Bed, Bath and Beyond 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company does not anticipate that any continuing lack of liquidity in its auction rate securities will affect its ability to

finance its operations, including its expansion program, share repurchase program, and planned capital expenditures. The

Company continues to monitor efforts by the financial markets to find alternative means for restoring the liquidity of these

investments. These investments will remain primarily classified as non-current assets until the Company has better visibility as

to when their liquidity will be restored. The classification and valuation of these securities will continue to be reviewed

quarterly.

Other Fiscal 2012 Information

At March 2, 2013, the Company maintained two uncommitted lines of credit of $100 million each, with expiration dates of

September 1, 2013 and February 28, 2014, respectively. These uncommitted lines of credit are currently and are expected to be

used for letters of credit in the ordinary course of business. During fiscal 2012, the Company did not have any direct

borrowings under the uncommitted lines of credit. As of March 2, 2013, there was approximately $11.6 million of outstanding

letters of credit. Although no assurances can be provided, the Company intends to renew both uncommitted lines of credit

before the respective expiration dates. In addition, as of March 2, 2013, the Company maintained unsecured standby letters of

credit of $76.2 million, primarily for certain insurance programs.

Between December 2004 and December 2012, the Company’s Board of Directors authorized, through share repurchase

programs, the repurchase of $7.450 billion of the Company’s common stock.

Since 2004 through the end of fiscal 2012, the Company has repurchased approximately $5.0 billion of its common stock

through share repurchase programs. The Company has approximately $2.4 billion remaining of authorized share repurchases

as of March 2, 2013. The execution of the Company’s share repurchase program will consider current business and market

conditions.

The Company has authorization to make repurchases from time to time in the open market or through other parameters

approved by the Board of Directors pursuant to existing rules and regulations.

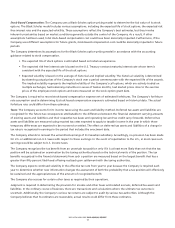

The Company has contractual obligations consisting mainly of operating leases for stores, offices, distribution facilities and

equipment, purchase obligations, long-term sale/leaseback and capital lease obligations and other long-term liabilities which

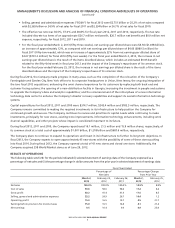

the Company is obligated to pay as of March 2, 2013 as follows:

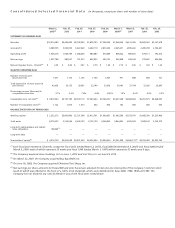

(in thousands) Total Less than 1 year 1 − 3 years 4 − 5 years After 5 years

Operating Lease Obligations

(1)

$3,353,145 $ 561,104 $971,468 $727,632 $1,092,941

Purchase Obligations

(2)

969,151 969,151 — — —

Long-term sale/leaseback and capital

lease obligations

(3)

352,262 9,877 19,689 19,921 302,775

Other long-term liabilities

(4)

456,648 — — — —

Total Contractual Obligations $5,131,206 $1,540,132 $991,157 $747,553 $1,395,716

(1)

The amounts presented represent the future minimum lease payments under non-cancelable operating leases. In addition to minimum rent,

certain of the Company’s leases require the payment of additional costs for insurance, maintenance and other costs. These additional

amounts are not included in the table of contractual commitments as the timing and/or amounts of such payments are not known. As of

March 2, 2013, the Company has leased sites for 31 locations planned for opening in fiscal 2013 or 2014, for which aggregate minimum

rental payments over the term of the leases are approximately $140.1 million and are included in the table above.

(2)

Purchase obligations primarily consist of purchase orders for merchandise.

(3)

Long-term sale/leaseback and capital lease obligations represent future minimum lease payments under the sale/leaseback agreements and

capital lease agreements, acquired through the World Market acquisition.

(4)

Other long-term liabilities are primarily comprised of income taxes payable, deferred rent, workers’ compensation and general liability

reserves and various other accruals and are recorded as Deferred Rent and Other Liabilities and Income Taxes Payable in the Consolidated

Balance Sheet as of March 2, 2013. The amounts associated with these other long-term liabilities have been reflected only in the Total

Column in the table above as the timing and/or amount of any cash payment is uncertain.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)

BED BATH & BEYOND 2012 ANNUAL REPORT

10