Bed, Bath and Beyond 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

21

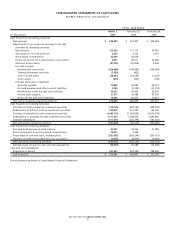

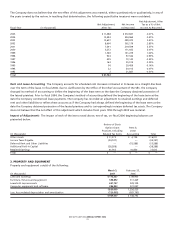

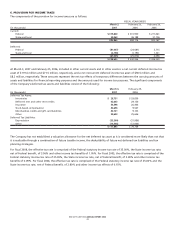

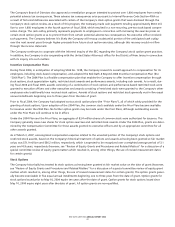

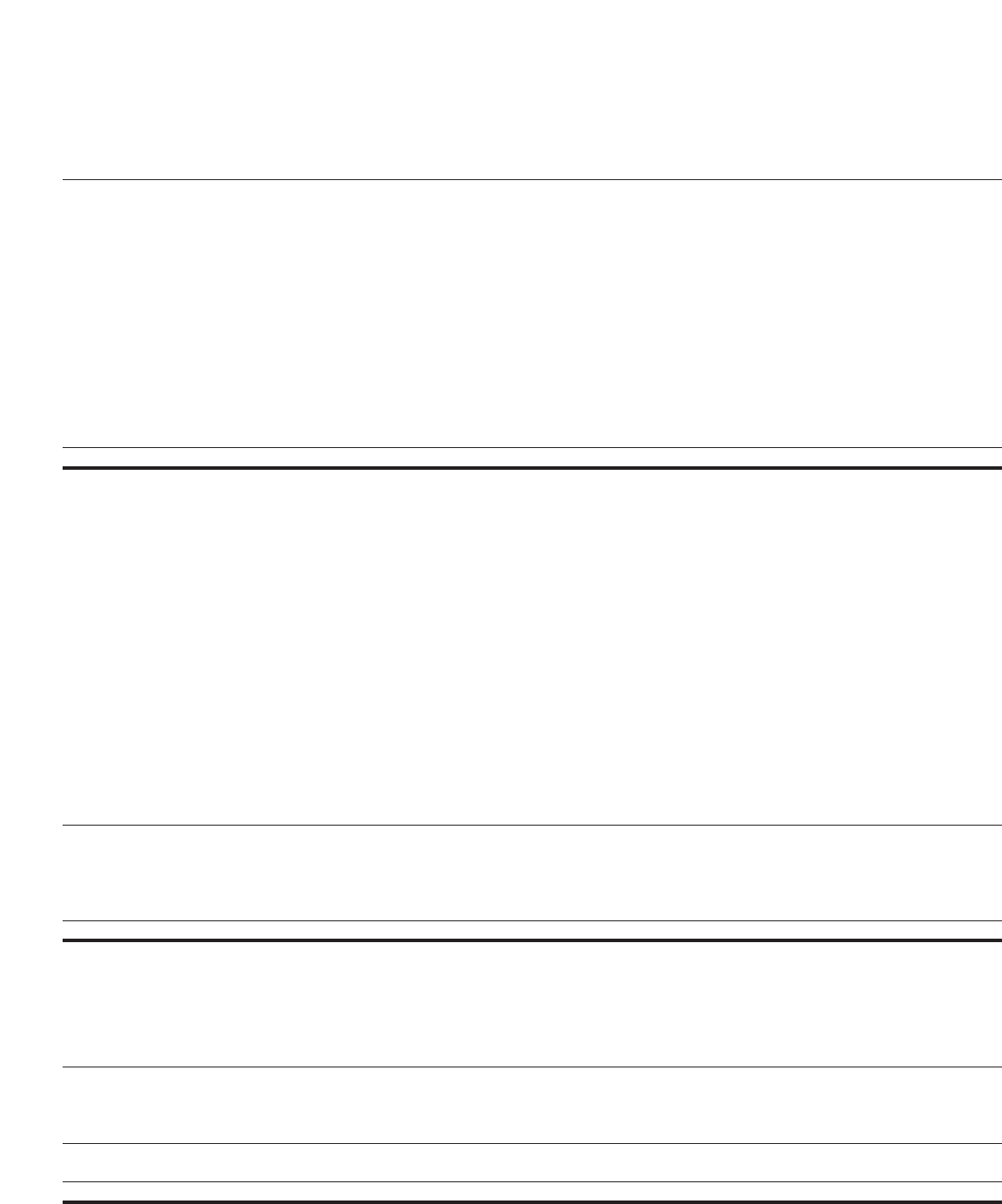

The Company does not believe that the net effect of this adjustment was material, either quantitatively or qualitatively, in any of

the years covered by the review. In reaching that determination, the following quantitative measures were considered:

Net Adjustment, After

Net Adjustment, Net Income Tax as a % of Net

Fiscal Year (in thousands) After Tax As Reported Income As Reported

2005 $ 11,488 $ 572,847 2.01%

2004 12,493 504,964 2.47%

2003 13,607 399,470 3.41%

2002 8,600 302,179 2.85%

2001 7,391 219,599 3.37%

2000 5,272 171,922 3.07%

1999 1,340 131,229 1.02%

1998 923 97,346 0.95%

1997 405 73,142 0.55%

1996 163 55,015 0.30%

1995 56 39,459 0.14%

1994 22 30,013 0.07%

1993 2 21,887 0.01%

Total $ 61,762

Rent and Lease Accounting The Company accounts for scheduled rent increases contained in its leases on a straight-line basis

over the term of the lease. In fiscal 2004, due to clarification by the Office of the Chief Accountant of the SEC, the Company

changed its method of accounting to define the beginning of the lease term as the date the Company obtained possession of

the leased premises. Prior to fiscal 2004, the Company’s method of accounting defined the beginning of the lease term as the

date the Company commenced lease payments. The Company has recorded an adjustment to retained earnings and deferred

rent and other liabilities to reflect these accounts as if the Company had always defined the beginning of the lease term as the

date the Company obtained possession of the leased premises and to correspondingly increase deferred tax assets. The Company

does not believe that the net effect of this adjustment which includes fiscal years 1993 through 2003 was material.

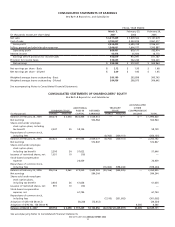

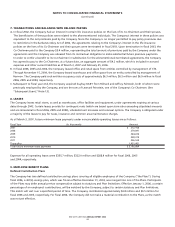

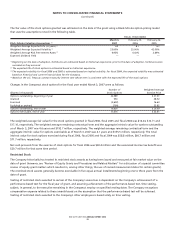

Impact of Adjustments The impact of each of the items noted above, net of tax, on fiscal 2006 beginning balances are

presented below:

Review of Stock

Option Grant Rent &

Practices, Including Lease

(in thousands) Related Tax Items Accounting Total

Other Assets $ 11,273)$ 4,738)$ 16,011)

Income Taxes Payable (34,747) —)(34,747)

Deferred Rent and Other Liabilities —)(15,588) (15,588)

Additional Paid-in Capital (38,288) —)(38,288)

Retained Earnings 61,762)10,850)72,612)

Total $—)$—)$—)

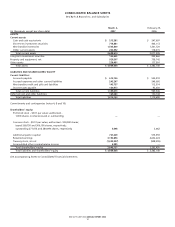

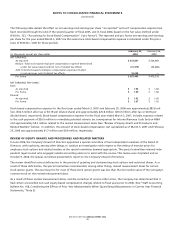

3. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

March 3, February 25,

(in thousands) 2007 2006

Land and buildings $ 112,527)$ 49,900)

Furniture, fixtures and equipment 598,892)517,469)

Leasehold improvements 651,737)528,109)

Computer equipment and software 286,943)231,047)

1,650,099)1,326,525)

Less: Accumulated depreciation and amortization (720,592) (587,783)

$ 929,507)$ 738,742)