Bed, Bath and Beyond 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

3

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

Bed Bath & Beyond Inc. and subsidiaries (the “Company”) is a nationwide chain of retail stores, operating under the names

Bed Bath & Beyond (“BBB”), Christmas Tree Shops (“CTS”) and Harmon. The Company sells a wide assortment of merchandise

principally including domestics merchandise and home furnishings as well as food, giftware and health and beauty care items.

The Company’s objective is to be a customer’s first choice for products and services in the categories offered, in the markets in

which the Company operates.

The Company’s strategy is to achieve this objective through excellent customer service, an extensive breadth and depth of assort-

ment, everyday low prices, introduction of new merchandising offerings and development of its infrastructure.

Operating in the highly competitive retail industry, the Company, along with other retail companies, is influenced by a number of

factors including, but not limited to, consumer preferences and spending habits, general economic conditions, unusual weather

patterns, competition from existing and potential competitors, and the ability to find suitable locations at acceptable occupancy

costs to support the Company’s expansion program.

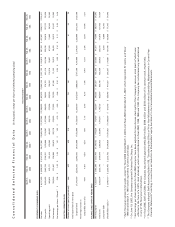

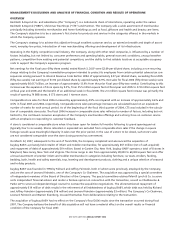

Net earnings for the fiscal year (fifty-three weeks) ended March 3, 2007 were $2.09 per diluted share, including a non-recurring

charge relating to the Company’s remediation program intended to protect its employees from certain potential adverse tax con-

sequences arising pursuant to Internal Revenue Code Section 409A of approximately $.07 per diluted share, exceeding fiscal 2005

(fifty-two weeks) net earnings of $1.92 per diluted share by approximately 8.9%. Net sales for fiscal 2006 (fifty-three weeks) were

approximately $6.617 billion, an increase of approximately 13.9% from the prior fiscal year (fifty-two weeks). Contributing to this

increase was the expansion of store space by 9.0%, from 25.5 million square feet at fiscal year end 2005 to 27.8 million square feet

at fiscal year end 2006 and the benefit of an additional week in fiscal 2006. The 2.3 million square feet increase was primarily the

result of opening 74 BBB stores, 6 CTS stores and 1 Harmon store.

Comparable store sales for fiscal 2006 increased by approximately 4.9% as compared with an increase of approximately 4.6% and

4.5% in fiscal 2005 and 2004, respectively. Comparable store sales percentage increases are calculated based on an equivalent

number of weeks for each annual period. As of the beginning of the fiscal third quarter of 2004, CTS was included in the calcula-

tion of comparable store sales. The fiscal 2006 increase in comparable store sales reflected a number of factors, including but not

limited to, the continued consumer acceptance of the Company’s merchandise offerings and a strong focus on customer service

with an emphasis on responding to customer feedback.

A store is considered a comparable store when it has been open for twelve full months following its grand opening period

(typically four to six weeks). Stores relocated or expanded are excluded from comparable store sales if the change in square

footage would cause meaningful disparity in sales over the prior period. In the case of a store to be closed, such store’s sales

are not considered comparable once the store closing process has commenced.

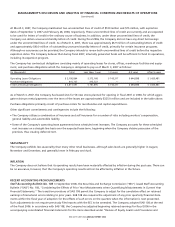

On March 22, 2007, subsequent to the end of fiscal 2006, the Company completed and announced the acquisition of

buybuy BABY, a privately held retailer of infant and toddler merchandise, for approximately $67 million (net of cash acquired)

and repayment of debt of approximately $19 million. Based in Garden City, New York, buybuy BABY operates a total of 8 stores in

Maryland, New Jersey, New York and Virginia. The stores range in size from approximately 28,000 to 60,000 square feet and offer

a broad assortment of premier infant and toddler merchandise in categories including furniture, car seats, strollers, feeding,

bedding, bath, health and safety essentials, toys, learning and development products, clothing and a unique selection of seasonal

and holiday products.

buybuy BABY was founded in 1996 by Richard and Jeffrey Feinstein, both of whom were previously employed by the Company,

and are the sons of Leonard Feinstein, one of the Company’s Co-Chairmen. The acquisition was approved by a special committee

of independent members of the Board of Directors of the Company. The special committee retained Merrill Lynch & Co. to serve

as its independent financial advisor and render a fairness opinion in connection with the transaction, as well as Chadbourne &

Parke LLP to serve as independent legal counsel to oversee the acquisition negotiations. The aforementioned repayment of

approximately $19 million of debt results in the retirement of all indebtedness of buybuy BABY, which debt was held by Richard

and Jeffrey Feinstein (approximately $16 million) and Leonard Feinstein (approximately $3 million). The Company’s Co-Chairmen,

Leonard Feinstein and Warren Eisenberg, recused themselves from deliberations relating to the transaction.

The acquisition of buybuy BABY had no effect on the Company’s fiscal 2006 results since the transaction occurred during fiscal

2007. The Company believes the benefit of this acquisition will not have a material effect on the overall results or financial

condition of the Company for fiscal 2007.