Bed, Bath and Beyond 2012 Annual Report Download - page 60

Download and view the complete annual report

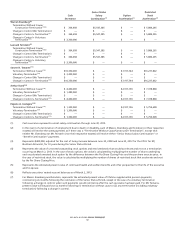

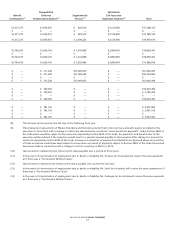

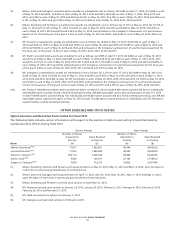

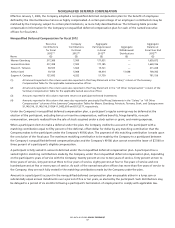

Please find page 60 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(8) All Other Compensation for Mr. Feinstein includes incremental costs to the Company for tax preparation services of $29,825,

$25,063 and $23,822, car service of $80,492, $62,400 and $88,840 and car allowance of $27,208, $28,451 and $26,314, and an

employer nonqualified deferred compensation plan matching contribution of $7,500, $7,350 and $7,350, for fiscal 2012, 2011 and

2010, respectively.

(9) Salary for Mr. Temares includes a deferral of $30,923, $26,615 and $26,000 for fiscal 2012, 2011 and 2010, respectively, pursuant to

the terms of the Company’s Nonqualified Deferred Compensation Plan. Such amount for fiscal 2012 is also reported in the

Nonqualified Deferred Compensation Table below.

(10) The change in pension value for fiscal 2012 and 2011 is an increase in the actuarial present value of the benefits payable under the

supplemental executive retirement benefit agreement with Mr. Temares, which is discussed more fully below. The change in

pension value for fiscal 2010 is the result of Mr. Temares’ increase in base salary for fiscal 2010, which followed a year (fiscal 2009)

in which he received no salary increase. There was no cash payment as a result of this increase. See also ‘‘Potential Payments Upon

Termination or Change in Control — Messrs. Temares, Castagna and Stark’’ below.

(11) All Other Compensation for Mr. Temares includes incremental costs to the Company for car allowance of $14,702, $10,225 and

$7,703 and employer 401(k) plan and nonqualified deferred compensation plan matching contributions of $7,509, $7,347 and

$7,349, for fiscal 2012, 2011 and 2010, respectively.

(12) Salary for Mr. Stark includes a deferral of $10,154, $10,000 and $10,000 for fiscal 2012, 2011 and 2010 pursuant to the terms of the

Company’s Nonqualified Deferred Compensation Plan. Such amount for fiscal 2012 is also reported in the Nonqualified Deferred

Compensation Table below.

(13) All Other Compensation for Mr. Stark includes incremental costs to the Company for car allowance of $4,757, $2,383 and $3,450

and employer 401(k) plan and nonqualified deferred compensation plan matching contributions of $7,505, $7,346 and $7,347, for

fiscal 2012, 2011 and 2010, respectively. Additionally, during fiscal 2010, the Compensation Committee determined to pay Mr. Stark

$185,916 in connection with the resolution of certain state tax withholding issues, including professional fees incurred in

connection with the resolution of these issues, for the years 2004 − 2006.

(14) Salary for Mr. Castagna includes a deferral of $127,692, $136,246 and $111,346 for fiscal 2012, 2011 and 2010, respectively,

pursuant to the terms of the Company’s Nonqualified Deferred Compensation Plan. Such amount for fiscal 2012 is also reported in

the Nonqualified Deferred Compensation Table below.

(15) All Other Compensation for Mr. Castagna includes incremental costs to the Company for car allowance of $6,280, $8,046 and

$11,006 and employer 401(k) plan and nonqualified deferred compensation plan matching contributions of $7,502, $7,349 and

$7,349, for fiscal 2012, 2011 and 2010, respectively.

BED BATH & BEYOND PROXY STATEMENT

58