Bed, Bath and Beyond 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

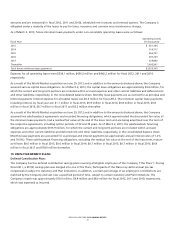

amounts and are immaterial in fiscal 2012, 2011 and 2010), scheduled rent increases and renewal options. The Company is

obligated under a majority of the leases to pay for taxes, insurance and common area maintenance charges.

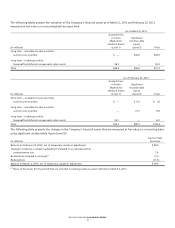

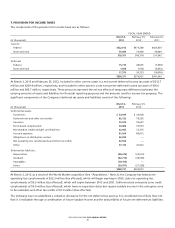

As of March 2, 2013, future minimum lease payments under non-cancelable operating leases were as follows:

Fiscal Year

Operating Leases

(in thousands)

2013 $ 561,104

2014 514,717

2015 456,751

2016 397,763

2017 329,869

Thereafter 1,092,941

Total future minimum lease payments $3,353,145

Expenses for all operating leases were $536.1 million, $456.2 million and $442.2 million for fiscal 2012, 2011 and 2010,

respectively.

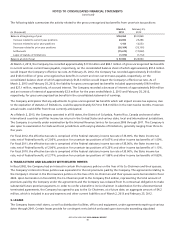

As a result of the World Market acquisition on June 29, 2012 and in addition to the amounts disclosed above, the Company

assumed various capital lease obligations. As of March 2, 2013, the capital lease obligations are approximately $4.4 million, for

which the current and long-term portions are included within accrued expenses and other current liabilities and deferred rent

and other liabilities, respectively, in the consolidated balance sheet. Monthly lease payments are accounted for as principal and

interest payments. Interest expense for all capital leases was $0.4 million for fiscal 2012. The minimum capital lease payments,

including interest, by fiscal year are: $1.1 million in fiscal 2013, $0.9 million in fiscal 2014, $0.8 million in fiscal 2015, $0.8

million in fiscal 2016, $0.7 million in fiscal 2017 and $3.2 million thereafter.

As a result of the World Market acquisition on June 29, 2012 and in addition to the amounts disclosed above, the Company

assumed two sale/leaseback agreements and recorded financing obligations, which approximated the discounted fair value of

the minimum lease payments, had a residual fair value at the end of the lease term and are being amortized over the term of

the respective agreements, including option periods, of 32 and 35 years. As of March 2, 2013, the sale/leaseback financing

obligations are approximately $105.9 million, for which the current and long-term portions are included within accrued

expenses and other current liabilities and deferred rent and other liabilities, respectively, in the consolidated balance sheet.

Monthly lease payments are accounted for as principal and interest payments (at approximate annual interest rates of 7.2%

and 10.6%). These sale/leaseback financing obligations, excluding the residual fair value at the end of the lease term, mature

as follows: $0.6 million in fiscal 2013, $0.6 million in fiscal 2014, $0.7 million in fiscal 2015, $0.7 million in fiscal 2016, $0.8

million in fiscal 2017 and $78.9 million thereafter.

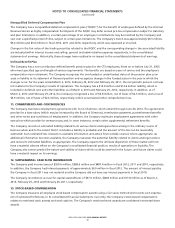

10. EMPLOYEE BENEFIT PLANS

Defined Contribution Plans

The Company has five defined contribution savings plans covering all eligible employees of the Company (‘‘the Plans’’). During

fiscal 2011, a 401(k) savings plan was merged into one of the Plans. Participants of the Plans may defer annual pre-tax

compensation subject to statutory and Plan limitations. In addition, a certain percentage of an employee’s contributions are

matched by the Company and vest over a specified period of time, subject to certain statutory and Plan limitations. The

Company’s match was approximately $10.9 million, $9.4 million and $8.6 million for fiscal 2012, 2011 and 2010, respectively,

which was expensed as incurred.

BED BATH & BEYOND 2012 ANNUAL REPORT

31