Bed, Bath and Beyond 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notice of 2013 Annual Meeting of Shareholders

Proxy Statement

2012 Annual Report

BED BATH & BEYOND INC.

Table of contents

-

Page 1

BED BATH & BEYOND INC. Notice of 2013 Annual Meeting of Shareholders Proxy Statement 2012 Annual Report -

Page 2

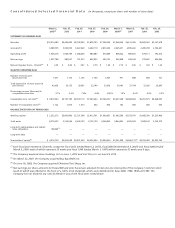

... Linen Holdings, LLC on June 1, 2012 and Cost Plus, Inc. on June 29, 2012. On March 22, 2007, the Company acquired Buy Buy BABY, Inc. On June 19, 2003, the Company acquired Christmas Tree Shops, Inc. Net earnings per share amounts for fiscal 2000 and prior have been adjusted for two-for-one stock... -

Page 3

...the Company adopted Staff Accounting Bulletin 108, ''Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements'' resulting in a one-time net reduction to Shareholders' equity of $34.3 million. (9) BED BATH & BEYOND 2012 ANNUAL REPORT 1 -

Page 4

... World Market and Linen Holdings associates and each concept's customers and vendors to the Bed Bath & Beyond family, we will be able to do even more for, and with, our collective customers. • We completed the relocation of our buying offices from New York to our headquarters in Union, New Jersey... -

Page 5

... 2012, excluding the acquisition of 258 World Market stores, we added 41 new stores consisting of 12 Bed Bath & Beyond stores throughout the United States and Canada, 3 Christmas Tree Shops stores (1 under the name andThat!), 18 buybuy Baby stores, 2 Harmon Face Values stores and 6 World Market... -

Page 6

... registered directly in your name with Bed Bath & Beyond's transfer agent, you are considered the shareholder of record with respect to those shares, and these proxy materials are being sent directly to you. If you hold restricted stock under the Company's 2012 Incentive Compensation Plan (formerly... -

Page 7

... the names Bed Bath & Beyond (''BBB''), Christmas Tree Shops or andThat! (collectively, ''CTS''), Harmon or Harmon Face Values (collectively, ''Harmon''), buybuy BABY and World Market or Cost Plus World Market (collectively, ''World Market''). The Company includes Linen Holdings, a distributor of... -

Page 8

... as: the completion of the relocation of the Company's Farmingdale and Garden City, New York offices to its corporate headquarters in Union, New Jersey; the ongoing integration of the two fiscal 2012 acquisitions; enhancing the omni channel experience for its customers by replacing both back end and... -

Page 9

... store sales percentages are calculated based on an equivalent number of weeks for each annual period. Sales of domestics merchandise accounted for approximately 39%, 40% and 41% of net sales in fiscal 2012, 2011 and 2010, respectively, of which the Company estimates that bed linens accounted... -

Page 10

... the Company's ability to execute its expansion program successfully. During fiscal 2012, the Company completed the relocation of its Farmingdale and Garden City, New York offices to its corporate headquarters in Union, New Jersey, which the Company believes improves the communication, collaboration... -

Page 11

...fiscal 2012. Prior to these tenders, all redemptions of these securities had been at par. The Company will continue to monitor the market for these securities and will expense any permanent changes to the value of the remaining securities, if any, as they occur. BED BATH & BEYOND 2012 ANNUAL REPORT... -

Page 12

... in the Consolidated Balance Sheet as of March 2, 2013. The amounts associated with these other long-term liabilities have been reflected only in the Total Column in the table above as the timing and/or amount of any cash payment is uncertain. (2) (3) (4) BED BATH & BEYOND 2012 ANNUAL REPORT 10 -

Page 13

... accounting principles requires the Company to establish accounting policies and to make estimates and judgments that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the reported... -

Page 14

.... Self Insurance: The Company utilizes a combination of insurance and self insurance for a number of risks including workers' compensation, general liability, automobile liability and employee related health care benefits (a portion of which is paid by its employees). Liabilities associated with the... -

Page 15

... where the ultimate tax outcome is uncertain. Additionally, the Company's various tax returns are subject to audit by various tax authorities. Although the Company believes that its estimates are reasonable, actual results could differ from these estimates. BED BATH & BEYOND 2012 ANNUAL REPORT 13 -

Page 16

... existing tax laws; changes to, or new, accounting standards including, without limitation, changes to lease accounting standards; and the integration of acquired businesses. The Company does not undertake any obligation to update its forward-looking statements. BED BATH & BEYOND 2012 ANNUAL REPORT... -

Page 17

... paid-in capital Retained earnings Treasury stock, at cost Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity See accompanying Notes to Consolidated Financial Statements. $ $ March 2, 2013 February 25, 2012 564,971 449,933 2,466,214... -

Page 18

CONSOLIDATED STATEMENTS OF EARNINGS Bed Bath & Beyond Inc. and Subsidiaries (in thousands, except per share data) Net sales Cost of sales Gross profit Selling, general and administrative expenses Operating profit Interest (expense) income, net Earnings before provision for income taxes Provision ... -

Page 19

... Notes to Consolidated Financial Statements. March 2, 2013 $1,037,788 FISCAL YEAR ENDED February 25, 2012 $989,537 February 26, 2011 $791,333 1,017 146 (3,604) (2,441) $1,035,347 (297) (4,596) (2,086) (6,979) $982,558 (663) 343 4,692 4,372 $795,705 BED BATH & BEYOND 2012 ANNUAL REPORT 17 -

Page 20

... OTHER COMPREHENSIVE INCOME (LOSS) TOTAL Balance at February 27, 2010 Net earnings Other comprehensive (loss) income Shares sold under employee stock option plans, net of taxes Issuance of restricted shares, net Stock-based compensation expense, net Director fees paid in stock Repurchase of... -

Page 21

CONSOLIDATED STATEMENTS OF CASH FLOWS Bed Bath & Beyond Inc. and Subsidiaries (in thousands) Cash Flows from Operating Activities: Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation Stock-based compensation Tax benefit from stock-based ... -

Page 22

... the names Bed Bath & Beyond (''BBB''), Christmas Tree Shops or andThat! (collectively, ''CTS''), Harmon or Harmon Face Values (collectively, ''Harmon''), buybuy BABY and World Market or Cost Plus World Market (collectively, ''World Market''). The Company includes Linen Holdings, a distributor of... -

Page 23

... presented in the balance sheet and reported at the lower of the carrying amount or fair value less costs to sell, and are no longer depreciated. The assets and liabilities of a disposal group classified as held for sale would be presented separately in the BED BATH & BEYOND 2012 ANNUAL REPORT 21 -

Page 24

.... During fiscal 2010, the Company repurchased approximately 15.9 million shares of its common stock at a total cost of approximately $687.6 million. The Company has approximately $2.4 billion remaining of authorized share repurchases as of March 2, 2013. BED BATH & BEYOND 2012 ANNUAL REPORT 22 -

Page 25

....3 million for fiscal 2012, 2011 and 2010, respectively. T. Stock-Based Compensation The Company measures all employee stock-based compensation awards using a fair value method and records such expense in its consolidated financial statements. The Company adopted the accounting guidance related to... -

Page 26

... beginning after September 15, 2012. Early adoption is permitted. During the fourth quarter of fiscal 2012, the Company adopted this guidance. The adoption of this guidance did not have a material impact on the Company's consolidated financial statements. BED BATH & BEYOND 2012 ANNUAL REPORT 24 -

Page 27

... anniversary of the acquisition. Since the date of acquisition, the results of Linen Holdings' operations, which are not material, have been included in the Company's results of operations for the fiscal year ended March 2, 2013. On June 29, 2012, the Company acquired Cost Plus, Inc. (''World Market... -

Page 28

..., with expiration dates of September 1, 2013 and February 28, 2014, respectively. These uncommitted lines of credit are currently and are expected to be used for letters of credit in the ordinary course of business. During fiscal 2012 and 2011, the Company did not have any direct borrowings under... -

Page 29

...earnings(1) Redemptions Balance on March 2, 2013, net of temporary valuation adjustment (1) Auction Rate Securities $ 80.2 1.6 (1.1) (31.7) $ 49.0 None of the losses for the period that are included in earnings relate to assets still held on March 2, 2013. BED BATH & BEYOND 2012 ANNUAL REPORT 27 -

Page 30

...nonqualified deferred compensation plan, are stated at fair market value. The values of these trading investment securities included in the table above are approximately $28.3 million and $22.1 million as of March 2, 2013 and February 25, 2012, respectively. BED BATH & BEYOND 2012 ANNUAL REPORT 28 -

Page 31

... The Company has not established a valuation allowance for the net deferred tax asset as it is considered more likely than not that it is realizable through a combination of future taxable income and the deductibility of future net deferred tax liabilities. BED BATH & BEYOND 2012 ANNUAL REPORT 29 -

Page 32

...9. LEASES The Company leases retail stores, as well as distribution facilities, offices and equipment, under agreements expiring at various dates through 2041. Certain leases provide for contingent rents (which are based upon store sales exceeding stipulated BED BATH & BEYOND 2012 ANNUAL REPORT 30 -

Page 33

... Fiscal Year 2013 2014 2015 2016 2017 Thereafter Total future minimum lease payments Expenses for all operating leases were $536.1 million, $456.2 million and $442.2 million for fiscal 2012, 2011 and 2010, respectively. As a result of the World Market acquisition on June 29, 2012 and in addition... -

Page 34

..., net of estimated forfeitures, in its consolidated financial statements. Currently, the Company's stock-based compensation relates to restricted stock awards and stock options. The Company's restricted stock awards are considered nonvested share awards. BED BATH & BEYOND 2012 ANNUAL REPORT 32 -

Page 35

... market prices close to the exercise prices of the employee stock options and were measured on the stock option grant date. Based on the U.S. Treasury constant maturity interest rate whose term is consistent with the expected life of the stock options. (4) BED BATH & BEYOND 2012 ANNUAL REPORT 33 -

Page 36

...: Weighted Average Grant-Date Fair Value $39.54 68.00 35.68 43.17 $45.98 (Shares in thousands) Unvested restricted stock, beginning of period Granted Vested Forfeited Unvested restricted stock, end of period Number of Restricted Shares 4,421 809 (984) (183) 4,063 BED BATH & BEYOND 2012 ANNUAL... -

Page 37

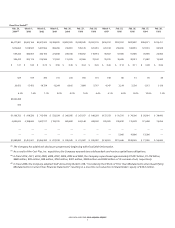

... 1.03 $3,401,477 1,394,877 598,034 597,784 223,912 $ 373,872 $ 1.70 $ 1.68 (in thousands, except per share data) May 28, 2011 FISCAL 2011 QUARTER ENDED August 27, 2011 November 26, 2011 February 25, 2012 Net sales Gross profit Operating profit Earnings before provision for income taxes Provision... -

Page 38

... to the basic consolidated financial statements taken as a whole, present fairly, in all material respects, the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Bed Bath & Beyond Inc.'s internal... -

Page 39

... Bath & Beyond Inc. acquired Linen Holdings, LLC on June 1, 2012 and Cost Plus, Inc. on June 29, 2012 (the ''Acquired Companies''), and management excluded from its assessment of the effectiveness of Bed Bath & Beyond Inc.'s internal control over financial reporting as of March 2, 2013, the Acquired... -

Page 40

... of the assessment) and total net sales of the acquired businesses of approximately $840.4 million. Our management has concluded that, as of March 2, 2013, our internal control over financial reporting is effective based on these criteria. April 30, 2013 BED BATH & BEYOND 2012 ANNUAL REPORT 38 -

Page 41

... 28, 2013: this Notice of 2013 Annual Meeting of Shareholders, Proxy Statement and the Company's 2012 Annual Report are available at www.bedbathandbeyond.com/annualmeeting2013.asp. May 29, 2013 Warren Eisenberg Co-Chairman Leonard Feinstein Co-Chairman BED BATH & BEYOND NOTICE OF ANNUAL MEETING... -

Page 42

... Bed Bath & Beyond Inc.'s transfer agent, American Stock Transfer & Trust Company, you are considered the shareholder of record with respect to those shares, and these proxy materials are being sent directly to you. If you hold restricted stock under the Company's 2012 Incentive Compensation Plan... -

Page 43

... mail Mark, sign and date your proxy card and return it in the postage-paid envelope we've provided, or return it to Bed Bath & Beyond Inc., c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Voting by any of these methods will not affect your right to attend the Annual Meeting and vote in person... -

Page 44

... Statement or the Annual Meeting or would like additional copies of this document or our 2012 Annual Report on Form 10-K, please contact: Bed Bath & Beyond Inc., 650 Liberty Avenue, Union, NJ 07083, Attention: Investor Relations Dept., Telephone: (908) 688-0888. BED BATH & BEYOND PROXY STATEMENT... -

Page 45

...director of the Company since 2001. During the last six years, Mr. Adler also served as a director of Developers Diversified Realty Corp., a shopping center real estate investment trust, and Electronics Boutique, Inc., a mall retailer. Mr. Adler has wide experience and involvement in commercial real... -

Page 46

... fees in stock or cash. In addition to the fees above, each director received an automatic grant of restricted stock under the Company's 2012 Incentive Compensation Plan with a fair market value on the date of the Company's Annual Meeting of Shareholders during such fiscal year (the average of the... -

Page 47

... Incentive Compensation Plan at fair market value on the date of the Company's 2012 Annual Meeting of Shareholders ($60.93 per share, the average of the high and low trading prices on June 22, 2012), such restricted stock to vest on the first trading day following the expiration of any applicable... -

Page 48

... things, recommending to the Board the engagement or discharge of independent auditors, discussing with the auditors their review of the Company's quarterly results and the results of their annual audit and reviewing the Company's internal accounting controls. BED BATH & BEYOND PROXY STATEMENT 46 -

Page 49

... covers directors and officers individually where exposures exist other than those for which the Company is able to provide indemnification. This coverage is from June 1, 2012 through June 1, 2013, at a total cost of approximately $244,625. The primary carrier is Arch Insurance Company. Management... -

Page 50

... of Linen Holdings, LLC and Cost Plus, Inc. and ''audit-related fees'' included fees for procedures required due to a Form S-8 registration statement. In fiscal 2012 and fiscal 2011, ''tax fees'' included fees associated with tax planning, tax compliance (including review of tax returns) and tax... -

Page 51

...control over financial reporting. Based on these discussions and the written disclosures received from the independent auditors, the Committee recommended that the Board of Directors include the audited financial statements in the Company's Annual Report on Form 10-K for the year ended March 2, 2013... -

Page 52

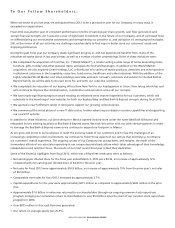

... programs. • Since the initial public offering of its common stock in 1992 through the end of fiscal 2011, the Company experienced an average annual growth rate in net sales of 22.0% and an average annual growth in net earnings per diluted share of 24.8%. BED BATH & BEYOND PROXY STATEMENT 50 -

Page 53

...expenditures, the Company's balance sheet included approximately $1.1 billion of cash and cash equivalents and investment securities. • Since the initial public offering of its common stock in 1992 through the end of fiscal 2012, the Company's stock price has increased at an average annual rate of... -

Page 54

... market review and total compensation recommendations by JFR. The peer group developed by JFR upon which it based its recommendations for fiscal 2010 and 2011 consisted of 18 companies that included direct competitors and retailing companies with a chairman among its named executive officers... -

Page 55

... and other benefits (consisting of health plans, a limited 401(k) plan match and a nonqualified deferred compensation plan) and perquisites. The Company places greater emphasis in the compensation packages for named executive officers on equity incentive compensation rather than cash compensation in... -

Page 56

...'s strong financial performance and Mr. Temares' strong individual performance. According to the analysis prepared by JFR, Mr. Temares' increased base salary for fiscal 2012 was at the 76th percentile of the total cash compensation of the 23-company peer group. BED BATH & BEYOND PROXY STATEMENT 54 -

Page 57

...'s 401(k) plan account, and the payment of a portion of the named executive officer's premiums for healthcare and basic life insurance. The Company has a nonqualified deferred compensation plan for the benefit of certain highly compensated associates, including the named executive officers. The plan... -

Page 58

... the Company's corporate governance guidelines on the recovery of incentive compensation, commonly referred to as a ''clawback policy,'' applicable to the Company's named executive officers (as defined under Item 402(a)(3) of Regulation S-K). The policy appears in the Company's Corporate Governance... -

Page 59

... cash in fiscal 2012, fiscal 2011 and fiscal 2010, and increases in salary, if any, were effective in May of the fiscal year. The value of stock awards and option awards represents their respective total fair value on the date of grant calculated in accordance with Accounting Standards Codification... -

Page 60

... Company for car allowance of $6,280, $8,046 and $11,006 and employer 401(k) plan and nonqualified deferred compensation plan matching contributions of $7,502, $7,349 and $7,349, for fiscal 2012, 2011 and 2010, respectively. (9) (10) (11) (12) (13) (14) (15) BED BATH & BEYOND PROXY STATEMENT... -

Page 61

...salary, benefits or perquisites or, prior to his Senior Status Period, there is a material diminution in the executive's duties or the Company's principal office or the executive's own office location as assigned to him by the Company is relocated and the executive elects to terminate his employment... -

Page 62

... reasonable and lawful directions of the Company's Chief Executive Officer or the Board of Directors, as applicable, commensurate with his titles and duties; (iii) performed his duties with gross negligence; or (iv) been convicted of a felony. Upon a termination of employment by the Company for any... -

Page 63

... (net of applicable withholding taxes) will be deposited into an escrow account to be distributed in nine equal annual installments on each of the following nine anniversaries of the deposit date, subject to acceleration in the case of Mr. Temares' death or a change of control of the Company. The... -

Page 64

... the number of shares of restricted stock that accelerate and vest by the Per Share Closing Price. Represents the estimated present value of continued health and welfare benefits and other perquisites for the life of the executive and his spouse. Reflects executives' vested account balances as... -

Page 65

...of the Code that would have been made in connection with a change in control occurring on March 2, 2013. Cash severance represents three times current salary payable over a period of three years. In the event of a termination of employment due to death or disability, Mr. Temares (or his estate) will... -

Page 66

... granted and restricted stock awarded during fiscal 2012 to each of the named executive officers under the Company's 2012 Incentive Compensation Plan (the ''2012 Plan''). The Company did not grant any non-equity incentive plan awards in fiscal 2012. All Other Option Awards: Number of Securities... -

Page 67

... 12, 2013, (b) 59,222 on each of May 11, 2013 and 2014, (c) 52,786 on each of May 10, 2013, 2014 and 2015, (d) 50,880 on each of May 10, 2013, 2014, 2015 and 2016, and (e) 49,869 on each of May 10, 2013, 2014 and 2016 and 49,870 on each of May 10, 2015 and 2017. BED BATH & BEYOND PROXY STATEMENT 65 -

Page 68

... on each of May 10, 2013 and 2015 and 18,600 on each of May 10, 2014 and 2016, and (e) based on the Company's achievement of a performance-based test for the fiscal year of the grant, 17,414 on each of May 10, 2013, 2014, 2015, 2016 and 2017. Mr. Stark's unvested stock awards are scheduled to vest... -

Page 69

...excluding bonus or incentive compensation, welfare benefits, fringe benefits, noncash remuneration, amounts realized from the sale of stock acquired under a stock option or grant, and moving expenses. When a participant elects to make a deferral under the plan, the Company credits the account of the... -

Page 70

...vote is required to approve this Proposal 3. THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY'S NAMED EXECUTIVE OFFICERS FOR FISCAL 2012 AS DISCLOSED IN THIS PROXY STATEMENT. BED BATH & BEYOND PROXY STATEMENT 68 -

Page 71

..., acquired in the ordinary course of business. The Schedule 13G also states that Davis Selected Advisers, L.P. has the sole power to dispose or to direct the disposition of 22,803,561 shares of common stock. The address of Davis Selected Advisers, L.P. is 2949 East Elvira Road, Suite 101, Tucson, AZ... -

Page 72

... common stock and their common stock holdings for fiscal 2012, we believe that all reporting requirements under Section 16(a) for such fiscal year were met in a timely manner by our directors and executive officers, except Mr. Stark had one late Form 4 filing. BED BATH & BEYOND PROXY STATEMENT 70 -

Page 73

... principal executive offices at 650 Liberty Avenue, Union, New Jersey 07083 between the close of business on February 28, 2014 and the close of business on March 31, 2014, and is otherwise in compliance with the requirements set forth in the Company's Amended By-laws. If the date of the 2014 Annual... -

Page 74

... of the Company's Policy of Ethical Standards for Business Conduct is also provided at this location. Stock Listing Shares of Bed Bath & Beyond Inc. are traded on the NASDAQ Stock Market under the symbol BBBY. Annual Meeting The Annual Meeting of Shareholders will be held at 9 a.m. June 28, 2013, at... -

Page 75

-

Page 76

BED BATH & BEYOND INC. 650 Liberty Avenue Union, NJ 07083 908-688-0888