Bed, Bath and Beyond 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

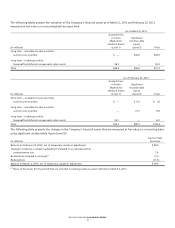

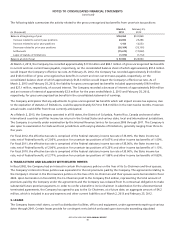

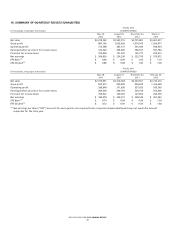

The following tables present the valuation of the Company’s financial assets as of March 2, 2013 and February 25, 2012,

measured at fair value on a recurring basis by input level:

As of March 2, 2013

(in millions)

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Unobservable

Inputs

(Level 3) Total

Long term − available-for-sale securities:

Auction rate securities $ — $49.0 $49.0

Long term − trading securities:

Nonqualified deferred compensation plan assets 28.3 — 28.3

Total $28.3 $49.0 $77.3

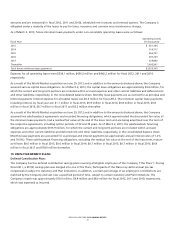

As of February 25, 2012

(in millions)

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Unobservable

Inputs

(Level 3) Total

Short term − available-for-sale securities:

Auction rate securities $ — $ 6.5 $ 6.5

Long term − available-for-sale securities:

Auction rate securities — 73.7 73.7

Long term − trading securities:

Nonqualified deferred compensation plan assets 22.1 — 22.1

Total $22.1 $80.2 $102.3

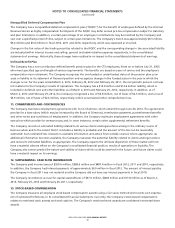

The following table presents the changes in the Company’s financial assets that are measured at fair value on a recurring basis

using significant unobservable inputs (Level 3):

(in millions)

Auction Rate

Securities

Balance on February 25, 2012, net of temporary valuation adjustment $ 80.2

Change in temporary valuation adjustment included in accumulated other

comprehensive loss 1.6

Realized loss included in earnings

(1)

(1.1)

Redemptions (31.7)

Balance on March 2, 2013, net of temporary valuation adjustment $ 49.0

(1)

None of the losses for the period that are included in earnings relate to assets still held on March 2, 2013.

BED BATH & BEYOND 2012 ANNUAL REPORT

27