Bed, Bath and Beyond 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

18

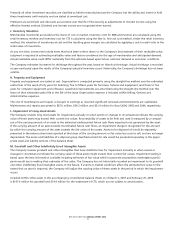

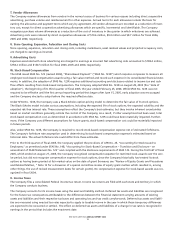

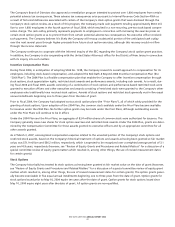

N. Self Insurance

The Company utilizes a combination of insurance and self insurance for a number of risks including workers’ compensation, gen-

eral liability, automobile liability and employee related health care benefits (a portion of which is paid by its employees). Liabilities

associated with the risks that the Company retains are estimated by considering historical claims experience, demographic factors,

severity factors and other actuarial assumptions. Although the Company’s claims experience has not displayed substantial volatility

in the past, actual experience could materially vary from its historical experience in the future. Factors that affect these estimates

include but are not limited to: inflation, the number and severity of claims and regulatory changes. In the future, if the Company

concludes an adjustment to self insurance accruals is required, the liability will be adjusted accordingly.

O. Litigation

The Company records an estimated liability related to various claims and legal actions arising in the ordinary course of business

which is based on available information and advice from outside counsel, where appropriate. As additional information becomes

available, the Company reassesses the potential liability related to its pending litigation and revises its estimates, as appropriate.

The ultimate resolution of these ongoing matters as a result of future developments could have a material impact on the

Company’s earnings. The Company cannot predict the nature and validity of claims which could be asserted in the future, and

future claims could have a material impact on its earnings.

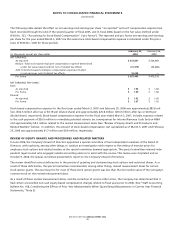

P. Deferred Rent

The Company accounts for scheduled rent increases contained in its leases on a straight-line basis over the term of the lease

beginning as of the date the Company obtained possession of the leased premises. Deferred rent amounted to $74.9 million and

$53.4 million as of March 3, 2007 and February 25, 2006, respectively.

Cash or lease incentives (“tenant allowances”) received pursuant to certain store leases are recognized on a straight-line basis

as a reduction to rent over the lease term. The unamortized portion of tenant allowances is included in deferred rent and other

liabilities. Tenant allowances amounted to $34.5 million and $21.1 million as of March 3, 2007 and February 25, 2006, respectively.

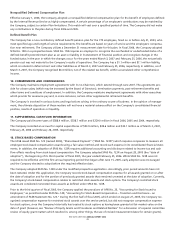

Q. Treasury Stock

The Company’s Board of Directors has authorized repurchases of shares of its common stock for $1 billion in December 2006, for

$200 million in January 2006, for $400 million in October 2005 and for $350 million in December 2004. The Company was author-

ized to make repurchases from time to time in the open market or through other parameters approved by the Board of Directors

pursuant to existing rules and regulations. During fiscal 2006, the Company repurchased approximately 7.5 million shares of its

common stock at a total cost of approximately $301 million excluding brokerage fees. During fiscal 2005, the Company repur-

chased approximately 16.4 million shares of its common stock at a total cost of approximately $598 million excluding brokerage

fees. During fiscal 2004, the Company repurchased approximately 8.8 million shares of its common stock at a total cost of $350

million excluding brokerage fees.

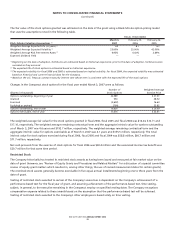

R. Revenue Recognition

Sales are recognized upon purchase by customers at the Company’s retail stores or when shipped for products purchased from its

websites. The value of point of sale coupons and point of sale rebates that result in a reduction of the price paid by the customer

are recorded as a reduction of sales. Shipping and handling fees that are billed to a customer in a sale transaction are recorded in

sales. Revenues from gift cards, gift certificates and merchandise credits are recognized when redeemed.

Sales returns are provided for in the period that the related sales are recorded based on historical experience. Although the esti-

mate for sales returns has not varied materially from historical provisions, actual experience could vary from historical experience

in the future if the level of sales return activity changes materially. In the future, if the Company concludes that an adjustment

to the sales returns accrual is required due to material changes in the returns activity, the reserve will be adjusted accordingly.

S. Cost of Sales

Cost of sales includes the cost of merchandise, buying costs and costs of our distribution network including inbound freight

charges, distribution facility costs, receiving costs and internal transfer costs.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)