Bed, Bath and Beyond 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEASONALITY

The Company’s sales exhibit seasonality with sales levels generally higher in the calendar months of August, November and

December, and generally lower in February.

RECENT ACCOUNTING PRONOUNCEMENTS

In September 2011, the Financial Accounting Standards Board (‘‘FASB’’) issued updated accounting guidance related to testing

goodwill for impairment. This guidance permits an entity to first assess qualitative factors to determine whether it is more

likely than not that the fair value of a reporting unit is less than its carrying value as a basis for determining whether it is

necessary to perform the two-step goodwill impairment test. This guidance is effective for annual and interim goodwill

impairment tests performed for fiscal years beginning after December 15, 2011. During the fourth quarter of fiscal 2012, the

Company adopted this guidance. The adoption of this guidance did not have a material impact on the Company’s consolidated

financial statements.

In July 2012, the FASB issued updated accounting guidance related to testing indefinite lived intangible assets for impairment.

This guidance permits an entity to first assess qualitative factors to determine whether the existence of events and

circumstances indicates that it is more likely than not that the fair value of an indefinite lived intangible asset is less than its

carrying amount as a basis for determining whether it is necessary to perform the annual impairment analysis. This guidance is

effective for annual and interim indefinite lived intangible asset impairment tests performed for fiscal years beginning after

September 15, 2012. Early adoption is permitted. During the fourth quarter of fiscal 2012, the Company adopted this

guidance. The adoption of this guidance did not have a material impact on the Company’s consolidated financial statements.

INFLATION

The Company does not believe that its operating results have been materially affected by inflation during the past year. There

can be no assurance, however, that the Company’s operating results will not be affected by inflation in the future.

CRITICAL ACCOUNTING POLICIES

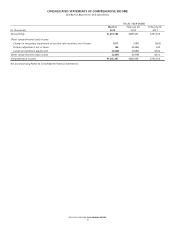

The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires

the Company to establish accounting policies and to make estimates and judgments that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the

reported amounts of revenues and expenses during the reporting period. The Company bases its estimates on historical

experience and on other assumptions that it believes to be relevant under the circumstances, the results of which form the

basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources.

In particular, judgment is used in areas such as inventory valuation, impairment of long-lived assets, goodwill and other

indefinite lived intangible assets, accruals for self insurance, litigation, store opening, expansion, relocation and closing costs,

stock-based compensation and income and certain other taxes. Actual results could differ from these estimates.

Inventory Valuation: Merchandise inventories are stated at the lower of cost or market. Inventory costs are primarily

calculated using the weighted average retail inventory method.

Under the retail inventory method, the valuation of inventories at cost and the resulting gross margins are calculated by

applying a cost-to-retail ratio to the retail values of inventories. The cost associated with determining the cost-to-retail ratio

includes: merchandise purchases, net of returns to vendors, discounts and volume and incentive rebates; inbound freight

expenses; duty, insurance and commissions.

At any one time, inventories include items that have been written down to the Company’s best estimate of their realizable

value. Judgment is required in estimating realizable value and factors considered are the age of merchandise and anticipated

demand. Actual realizable value could differ materially from this estimate based upon future customer demand or economic

conditions.

The Company estimates its reserve for shrinkage throughout the year based on historical shrinkage and any current trends, if

applicable. Actual shrinkage is recorded at year end based upon the results of the Company’s physical inventory counts for

locations at which counts were conducted. For locations where physical inventory counts were not conducted in the fiscal year,

an estimated shrink reserve is recorded based on historical shrinkage and any current trends, if applicable. Historically, the

Company’s shrinkage has not been volatile.

BED BATH & BEYOND 2012 ANNUAL REPORT

11