Blackberry 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Product defects and product liability

• Software defects and product liability

• Expansion of international operations

• Pursuit of strategic acquisitions and failure to integrate such acquisitions

• Recruitment and retention of personnel as well as dependence upon key personnel

• Changes in Canadian and foreign laws and regulations

• Uncertain continuing availability of government research and development incentives and other tax advantages

• Others as detailed in RIM’s Annual Information Form (AIF) dated July 18, 2001.

If one or more of these risks or uncertainties materialize, or if assumptions underlying the forward-looking statements prove

incorrect, actual results could vary materially from those that are expressed or implied by these forward-looking statements.

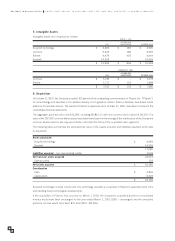

Impact of Accounting Pronouncements Not Yet Implemented

Goodwill and Intangible Assets

In August 2001, the Canadian Institute of Chartered Accountants (“CICA”) issued Handbook Section 1581, Business

Combinations (“Section 1581”), and Handbook Section 3062, Goodwill and Other Intangible Assets (“Section 3062”).

Section 1581 requires that all business combinations that are initiated after June 30, 2001 be accounted for using the

purchase method of accounting. In addition, Section 1581 specifies criteria for the identification of and recording of

intangible assets apart from goodwill. Section 3062 eliminates the amortization of goodwill and intangible assets with

indefinite lives, but requires an annual test for impairment. This standard is effective for fiscal years beginning after

January 1, 2002. In all cases, the standard must be adopted at the beginning of a fiscal year. However, this statement

prohibits the amortization of goodwill associated with business combinations that close after June 30, 2001. The

Company does not have any goodwill or indefinite life intangible assets, with the exception of the goodwill generated

during the acquisition of Plazmic Inc., effective October 31, 2001. The Company has not amortized this resulting

goodwill in accordance with the standard. The Company plans to adopt Section 3062 in fiscal 2003 and does not

expect any impairment of goodwill upon adoption.

Stock-Based Compensation

In November 2001, the CICA issued Handbook Section 3870, Stock-Based Compensation and Other Stock-Based

Payments. This standard requires that certain types of stock-based compensation arrangements be accounted for at fair

value, giving rise to compensation expense, for fiscal years beginning on or after January 1, 2002. The Company plans

to adopt this standard in fiscal 2003 and does not expect a material impact on the consolidated financial position or

results of operation.

Outlook

RIM’s ongoing strategy is to extend its technical and market lead by investing in core research and development of next-

generation products and solutions, fostering new international business relationships, and enhancing its infrastructure

to support global growth.

Research and development remains an integral part of RIM’s long-term strategy. RIM will continue to enhance the

functionality of the BlackBerry solution by developing new innovative handheld devices, creating additional BlackBerry

applications, and enhancing BlackBerry service and software offerings.

Fostering new carrier channels for the sale of BlackBerry, together with continued focus on building internal resources

to support these new channels, is a key focus for RIM’s sales, marketing and business development teams in fiscal

2003. RIM will continue to invest heavily in personnel and selling and marketing initiatives to support our global business

expansion effort with new BlackBerry rollouts in Europe, North America and Asia.

Investing in infrastructure in all facets of the organization is vital for the execution of RIM’s long-term plan. RIM moved

into its new manufacturing facility in March 2002 and RIM’s new R&D facility was completed in November 2001. In

addition, in July 2001 RIM successfully launched SAP, an Enterprise-wide Resource Planning system, which will improve

internal processes and procedures to support future initiatives. Leveraging these new strategic assets, together with

continued investments in infrastructure, will better position RIM to support its long-term strategy.

In summary, RIM anticipates significant growth through ongoing development of the BlackBerry solution, strengthening

new carrier relationships, as well as developing support structures required for international expansion.

2002 ANNUAL REPORT RESEARCH IN MOTION LIMITED

5

1