Bed, Bath and Beyond 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

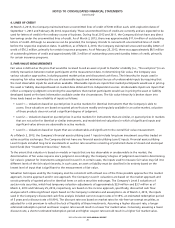

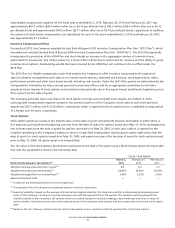

Changes in the Company’s stock options for the fiscal year ended March 2, 2013 were as follows:

(Shares in thousands)

Number of

Stock Options

Weighted Average

Exercise Price

Options outstanding, beginning of period 5,998 $38.96

Granted 503 68.57

Exercised (1,489) 37.67

Forfeited or expired (6) 37.38

Options outstanding, end of period 5,006 $42.32

Options exercisable, end of period 3,155 $38.20

The weighted average fair value for the stock options granted in fiscal 2012, 2011 and 2010 was $22.95, $19.65 and $17.05,

respectively. The weighted average remaining contractual term and the aggregate intrinsic value for options outstanding as of

March 2, 2013 was 3.5 years and $79.2 million, respectively. The weighted average remaining contractual term and the

aggregate intrinsic value for options exercisable as of March 2, 2013 was 2.3 years and $59.1 million, respectively. The total

intrinsic value for stock options exercised during fiscal 2012, 2011 and 2010 was $38.8 million, $101.5 million and $50.5 million,

respectively.

Net cash proceeds from the exercise of stock options for fiscal 2012 were $56.4 million and the net associated income tax

benefit was $18.2 million.

Restricted Stock

Restricted stock awards are issued and measured at fair market value on the date of grant and generally become vested in five

equal annual installments beginning one to three years from the date of grant, subject, in general, to the recipient remaining

in the Company’s employ or service on specified vesting dates. Vesting of restricted stock awarded to certain of the Company’s

executives is dependent on the Company’s achievement of a performance-based test for the fiscal year of grant and, assuming

achievement of the performance-based test, time vesting, subject, in general, to the executive remaining in the Company’s

employ on specified vesting dates. The Company recognizes compensation expense related to these awards based on the

assumption that the performance-based test will be achieved. Vesting of restricted stock awarded to the Company’s other

employees is based solely on time vesting.

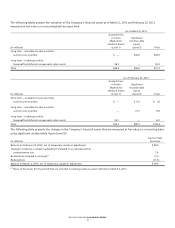

Changes in the Company’s restricted stock for the fiscal year ended March 2, 2013 were as follows:

(Shares in thousands)

Number of

Restricted Shares

Weighted Average

Grant-Date

Fair Value

Unvested restricted stock, beginning of period 4,421 $39.54

Granted 809 68.00

Vested (984) 35.68

Forfeited (183) 43.17

Unvested restricted stock, end of period 4,063 $45.98

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

BED BATH & BEYOND 2012 ANNUAL REPORT

34