Bed, Bath and Beyond 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

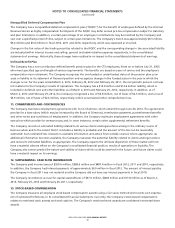

7. PROVISION FOR INCOME TAXES

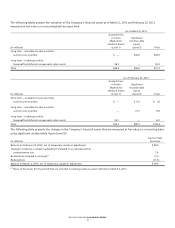

The components of the provision for income taxes are as follows:

FISCAL YEAR ENDED

(in thousands)

March 2,

2013

February 25,

2012

February 26,

2011

Current:

Federal $522,812 $475,280 $426,956

State and local 55,889 74,438 90,689

578,701 549,718 517,645

Deferred:

Federal 15,710 28,695 (7,698)

State and local 1,860 1,538 (8,302)

17,570 30,233 (16,000)

$596,271 $579,951 $501,645

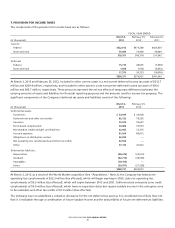

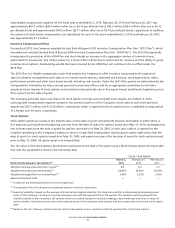

At March 2, 2013 and February 25, 2012, included in other current assets is a net current deferred income tax asset of $212.7

million and $209.4 million, respectively, and included in other assets is a net noncurrent deferred income tax asset of $36.0

million and $43.7 million, respectively. These amounts represent the net tax effects of temporary differences between the

carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The

significant components of the Company’s deferred tax assets and liabilities consist of the following:

(in thousands)

March 2,

2013

February 25,

2012

Deferred tax assets:

Inventories $ 33,699 $ 33,058

Deferred rent and other rent credits 82,123 78,292

Insurance 55,070 53,607

Stock-based compensation 33,486 37,633

Merchandise credits and gift card liabilities 22,683 12,376

Accrued expenses 81,069 80,012

Obligations on distribution centers 42,024 —

Net operating loss carryforwards and other tax credits 42,506 —

Other 57,129 47,422

Deferred tax liabilities:

Depreciation (40,276) (25,510)

Goodwill (42,719) (36,590)

Intangibles (78,106) —

Other (39,957) (27,228)

$248,731 $253,072

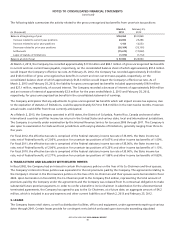

At March 2, 2013, as a result of the World Market acquisition (See ‘‘Acquisitions,’’ Note 2), the Company has federal net

operating loss carryforwards of $22.3 million (tax effected), which will begin expiring in 2025, state net operating loss

carryforwards of $9.3 million (tax effected), which will expire between 2012 and 2031, California state enterprise zone credit

carryforwards of $9.9 million (tax effected), which have no expiration dates but require taxable income in the enterprise zone

to be realizable and other tax credits of $1.0 million (tax effected).

The Company has not established a valuation allowance for the net deferred tax asset as it is considered more likely than not

that it is realizable through a combination of future taxable income and the deductibility of future net deferred tax liabilities.

BED BATH & BEYOND 2012 ANNUAL REPORT

29