Bed, Bath and Beyond 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For fiscal 2012, the base salary for Mr. Stark increased by $100,000 and the base salary for Mr. Castagna increased by $100,000.

The Compensation Committee determined that these increases were warranted based on the Company’s growth and strong

financial results in 2011 and based on the results and recommendations of JFR’s compensation review discussed above.

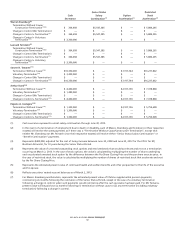

The aggregate equity awards to Mr. Temares for fiscal 2012 increased from fiscal 2011 by $1,525,000 to $11,750,000, with the

increase comprised of $750,000 in stock options and $775,000 in performance-based restricted stock. Of the total of

$11,750,000 of equity awards to Mr. Temares for fiscal 2012, $6,000,000 consisted of performance-based restricted stock (based

on the market value of the Company’s common stock on the date of grant) and $5,750,000 consisted of stock options (based

on the Stock Option Fair Value). Thus, approximately 75% of Mr. Temares’ total compensation for fiscal 2012 is dependent on

Company performance or increase in shareholder value and vests over a five year period.

The equity awards to Messrs. Eisenberg and Feinstein for fiscal 2012 remained unchanged from fiscal 2011 at $2,000,000 for

each such executive, comprised of $1,500,000 of performance-based restricted stock and $500,000 of stock options (valued on

the same basis as Mr. Temares’ awards).

The aggregate equity awards to each of Mr. Stark and Mr. Castagna for fiscal 2012 increased from 2011 by $100,000, with the

increase comprised of performance-based restricted stock.

In the view of the Compensation Committee, the base salary, stock option grants, and performance-based restricted stock

awards constitute compensation packages for the Chief Executive Officer and for the Co-Chairmen, as well as the other named

executive officers, which are appropriate for a company with the revenues and earnings of the Company. The stock options

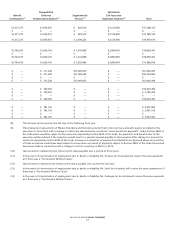

granted to the Chief Executive Officer vest in five equal annual installments, while the stock options awarded to the

Co-Chairmen vest in three equal annual installments, in each case commencing on the first anniversary of the grant date and

based on continued service to the Company. The restricted stock awards to each such executive are conditioned on the

performance-based test described above with time vesting in five equal annual installments, in each case commencing on the

first anniversary of the grant date and based on continued service to the Company.

For further discussion related to equity grants to the named executive officers, see ‘‘Potential Payments Upon Termination or

Change in Control’’ below.

Other Benefits

The Company provides the named executive officers with the same benefits offered to all other associates. The cost of these

benefits constitutes a small percentage of each named executive officer’s total compensation. Key benefits include paid

vacation, premiums paid for long-term disability insurance, a matching contribution to the named executive officer’s

401(k) plan account, and the payment of a portion of the named executive officer’s premiums for healthcare and basic

life insurance.

The Company has a nonqualified deferred compensation plan for the benefit of certain highly compensated associates,

including the named executive officers. The plan provides that a certain percentage of an associate’s contributions may be

matched by the Company, subject to certain limitations. This matching contribution will vest over a specified period of time.

See the ‘‘Nonqualified Deferred Compensation Table’’ below.

The Company provides the named executive officers with certain perquisites including tax preparation services and car service,

in the case of Messrs. Eisenberg and Feinstein, and a car allowance, in the case of all named executive officers. The

Compensation Committee believes all such perquisites are reasonable and consistent with its overall objective of attracting

and retaining our named executive officers.

See the ‘‘All Other Compensation’’ column in the Summary Compensation Table for further information regarding these

benefits and perquisites, and ‘‘Potential Payments Upon Termination or Change in Control’’ below for information regarding

termination and change in control payments and benefits.

Impact of Accounting and Tax Considerations

The Compensation Committee considers the accounting cost associated with equity compensation and the impact of Section

162(m) of the Code, which generally prohibits any publicly held corporation from taking a federal income tax deduction for

compensation paid in excess of $1 million in any taxable year to certain executives, subject to certain exceptions for

performance-based compensation. Stock options and performance-based compensation granted to our named executive

officers are intended to satisfy the performance-based exception and be deductible. Base salary amounts in excess of

$1 million are not deductible by the Company.

BED BATH & BEYOND PROXY STATEMENT

55