Bed, Bath and Beyond 2012 Annual Report Download - page 25

Download and view the complete annual report

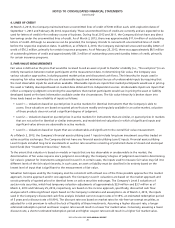

Please find page 25 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company has authorization to make repurchases from time to time in the open market or through other parameters

approved by the Board of Directors pursuant to existing rules and regulations.

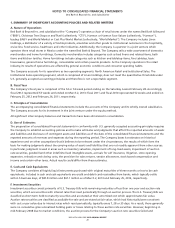

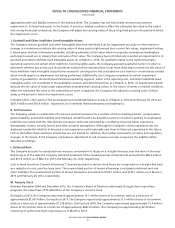

N. Fair Value of Financial Instruments

The Company’s financial instruments include cash and cash equivalents, investment securities, accounts payable and certain

other liabilities. The Company’s investment securities consist primarily of U.S. Treasury securities, which are stated at amortized

cost, and auction rate securities, which are stated at their approximate fair value. The book value of all financial instruments is

representative of their fair values (See ‘‘Fair Value Measurements,’’ Note 5).

O. Revenue Recognition

Sales are recognized upon purchase by customers at the Company’s retail stores or upon delivery for products purchased from

its websites. The value of point-of-sale coupons and point-of-sale rebates that result in a reduction of the price paid by the

customer are recorded as a reduction of sales. Shipping and handling fees that are billed to a customer in a sale transaction

are recorded in sales. Taxes, such as sales tax, use tax and value added tax, are not included in sales.

Revenues from gift cards, gift certificates and merchandise credits are recognized when redeemed. Gift cards have no

provisions for reduction in the value of unused card balances over defined time periods and have no expiration dates.

Sales returns are provided for in the period that the related sales are recorded based on historical experience. Although the

estimate for sales returns has not varied materially from historical provisions, actual experience could vary from historical

experience in the future if the level of sales return activity changes materially. In the future, if the Company concludes that an

adjustment to the sales return accrual is required due to material changes in the returns activity, the reserve will be adjusted

accordingly.

P. Cost of Sales

Cost of sales includes the cost of merchandise, buying costs and costs of the Company’s distribution network including inbound

freight charges, distribution facility costs, receiving costs, internal transfer costs and shipping and handling costs.

Q. Vendor Allowances

The Company receives allowances from vendors in the normal course of business for various reasons including direct

cooperative advertising, purchase volume and reimbursement for other expenses. Annual terms for each allowance include the

basis for earning the allowance and payment terms, which vary by agreement. All vendor allowances are recorded as a

reduction of inventory cost, except for direct cooperative advertising allowances which are specific, incremental and

identifiable. The Company recognizes purchase volume allowances as a reduction of the cost of inventory in the quarter in

which milestones are achieved. Advertising costs were reduced by direct cooperative allowances of $19.8 million, $19.5 million

and $17.6 million for fiscal 2012, 2011 and 2010, respectively.

R. Store Opening, Expansion, Relocation and Closing Costs

Store opening, expansion, relocation and closing costs, including markdowns, asset residual values and projected occupancy

costs, are charged to earnings as incurred.

S. Advertising Costs

Expenses associated with direct response advertising are expensed over the period during which the sales are expected to

occur, generally four to seven weeks, and all other expenses associated with store advertising are charged to earnings as

incurred. Net advertising costs amounted to $250.6 million, $192.5 million and $198.3 million for fiscal 2012, 2011 and 2010,

respectively.

T. Stock-Based Compensation

The Company measures all employee stock-based compensation awards using a fair value method and records such expense in

its consolidated financial statements. The Company adopted the accounting guidance related to stock compensation on

August 28, 2005 (the ‘‘date of adoption’’) under the modified prospective application. Under this application, the Company

records stock-based compensation expense for all awards granted on or after the date of adoption and for the portion of

BED BATH & BEYOND 2012 ANNUAL REPORT

23