Bed, Bath and Beyond 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

29

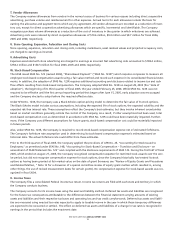

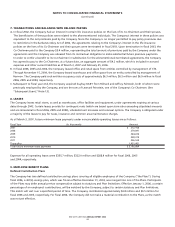

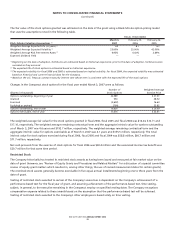

Changes in the Company’s restricted stock for the fiscal year ended March 3, 2007 were as follows:

Weighted Average

Number of Grant-Date

(Shares in thousands) Restricted Shares Fair Value

Unvested restricted stock, beginning of year 1,031)$ 37.00

Granted 1,120)37.55

Vested (91) 37.81

Forfeited (129) 37.42

Unvested restricted stock, end of year 1,931)$ 37.25

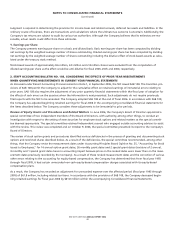

13. SUBSEQUENT EVENT

On March 22, 2007, subsequent to the end of fiscal 2006, the Company completed and announced the acquisition of buybuy

BABY, a privately held retailer of infant and toddler merchandise, for approximately $67 million (net of cash acquired) and

repayment of debt of approximately $19 million. Based in Garden City, New York, buybuy BABY operates a total of 8 stores in

Maryland, New Jersey, New York and Virginia. The stores range in size from approximately 28,000 to 60,000 square feet and

offer a broad assortment of premier infant and toddler merchandise in categories including furniture, car seats, strollers, feeding,

bedding, bath, health and safety essentials, toys, learning and development products, clothing and a unique selection of seasonal

and holiday products.

buybuy BABY was founded in 1996 by Richard and Jeffrey Feinstein, both of whom were previously employed by the Company,

and are the sons of Leonard Feinstein, one of the Company’s Co-Chairmen. The acquisition was approved by a special committee

of independent members of the Board of Directors of the Company. The special committee retained Merrill Lynch & Co. to serve

as its independent financial advisor and render a fairness opinion in connection with the transaction, as well as Chadbourne &

Parke LLP to serve as independent legal counsel to oversee the acquisition negotiations. The aforementioned repayment of

approximately $19 million of debt results in the retirement of all indebtedness of buybuy BABY, which debt was held by Richard

and Jeffrey Feinstein (approximately $16 million) and Leonard Feinstein (approximately $3 million). The Company’s Co-Chairmen,

Leonard Feinstein and Warren Eisenberg, recused themselves from deliberations relating to the transaction.

The acquisition of buybuy BABY had no effect on the Company’s fiscal 2006 results since the transaction occurred during fiscal

2007. The Company believes the benefit of this acquisition will not have a material effect on the overall results or financial condi-

tion of the Company for fiscal 2007.

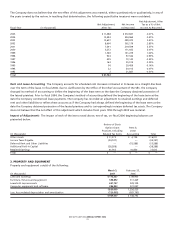

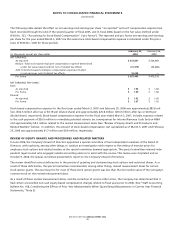

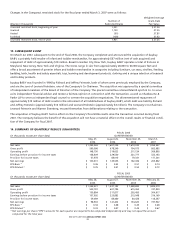

14. SUMMARY OF QUARTERLY RESULTS (UNAUDITED)

FISCAL 2006

(in thousands, except per share data) QUARTER ENDED

May 27, August 26, November 25, March 3,

2006 2006 2006 2007

Net sales $ 1,395,963 $ 1,607,239 $ 1,619,240 $ 1,994,987

Gross profit 590,098 678,249 704,073 862,982

Operating profit 148,750 219,622 211,134 309,895

Earnings before provision for income taxes 158,409 229,550 221,777 323,143

Provision for income taxes 57,978 84,015 79,341 117,301

Net earnings $ 100,431 $ 145,535 $ 142,436 $ 205,842

EPS-Basic (1) $ 0.36 $ 0.52 $ 0.51 $ 0.74

EPS-Diluted (1) $ 0.35 $ 0.51 $ 0.50 $ 0.72

FISCAL 2005

(in thousands, except per share data) QUARTER ENDED

May 28, August 27, November 26, February 25,

2005 2005 2005 2006

Net sales $ 1,244,421 $ 1,431,182 $ 1,448,680 $ 1,685,279

Gross profit 520,781 601,784 615,363 747,820

Operating profit 150,884 217,877 205,493 304,917

Earnings before provision for income taxes 157,992 225,882 215,048 316,169

Provision for income taxes 59,089 84,480 80,428 118,247

Net earnings $ 98,903 $ 141,402 $ 134,620 $ 197,922

EPS-Basic (1) $ 0.34 $ 0.48 $ 0.45 $ 0.68

EPS-Diluted (1) $ 0.33 $ 0.47 $ 0.45 $ 0.67

(1) Net earnings per share (“EPS”) amounts for each quarter are required to be computed independently and may not equal the amount

computed for the total year.