Bed, Bath and Beyond 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

6

At March 3, 2007, the Company maintained two uncommitted lines of credit of $100 million and $75 million, with expiration

dates of September 3, 2007 and February 28, 2008, respectively. These uncommitted lines of credit are currently and are expected

to be used for letters of credit in the ordinary course of business. In addition, under these uncommitted lines of credit, the

Company can obtain unsecured standby letters of credit. During fiscal 2006, the Company did not have any direct borrowings

under the uncommitted lines of credit. As of March 3, 2007, there was approximately $6.9 million of outstanding letters of credit

and approximately $40.0 million of outstanding unsecured standby letters of credit, primarily for certain insurance programs.

Although no assurances can be provided, the Company intends to renew both uncommitted lines of credit before the respective

expiration dates. The Company believes that during fiscal 2007, internally generated funds will be sufficient to fund its operations,

including its expansion program.

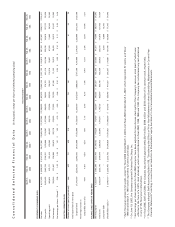

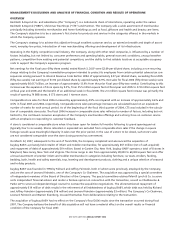

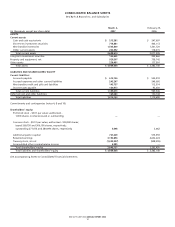

The Company has contractual obligations consisting mainly of operating leases for stores, offices, warehouse facilities and equip-

ment, and purchase obligations which the Company is obligated to pay as of March 3, 2007 as follows:

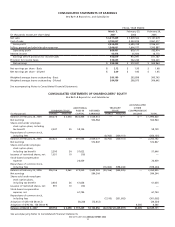

(in thousands) Total Less than 1 year 1-3 years 4-5 years After 5 years

Operating Lease Obligations $ 3,195,864 $ 372,168 $ 743,317 $ 644,898 $ 1,435,481

Purchase Obligations 415,727 415,727 — — —

Total Contractual Obligations $ 3,611,591 $ 787,895 $ 743,317 $ 644,898 $ 1,435,481

As of March 3, 2007, the Company has leased sites for 58 new stores planned for opening in fiscal 2007 or 2008, for which aggre-

gate minimum rental payments over the term of the leases are approximately $325.0 million and are included in the table above.

Purchase obligations primarily consist of purchase orders for merchandise and capital expenditures.

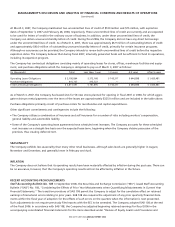

Other significant commitments and contingencies include the following:

• The Company utilizes a combination of insurance and self insurance for a number of risks including workers’ compensation,

general liability and automobile liability.

• Some of the Company’s operating lease agreements have scheduled rent increases. The Company accounts for these scheduled

rent increases on a straight-line basis over the expected lease term, beginning when the Company obtains possession of the

premises, thus creating deferred rent.

SEASONALITY

The Company exhibits less seasonality than many other retail businesses, although sales levels are generally higher in August,

November and December, and generally lower in February and April.

INFLATION

The Company does not believe that its operating results have been materially affected by inflation during the past year. There can

be no assurance, however, that the Company’s operating results will not be affected by inflation in the future.

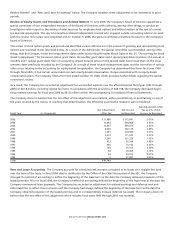

RECENT ACCOUNTING PRONOUNCEMENTS

Staff Accounting Bulletin No. 108 In September 2006, the Securities and Exchange Commission (“SEC”) issued Staff Accounting

Bulletin (“SAB”) No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year

Financial Statements.” The transition provisions of SAB 108 permit the Company to adjust for the cumulative effect on retained

earnings of immaterial errors relating to prior years. SAB 108 also requires the adjustment of any prior quarterly financial state-

ments within the fiscal year of adoption for the effects of such errors on the quarters when the information is next presented.

Such adjustments do not require previously filed reports with the SEC to be amended. The Company adopted SAB 108 at the end

of the fiscal 2006. In accordance with SAB 108, the Company has adjusted beginning retained earnings for fiscal 2006 in the

accompanying consolidated financial statements for the items described under “Review of Equity Grants and Procedures and

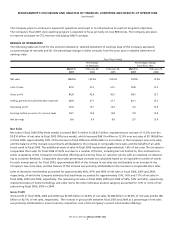

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)