Bed, Bath and Beyond 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

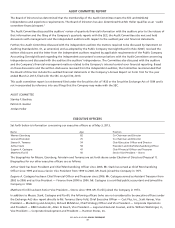

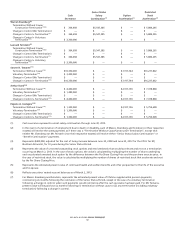

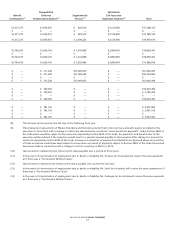

SUMMARY COMPENSATION TABLE FOR FISCAL 2012, FISCAL 2011 AND FISCAL 2010

The following table sets forth information concerning the compensation of the Company’s named executive officers.

Name and

Principal Position

Fiscal

Year

Salary

(1)(2)

($)

Stock

Awards

(3)(4)

($)

Option

Awards

(3)

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

Warren Eisenberg

(5) (6)

2012 1,142,308 1,500,033 499,991 — 136,688 3,279,020

Co-Chairman 2011 1,100,000 1,500,027 500,000 — 115,564 3,215,591

2010 1,100,000 1,500,007 500,008 — 80,072 3,180,087

Leonard Feinstein

(7) (8)

2012 1,142,308 1,500,033 499,991 — 145,025 3,287,357

Co-Chairman 2011 1,100,000 1,500,027 500,000 — 123,264 3,223,291

2010 1,100,000 1,500,007 500,008 — 146,326 3,246,341

Steven H. Temares

(9) (10) (11)

2012 3,478,846 5,999,994 5,749,992 684,106 22,211 15,935,149

Chief Executive Officer 2011 2,894,231 5,225,036 5,000,003 790,392 17,572 13,927,234

2010 2,288,462 4,500,022 4,500,007 4,179,870 15,052 15,483,413

Arthur Stark

(12) (13)

2012 1,513,847 1,350,016 600,003 — 12,262 3,476,128

President and Chief 2011 1,353,558 1,250,004 600,000 — 9,729 3,213,291

Merchandising Officer 2010 1,212,692 1,250,006 547,322 — 196,713 3,206,733

Eugene A. Castagna

(14) (15)

2012 1,326,923 1,100,010 600,003 — 13,782 3,040,718

Chief Financial Officer 2011 1,166,154 1,000,037 600,000 — 15,395 2,781,586

and Treasurer 2010 997,692 1,000,005 547,322 — 18,355 2,563,374

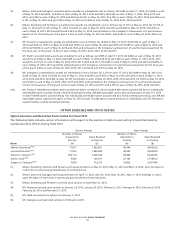

(1) Due to fiscal 2012 being a 53 week year and the timing of the pay cycles, the fiscal 2012 salary amounts include an additional pay

period. Without this additional pay period, fiscal 2012 salaries would have been $1,100,000 each for Messrs. Eisenberg and

Feinstein as their salaries were for the prior six fiscal years and $3,346,154, $1,456,924 and $1,276,923 for Messrs. Temares, Stark

and Castagna, respectively.

(2) Except as otherwise described in this Summary Compensation Table, salaries to named executive officers were paid in cash in fiscal

2012, fiscal 2011 and fiscal 2010, and increases in salary, if any, were effective in May of the fiscal year.

(3) The value of stock awards and option awards represents their respective total fair value on the date of grant calculated in

accordance with Accounting Standards Codification Topic No. 718, ‘‘Compensation — Stock Compensation’’ (‘‘ASC 718’’), without

regard to the estimated forfeiture related to service-based vesting conditions. All assumptions made in the valuations are

contained and described in footnote 13 to the Company’s financial statements in the Company’s Form 10-K for fiscal 2012. Stock

awards and option awards are rounded up to the nearest whole share when converted from dollars to shares. The amounts shown

in the table reflect the Company’s accounting expense and do not necessarily reflect the actual value, if any, that may be realized

by the named executive officers.

(4) The vesting of restricted stock awards depends on (i) the Company’s achievement of a performance-based test for the fiscal year of

the grant, and (ii) assuming the performance-based test is met, time vesting, subject in general to the executive remaining in the

Company’s employ on specific vesting dates. The performance-based tests for fiscal years 2012, 2011 and 2010 were met. The fair

value of the performance-based stock awards are reported above at 100% of target, their maximum value assuming the highest

level of performance.

(5) Salary for Mr. Eisenberg includes a deferral of $317,308, $275,000 and $275,000 for fiscal 2012, 2011 and 2010, respectively,

pursuant to the terms of the Company’s Nonqualified Deferred Compensation Plan. Such amount for fiscal 2012 is also reported in

the Nonqualified Deferred Compensation Table below.

(6) All Other Compensation for Mr. Eisenberg includes incremental costs to the Company for tax preparation services of $29,825,

$25,063 and $23,822, car service of $74,906, $59,740 and $28,140 and car allowance of $24,457, $23,411 and $20,760, and an

employer nonqualified deferred compensation plan matching contribution of $7,500, $7,350 and $7,350, for fiscal 2012, 2011 and

2010, respectively.

(7) Salary for Mr. Feinstein includes a deferral of $317,308, $275,000 and $275,000 for fiscal 2012, 2011 and 2010, respectively, pursuant

to the terms of the Company’s Nonqualified Deferred Compensation Plan. Such amount for fiscal 2012 is also reported in the

Nonqualified Deferred Compensation Table below.

BED BATH & BEYOND PROXY STATEMENT

57