Bed, Bath and Beyond 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

20

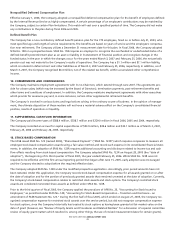

Judgment is required in determining the provision for income taxes and related accruals, deferred tax assets and liabilities. In the

ordinary course of business, there are transactions and calculations where the ultimate tax outcome is uncertain. Additionally, the

Company’s tax returns are subject to audit by various tax authorities. Although the Company believes that its estimates are rea-

sonable, actual results could differ from these estimates.

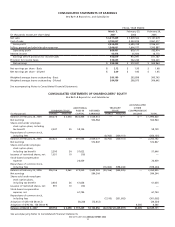

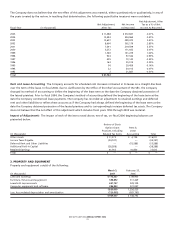

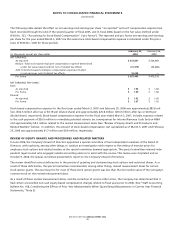

Y. Earnings per Share

The Company presents earnings per share on a basic and diluted basis. Basic earnings per share has been computed by dividing

net earnings by the weighted average number of shares outstanding. Diluted earnings per share has been computed by dividing

net earnings by the weighted average number of shares outstanding including the dilutive effect of stock-based awards as calcu-

lated under the treasury stock method.

Stock-based awards of approximately 8.6 million, 4.9 million and 2.8 million shares were excluded from the computation of

diluted earnings per share as the effect would be anti-dilutive for fiscal 2006, 2005 and 2004, respectively.

2. STAFF ACCOUNTING BULLETIN NO. 108, CONSIDERING THE EFFECTS OF PRIOR YEAR MISSTATEMENTS

WHEN QUANTIFYING MISSTATEMENTS IN CURRENT YEAR FINANCIAL STATEMENTS

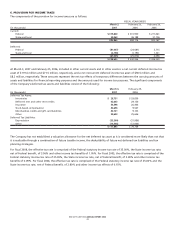

As discussed under Recent Accounting Pronouncements in Note 1, in September 2006, the SEC issued SAB 108. The transition pro-

visions of SAB 108 permit the Company to adjust for the cumulative effect on retained earnings of immaterial errors relating to

prior years. SAB 108 also requires the adjustment of any prior quarterly financial statements within the fiscal year of adoption for

the effects of such errors on the quarters when the information is next presented. Such adjustments do not require previously

filed reports with the SEC to be amended. The Company adopted SAB 108 at the end of fiscal 2006. In accordance with SAB 108,

the Company has adjusted beginning retained earnings for fiscal 2006 in the accompanying consolidated financial statements for

the items described below. The Company considers these adjustments to be immaterial to prior periods.

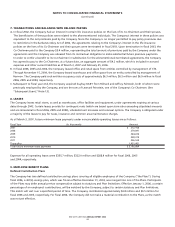

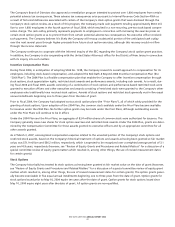

Review of Equity Grants and Procedures and Related Matters In June 2006, the Company’s Board of Directors appointed a

special committee of two independent members of the Board of Directors, with authority, among other things, to conduct an

investigation with respect to the setting of exercise prices for employee stock options and related matters as the special commit-

tee deemed appropriate. The special committee retained independent counsel who engaged outside accounting advisors to assist

with the review. This review was completed and on October 9, 2006, the special committee presented its report to the Company’s

Board of Directors.

The review of stock option grants and procedures identified various deficiencies in the process of granting and documenting stock

options and restricted shares described below. As a result of the deficiencies, the special committee recommended, among other

things, that the Company revise the measurement dates under Accounting Principles Board Opinion No. 25, “Accounting for Stock

Issued to Employees,” for 16 annual option grant dates, 26 monthly grant dates and 2 special grant dates (revisions of 2 annual,

4 monthly and 1 special grant dates have no accounting impact because prices on the revised dates were lower than on the meas-

urement dates previously recorded by the Company). As a result of these revised measurement dates and the correction of various

other errors relating to the accounting for equity-based compensation, the Company has determined that from fiscal year 1993

through fiscal 2005, it had certain unrecorded non-cash equity-based compensation charges associated with its equity-based

compensation plans.

As a result, the Company has recorded an adjustment for unrecorded expense over the affected period (fiscal year 1993 through

2005) of $61.8 million, including related tax items. In accordance with the provisions of SAB 108, the Company decreased begin-

ning retained earnings for fiscal year 2006 by $61.8 million within the accompanying Consolidated Financial Statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)