Bed, Bath and Beyond 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

26

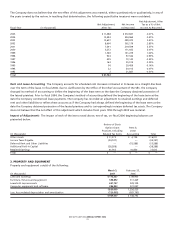

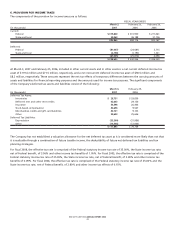

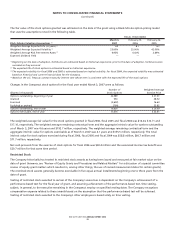

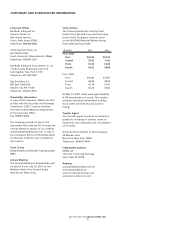

The following table details the effect on net earnings and earnings per share “as reported” and as if compensation expense had

been recorded through the end of the second quarter of fiscal 2005, and in fiscal 2004, based on the fair value method under

SFAS No. 123, “Accounting for Stock-Based Compensation” (“pro forma”). The reported and pro forma net earnings and earnings

per share for the year ended March 3, 2007 are the same since stock-based compensation expense is calculated under the provi-

sions of SFAS No. 123R for those periods.

February 25, February 26,

(in thousands, except per share data) 2006 2005

NET EARNINGS:

As reported $ 572,847)$ 504,964)

Deduct: Total stock-based employee compensation expense determined

under fair value based method, net of related tax effects (31,415) (34,686)

Add: Total stock-based employee compensation expense included

in net earnings, net of related tax effects 16,008)—)

Pro forma $ 557,440)$ 470,278)

NET EARNINGS PER SHARE:

Basic:

As reported $ 1.95)$1.68)

Pro forma $ 1.90)$1.56)

Diluted:

As reported $ 1.92)$1.65)

Pro forma $ 1.87)$1.55)

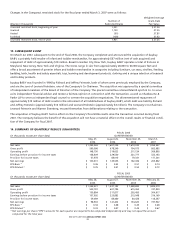

Stock-based compensation expense for the fiscal year ended March 3, 2007 and February 25, 2006 was approximately $82.6 mil-

lion, ($52.6 million after tax or $0.18 per diluted share) and approximately $25.6 million ($16.0 million after tax or $0.05 per

diluted share), respectively. Stock-based compensation expense for the fiscal year ended March 3, 2007, includes expenses related

to the cash payment of $30.0 million to remediate potential adverse tax consequences for Internal Revenue Code Section 409A

and approximately $8.2 million related to the revised measurement dates (See “Review of Equity Grants and Procedures and

Related Matters” below). In addition, the amount of stock-based compensation cost capitalized as of March 3, 2007 and February

25, 2006 was approximately $1.7 million and $0.9 million, respectively.

REVIEW OF EQUITY GRANTS AND PROCEDURES AND RELATED MATTERS

In June 2006, the Company’s Board of Directors appointed a special committee of two independent members of the Board of

Directors, with authority, among other things, to conduct an investigation with respect to the setting of exercise prices for

employee stock options and related matters as the special committee deemed appropriate. The special committee retained inde-

pendent legal counsel who engaged outside accounting advisors to assist with the review. This review was completed and on

October 9, 2006, the special committee presented its report to the Company’s Board of Directors.

The review identified various deficiencies in the process of granting and documenting stock options and restricted shares. As a

result of these deficiencies, the special committee recommended, among other things, revised measurement dates for certain

stock option grants. The exercise price for most of these stock option grants was less than the fair market value of the Company’s

common stock on the revised measurement date.

As a result of these revised measurement dates, and the correction of various other errors, the Company has determined that it

had certain unrecorded non-cash equity-based compensation charges related to fiscal years prior to 2006. (See “Staff Accounting

Bulletin No. 108, Considering the Effects of Prior Year Misstatements When Quantifying Misstatements in Current Year Financial

Statements,” Note 2).

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)