Bed, Bath and Beyond 2012 Annual Report Download - page 4

Download and view the complete annual report

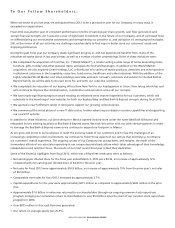

Please find page 4 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.When we wrote to you last year, we anticipated fiscal 2012 to be a productive year for our Company. In many ways, it

exceeded our expectations.

Fiscal 2012 was another year of consistent performance in terms of earnings per share growth, cash flow generation and

overall financial strength, yet it was also a year of significant investment in the future of our Company, and of continued focus

on differentiating our merchandise assortments and strengthening our presence in, and utilization of, emerging technologies.

Still, at the center of all our activities, we challenge ourselves daily to find ways to better serve our customers’ needs and

shopping preferences.

During the past fiscal year our Company made significant progress in, and has experienced benefits from, many of the

initiatives we spoke about in last year’s letter, as well as a number of other undertakings. Some of these initiatives were:

• We completed the acquisition of Cost Plus, Inc. (‘‘World Market’’), a retailer selling a wide range of home decorating items,

furniture, gifts, holiday and other seasonal items, and specialty food and beverages. In addition to the World Market

acquisition, we also acquired Linen Holdings, LLC, a distributor of a variety of textile products, amenities and other goods to

institutional customers in the hospitality, cruise line, food service, healthcare and other industries. With the addition of the

highly talented World Market and Linen Holdings associates and each concept’s customers and vendors to the Bed Bath &

Beyond family, we will be able to do even more for, and with, our collective customers.

• We completed the relocation of our buying offices from New York to our headquarters in Union, New Jersey, which has and

will continue to improve the communication, coordination and execution across all our concepts.

• We have made significant progress toward creating an enhanced omni channel experience for our customers, which will

culminate in the launching of new websites for both our buybuy Baby and Bed Bath & Beyond concepts during fiscal 2013.

• We opened a new fulfillment center in Georgia to support our growing online business.

• We commenced the initial phase of a new IT data center, further advancing our disaster recovery capabilities and supporting

our overall IT systems.

In addition to these initiatives, our joint venture in Mexico opened its third store under the name Bed Bath & Beyond and

rebranded its two existing locations as Bed Bath & Beyond stores. We took this action with our joint venture partners in order

to leverage the Bed Bath & Beyond name as we continue to expand our footprint in Mexico.

As we grow and invest in our businesses to meet the evolving needs of our customers and to face the challenges of an

increasingly competitive retail environment, we continue to foster those aspects of our culture that best help us to enhance

our customers’ overall experience. The ongoing success of our Company has always been, and remains, the result of the

tremendous efforts of our associates operating in our unique decentralized culture which takes advantage of their knowledge,

independence and customer focus. The results of our most recent fiscal year reflect their dedication.

Some of the financial highlights from fiscal 2012, which was a fifty-three week year, were as follows:

• Net earnings per diluted share for the fiscal year ended March 2, 2013 were $4.56, an increase of approximately 12%

compared with net earnings per diluted share of $4.06 for the prior year.

• Net sales for fiscal 2012 were approximately $10.9 billion, an increase of approximately 15% from the prior year’s net sales

of $9.5 billion.

• Comparable store sales for fiscal 2012 increased by approximately 2.7%.

• Capital expenditures for the year were approximately $315 million as compared to approximately $243 million in the prior

year.

• Approximately $1.0 billion in value was returned to our shareholders through our ongoing common stock repurchase

program, bringing our cumulative return to shareholders to over $5.0 billion since the start of our common stock repurchase

programs in 2004.

• Over $875 million in free cash flow was generated.

• Our return on average equity was 25.9%.

To Our Fellow Shareholders:

BED BATH & BEYOND 2012 ANNUAL REPORT

2