Bed, Bath and Beyond 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

27

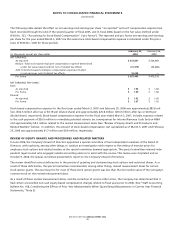

The Company’s Board of Directors also approved a remediation program intended to protect over 1,600 employees from certain

potential adverse tax consequences. These adverse tax consequences arise pursuant to Internal Revenue Code Section 409A as

a result of historical deficiencies associated with certain of the Company’s stock option grants that were disclosed through the

Company’s stock option review. As a result of this program, the Company made cash payments totaling approximately $30.0 mil-

lion to over 1,600 employees in the fourth quarter of fiscal 2006, which resulted in a non-recurring, pre-tax stock-based compen-

sation charge. The cash outlay primarily represents payments to employees in connection with increasing the exercise prices on

certain stock option grants so as to protect them from certain potential adverse tax consequences. No executive officer received

such payments. The Company believes it is likely the Company will recoup a substantial portion of the anticipated cash outlay

over the next several years through higher proceeds from future stock option exercises, although this recovery would not flow

through the income statement.

The Company continues to cooperate with the informal inquiry of the SEC regarding the Company’s stock option grant practices.

In addition, the Company is also cooperating with the United States Attorney’s office for the District of New Jersey in connection

with its inquiry into such matters.

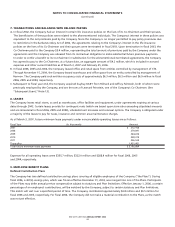

Incentive Compensation Plans

During fiscal 2004, in anticipation of adopting SFAS No. 123R, the Company revised its overall approach to compensation for its

employees, including stock-based compensation, and adopted the Bed Bath & Beyond 2004 Incentive Compensation Plan (the

“2004 Plan”). The 2004 Plan is a flexible compensation plan that enables the Company to offer incentive compensation through

stock options, stock appreciation rights, restricted stock awards and performance awards, including cash awards. As a result, dur-

ing fiscal 2006 and fiscal 2005, awards consisting of a combination of stock options and performance-based restricted stock were

granted to executive officers and other executives and awards consisting of restricted stock were granted to the Company’s other

employees who traditionally have received stock options. Awards of stock options and restricted stock generally vest in five equal

annual installments beginning one to three years from the date of grant.

Prior to fiscal 2004, the Company had adopted various stock option plans (the “Prior Plans”), all of which solely provided for the

granting of stock options. Upon adoption of the 2004 Plan, the common stock available under the Prior Plans became available

for issuance under the 2004 Plan. No further option grants may be made under the Prior Plans, although outstanding awards

under the Prior Plans will continue to be in effect.

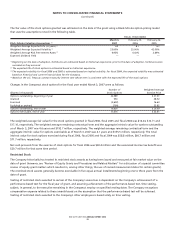

Under the 2004 Plan and the Prior Plans, an aggregate of 83.4 million shares of common stock were authorized for issuance. The

Company generally issues new shares for stock option exercises and restricted stock awards. Under the 2004 Plan, grants are deter-

mined by the Compensation Committee for those awards granted to executive officers and by an appropriate committee for all

other awards granted.

As of March 3, 2007, unrecognized compensation expense related to the unvested portion of the Company’s stock options and

restricted stock awards, based on the Company’s historical treatment of options and awards as having been granted at fair market

value, was $71.9 million and $56.2 million, respectively, which is expected to be recognized over a weighted average period of 3.1

years and 4.9 years, respectively (however, see “Review of Equity Grants and Procedures and Related Matters” for a discussion of a

special committee review of equity grant matters which resulted in, among other things, the use of revised measurement dates

for certain grants).

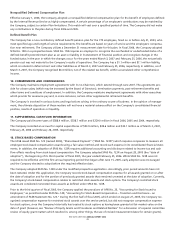

Stock Options

The Company historically has treated its stock options as having been granted at fair market value on the date of grant (however,

see “Review of Equity Grants and Procedures and Related Matters” for a discussion of a special committee review of equity grant

matters which resulted in, among other things, the use of revised measurement dates for certain grants). The option grants gener-

ally become exercisable in five equal annual installments beginning one to three years from the date of grant. Option grants for

stock options issued prior to May 10, 2004 expire ten years after the date of grant. Option grants for stock options issued since

May 10, 2004 expire eight years after the date of grant. All option grants are non-qualified.