Blackberry 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(i) Intangible assets and goodwill –Intangible assets are stated at cost less accumulated amortization. Intangible

assets are amortized as follows:

Acquired technology - Straight-line over 2 to 5 years

Licences - Lesser of 5 years or the actual number of units

sold during the terms of the licence agreements

Patents - Straight-line over 17 years

Goodwill represents the excess of the purchase price of business acquisitions over the fair value of identifiable net

assets acquired in such acquisitions.

In August 2001, the Canadian Institute of Chartered Accountants (“CICA”) issued Handbook Section 1581, Business

Combinations (“Section 1581”), and Handbook Section 3062, Goodwill and Other Intangible Assets (“Section 3062”).

Section 1581 requires that all business combinations that are initiated after June 30, 2001 be accounted for using

the purchase method of accounting. In addition, Section 1581 specifies criteria for the identification and recording

of intangible assets apart from goodwill. The standards require that the value of the shares issued in a business

combination be measured using the average share price for a reasonable period before and after the date the terms

of the acquisition are agreed to and announced.

Section 3062 eliminates the amortization of goodwill and intangible assets with indefinite lives, but requires an

annual test for impairment. This standard is effective for fiscal years beginning after January 1, 2002. In all cases,

the standard must be adopted at the beginning of a fiscal year. However, this statement prohibits the amortization

of goodwill associated with business combinations that close after June 30, 2001. The Company does not have any

goodwill or indefinite life intangible assets, with the exception of the goodwill generated during the acquisition of

Plazmic Inc., effective October 31, 2001. The Company has not amortized this resulting goodwill in accordance

with the standard. The Company plans to adopt Section 3062 in fiscal 2003 and does not expect any impairment

of goodwill upon adoption.

When circumstances and events warrant a review, the Company evaluates the carrying value of intangible assets

for potential permanent impairment. The carrying value of an intangible asset is considered impaired when the

anticipated net recoverable amount of the asset is less than its carrying value. In that event, a loss is recognized in

an amount equal to the difference.

(j) Investments – Investments in companies where the Company has less than a 20% ownership interest and does

not control or exercise significant influence are accounted for by the cost method. The Company regularly reviews

the carrying values of its investments to determine whether a decline other than temporary in nature has occurred.

When such declines have occurred, investments are written down to reflect the impairment.

(k) Income taxes – Effective March 1, 2000, the Company adopted the new CICA accounting recommendations

related to income taxes on a retroactive basis without restating the financial statements of any prior periods. As a

result of adopting the new accounting recommendations, the previously unrecognized benefit of financing costs of

$1.1 million was reflected as an adjustment to share capital. Retained earnings were unaffected by this change.

Under this new accounting standard, the liability method of tax allocation is used to account for income taxes. Under

this method, future tax assets and liabilities are determined based upon differences between the financial reporting

and tax bases of assets and liabilities, and measured using the substantively enacted tax rates and laws that will be in

effect when the differences are expected to reverse.

(l) Revenue recognition – The Company recognizes revenue when it is realized or realizable and earned. The Company

considers revenue realized or realizable and earned when it has persuasive evidence of an arrangement, the product

has been shipped or the services have been provided to the customer, the sales price is fixed or determinable and

collectibility is reasonably assured. In addition to this general policy, the following are the specific revenue recognition

policies for each major category of revenue.

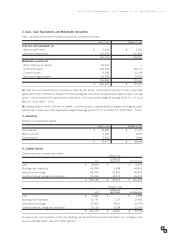

FOR THE YEARS ENDED MARCH 2, 2002, FEBRUARY 28, 2001 AND FEBRUARY 29, 2000

1

2