Blackberry 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

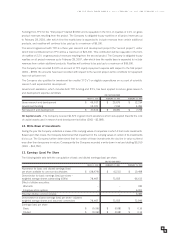

14. Supplemental Information

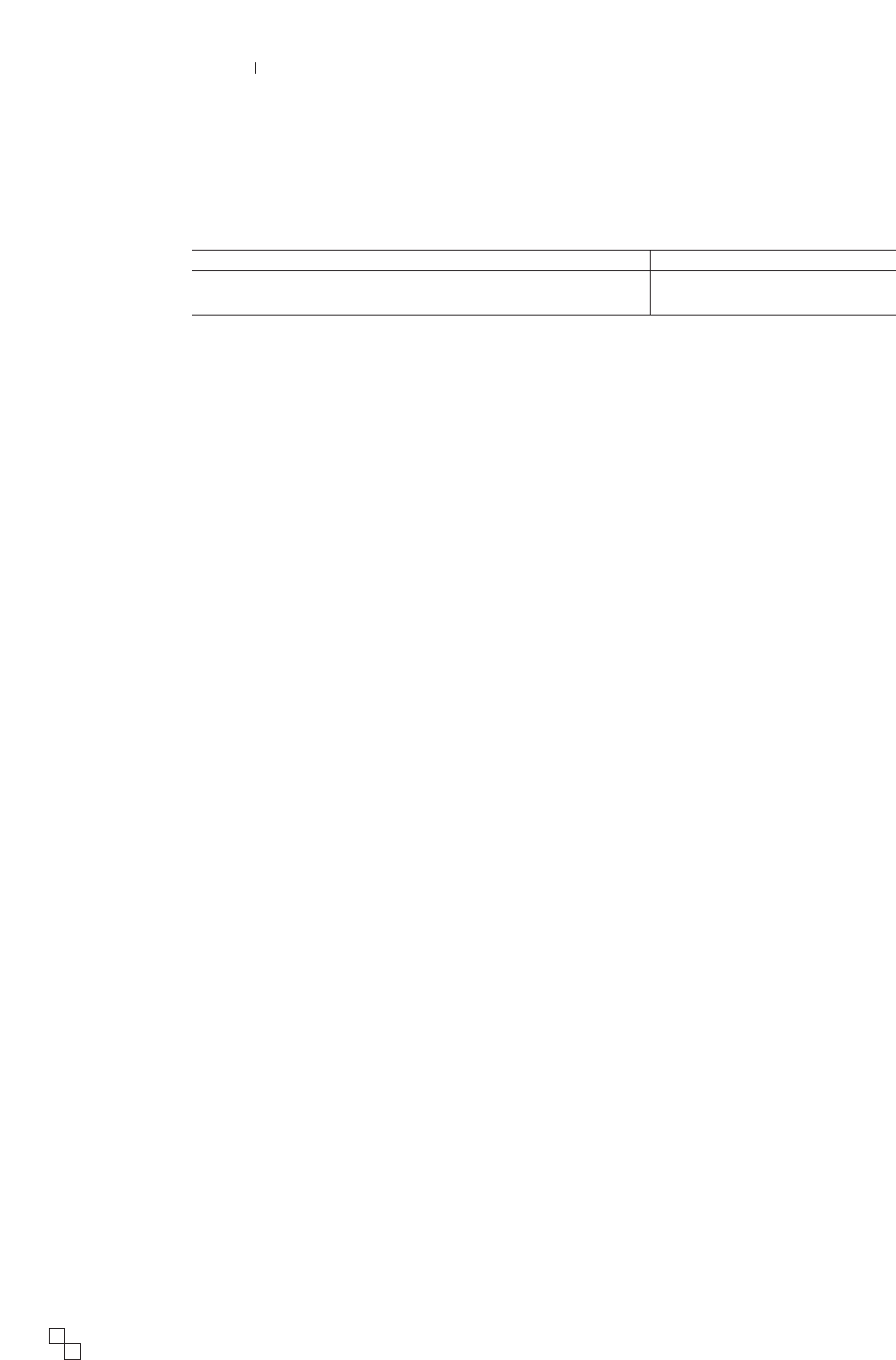

(a) Statement of cash flows –The following summarizes interest and income taxes paid:

FOR THE YEAR ENDED

MARCH 2, 2002 FEBRUARY 28, 2001 FEBRUARY 29, 2000

Interest paid during the year $ 779 $ 456 $ –

Income taxes paid during the year 967 897 756

(b) Other information –Included in Selling, Marketing and Administration expense is advertising expense, which

includes media, agency and promotional expenses, of $18,549 (2001 – $15,932).

The foreign currency translation loss amounted to $1,042 (2001 –gain of $423).

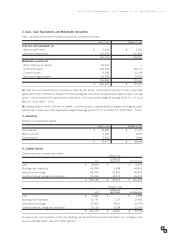

15. Financial Instruments

The majority of the Company’s revenues in fiscal 2002 are transacted in U.S. dollars and British pounds sterling.

Purchases of raw materials are primarily transacted in U.S. dollars. Certain other expenses, consisting of salaries,

operating costs and manufacturing overhead, are incurred primarily in Canadian dollars. The Company is exposed

to foreign exchange risk as a result of transactions in currencies other than its functional currency of U.S. dollars.

At March 2, 2002 approximately nil % of cash and cash equivalents, 24% of trade receivables and 25% of accounts

payable and accrued liabilities are denominated in foreign currencies (2001 – 3%, 11%, and 27%, respectively). These

foreign currencies include the Canadian Dollar, British Pound, Euro and Japanese Yen.

To mitigate the risks relating to foreign exchange fluctuations, the Company maintains net monetary asset and/or liability

balances in foreign currencies and engages in foreign currency hedging activities through the utilization of derivative

financial instruments. The Company does not purchase or hold any derivative instruments for speculative purposes.

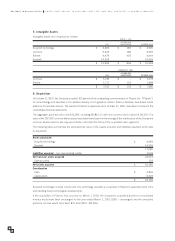

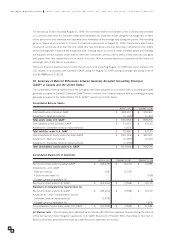

As at March 2, 2002, the Company has entered into forward foreign exchange contracts to sell U.S. dollars and

purchase Canadian dollars with an aggregate notional value of U.S. $87.5 million (2001 – $44.5 million). These

contracts mature at varying dates at a weighted average rate of U.S. $1.00 equals Cdn. $1.567, with the latest being

January 29, 2003. These contracts have been designated as cash flow hedge instruments, with gains and losses on

the hedge instruments being recognized in the same period as, and as part of, the hedged transaction. As at March 2,

2002, the notional loss on these forward contracts was approximately $1.5 million (2001 – $ nil).

As at March 2, 2002, the Company has entered into a forward foreign exchange contract to sell British pounds and

purchase U.S. dollars with a notional value of U.S. $1.1 million at a rate of GBP £1.00 equals U.S. $1.4220. This

contract matures on May 20, 2002. As at March 2, 2002, there was no significant gain or loss on this contract.

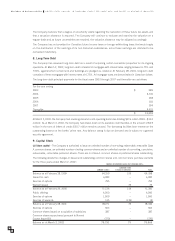

The Company is exposed to credit risk on financial instruments arising from the potential for counter-parties to default

on their contractual obligations to the Company. The Company limits this risk by dealing with financially sound

counter-parties and by continuously monitoring the creditworthiness of all counter-parties.

The Company is exposed to market and credit risk on its investment portfolio. The Company limits this risk by investing

only in highly liquid, investment grade securities and by limiting exposure to any one entity or group of entities. As at

March 2, 2002, no single issuer represented more than 5% of the total cash, cash equivalents and marketable

securities (2001 – one issuer represented 14% of marketable securities).

The Company is exposed to interest rate risk as a result of holding investments of varying maturities up to one year.

The fair value of marketable securities, as well as the investment income derived from the investment portfolio, will

fluctuate with changes in prevailing interest rates. The Company does not currently use interest rate derivative financial

instruments in its investment portfolio.

The Company, in the normal course of business, monitors the financial condition of its customers and reviews the credit

history of each new customer. The Company establishes an allowance for doubtful accounts that corresponds to the

specific credit risk of its customers, historical trends and economic circumstances. The allowance as at March 2, 2002

is $2,218 (2001 – $4,976).

RESEARCH IN MOTION LIMITED UNITED STATES DOLLARS, IN THOUSANDS EXCEPT PER SHARE DATA, AND EXCEPT AS OTHERWISE INDICATED.

3

0