Blackberry 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

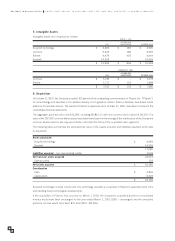

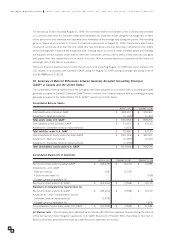

(f) Earnings (loss) per share –The following table sets forth the computation of basic and diluted earnings per

share under U.S. GAAP.

FOR THE YEAR ENDED

MARCH 2, 2002 FEBRUARY 28, 2001 FEBRUARY 29, 2000

Numerator for basic and diluted earnings (loss) per

share available to common stockholders $ (28,321) $ (7,568) $ 10,170

Denominator for diluted earnings (loss) per share –

adjusted weighted average shares and

assumed conversions 78,467 73,555 72,996

Earnings (loss) per share under U.S. GAAP

Basic $ (0.36) $ (0.10) $ 0.15

Diluted $ (0.36) $ (0.10) $ 0.14

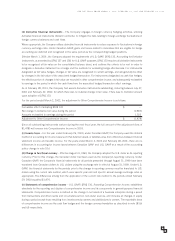

(g) Accounting for stock compensation – Under U.S. GAAP, for any stock option with an exercise price that is less

than the market price on the date of grant, the difference between the exercise price and the market price on the

date of grant is recorded as compensation expense (“intrinsic value based method”). The Company grants stock

options at the fair market value of the shares on the day preceding the date of the grant of the options. Consequently,

no compensation expense is recognized. This method is consistent with U.S. GAAP, APB Opinion 25, Accounting

for Stock Issued to Employees.

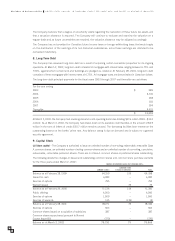

SFAS No. 123, Accounting for Stock-Based Compensation, requires proforma disclosures of net income and earnings

per share, as if the fair value based method as opposed to the intrinsic value based method of accounting for

employee stock options had been applied. The disclosures in the following table show the Company’s net income

and earnings per share on a proforma basis, using the fair value method as determined by using the Black-Scholes

option pricing model, include:

FOR THE YEAR ENDED

MARCH 2, 2002 FEBRUARY 28, 2001 FEBRUARY 29, 2000

Net income (loss) under U.S. GAAP $ (28,321) $ (7,568) $ 10,170

Estimated stock-based compensation costs 21,410 11,782 3,261

Proforma net income (loss) under U.S. GAAP $ (49,731) $ (19,350) $ 6,909

Proforma net income (loss) per common share

Basic $ (0.63) $ (0.26) $ 0.10

Diluted $ (0.63) $ (0.26) $ 0.09

Weighted average number of shares (000’s)

Basic 78,467 73,555 66,613

Diluted 78,467 73,555 72,996

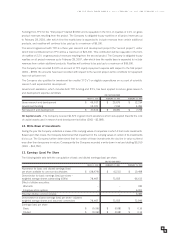

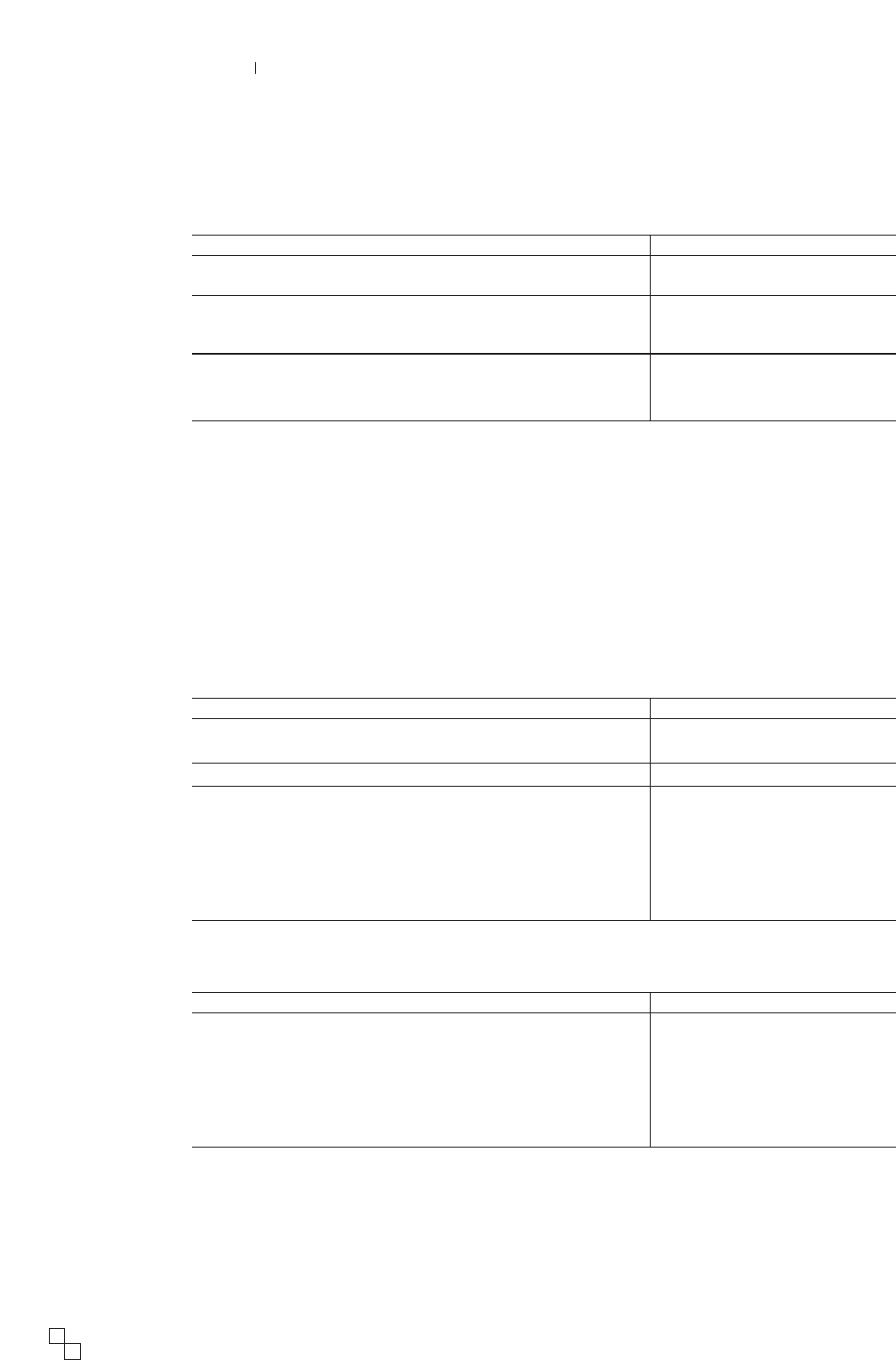

The weighted average fair value of options granted during the following periods were calculated as follows using

the Black-Scholes option pricing model with the following assumptions:

FOR THE YEAR ENDED

MARCH 2, 2002 FEBRUARY 28, 2001 FEBRUARY 29, 2000

Weighted average Black-Scholes value of options $ 12.00 $ 34.82 $ 10.77

Assumptions:

Risk free interest rates 4% 4% 4% - 5%

Expected life in years 3.5 3.5 3.5

Expected dividend yield 0% 0% 0%

Volatility 75% 100% 60% - 90%

RESEARCH IN MOTION LIMITED UNITED STATES DOLLARS, IN THOUSANDS EXCEPT PER SHARE DATA, AND EXCEPT AS OTHERWISE INDICATED.

3

4