling, marketing and administration expenses were impacted as follows with respect to a large

customer previously in Chapter 11 bankruptcy proceedings as noted below:

SELLING, MARKETING & ADMINISTRATION EXPENSES (“SM&A”) TOTAL

SM&A as reported $ 102,359

Bad debt expense provision recorded in the 2nd quarter (6,900)

Collection of trade receivables during the 4th quarter previously written off 3,950

Net bad debt expense attributable to customer (2,950)

Adjusted SM&A $99,409

Amortization

Amortization expense on account of capital and intangible assets increased by $8.9 million to $17.5 million for the year

ended March 2, 2002 compared to $8.6 million for the prior year. The Company made expenditures with respect to

capital and intangible assets of $81.0 million in fiscal 2002 and $65.6 million in the previous year. Major additions in

the 2002 and 2001 fiscal years included land and office buildings, production equipment and tooling, research and

development computers and equipment and computer infrastructure for the BlackBerry solution as well as capital

equipment required for the expansion of operations internationally. Additionally, RIM continued to invest in the further

acquisition, configuration and implementation of its fully integrated Enterprise Resource Planning SAP software.

Investment Income

Investment income increased in fiscal 2002 by $2.8 million to $25.7 million from $22.9 million in the year ended

February 28, 2001. The increase is a result of higher average balances of cash, cash equivalents and marketable

securities investments in fiscal 2002 versus the prior year being partially offset by declining average interest rates being

realized. The weighted average yield for cash and cash equivalents as at March 2, 2002 is 1.7% (February 28,

2001 – 5.3%); and 2.7% for marketable securities as at March 2, 2002 (February 28, 2001 – 5.6%).

Write-Down of Investments

The Company made several strategic investments in technology companies in fiscal 2001, representing ownership

positions of less than 10%. The Company did not exercise significant influence with respect to any of these companies.

The Company reviews the carrying values of its investments to determine if a decline in value other than temporary in

nature has occurred. In its review of these investments for impairment, the Company considers the following matters:

•recent trading prices and trending if available

•where the investees required and obtained additional funding, values indicated by recent rounds of financing

•in certain instances, the investees required additional funding and were unable to obtain it. The Company has also

declined to participate in proposed additional fundings for certain of these companies.

•in certain cases, the investment was made based upon a business model and/or plan that, in the Company’s view,

is no longer likely to be successfully executed

•in certain cases, actual “cash burn”rates and revised estimated “costs to market”are now well in excess of

available resources, and

•where technology that is being developed is not necessarily proprietary and hence less valuable.

Based upon the foregoing review, the Company determined that an impairment in the carrying values of certain

of its investments had occurred during the fourth quarter of fiscal 2001 and that the decline in value was other than

temporary. Consequently the Company recorded a write-down of its investments in the amount of $14.8 million

in fiscal 2001.

During fiscal 2002 the Company reviewed the remaining carrying values of these investments and determined that

the financial, operational and strategic circumstances relating to most of these investments warranted an additional

write-down of the carrying values. Consequently the Company recorded a further reduction of its investments in the

amount of $5.4 million during the second quarter of 2002.

RESEARCH IN MOTION LIMITED 2002 ANNUAL REPORT

1

2