Bed, Bath and Beyond 2012 Annual Report Download - page 10

Download and view the complete annual report

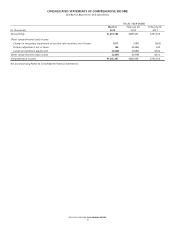

Please find page 10 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest (Expense) Income

Interest expense was $4.2 million in fiscal 2012 and interest income was $1.1 million and $4.5 million in fiscal 2011 and 2010,

respectively. Interest expense for fiscal 2012 increased primarily due to the inclusion of interest expense related to the

sale/leaseback obligations on the distribution facilities acquired as part of the fiscal 2012 acquisitions.

Income Taxes

The effective tax rate was 36.5% for fiscal 2012, 37.0% for fiscal 2011 and 38.8% for fiscal 2010. For fiscal 2012, the tax rate

included an approximate $26.7 million net benefit primarily due to the recognition of favorable discrete state tax items. For

fiscal 2011, the tax rate included an approximate $20.7 million net benefit primarily due to the settlement of certain discrete

tax items from on-going examinations, the recognition of favorable discrete state tax items and from changing the blended

state tax rate of deferred income taxes. For fiscal 2010, the tax rate included an approximate $0.9 million net expense

primarily due to the recognition of certain discrete tax items, partially offset by the changing of the blended state tax rate of

deferred income taxes.

The Company expects continued volatility in the effective tax rate from year to year because the Company is required each

year to determine whether new information changes the assessment of both the probability that a tax position will effectively

be sustained and the appropriateness of the amount of recognized benefit.

EXPANSION PROGRAM

The Company is engaged in an ongoing expansion program involving the opening of new stores in both new and existing

markets, the expansion or relocation of existing stores and the continuous review of strategic acquisitions. In the 21-year

period from the beginning of fiscal 1992 to the end of fiscal 2012, the chain has grown from 34 to 1,471 stores, including the

264 World Market stores (258 stores were acquired on June 29, 2012). Total square footage grew from approximately 0.9

million square feet at the beginning of fiscal 1992 to approximately 42.0 million square feet at the end of fiscal 2012, including

the 264 World Market stores. During fiscal 2012, the Company opened a total of 41 new stores and closed one store, all of

which resulted in the aggregate addition of approximately 5.9 million square feet of store space, including approximately 4.8

million square feet of store space for the 258 World Market stores acquired on June 29, 2012. Additionally, the Company is a

partner in a joint venture which opened one store during fiscal 2012 and as of March 2, 2013, operated a total of three retail

stores in Mexico under the name Bed Bath & Beyond.

During fiscal 2012, the Company acquired Linen Holdings and World Market.

The Company plans to continue to expand its operations and invest in its infrastructure to reach its long term objectives. In

fiscal 2013, the Company expects to open approximately 45 new stores with the possibility of some of these stores pushing

into fiscal 2014. The continued growth of the Company is dependent, in part, upon the Company’s ability to execute its

expansion program successfully. During fiscal 2012, the Company completed the relocation of its Farmingdale and Garden City,

New York offices to its corporate headquarters in Union, New Jersey, which the Company believes improves the

communication, collaboration, coordination and execution across all concepts, activities and platforms.

LIQUIDITY AND CAPITAL RESOURCES

The Company has been able to finance its operations, including its expansion program, entirely through internally generated

funds. For fiscal 2013, the Company believes that it can continue to finance its operations, including its expansion program,

share repurchase program and planned capital expenditures, entirely through existing and internally generated funds. The

Company periodically reviews its alternatives with respect to optimizing its capital structure. Capital expenditures for fiscal

2013, principally for new stores, existing store improvements, information technology enhancements, including omni channel

capabilities, and other projects are planned to be approximately $350.0 million, subject to the timing and composition of the

projects. Some of the initiatives included in capital expenditures for fiscal 2013 are: enhancing the omni channel experience

for its customers through replacing both back end and customer facing systems, upgrading the Company’s mobile sites and

applications, enhancing network communications in the stores and implementing point of sale improvements; building,

equipping and staffing a new information technology data center to enhance disaster recovery capabilities and to support the

Company’s ongoing technology initiatives; and retrofitting energy saving equipment in the stores.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)

BED BATH & BEYOND 2012 ANNUAL REPORT

8