Bed, Bath and Beyond 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

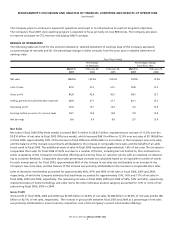

Inventory Valuation: Merchandise inventories are stated at the lower of cost or market. Inventory costs for BBB and Harmon

are calculated using the retail inventory method and inventory cost for CTS is calculated using the first-in, first-out cost method.

Under the retail inventory method, the valuation of inventories at cost and the resulting gross margins are calculated by applying

a cost-to-retail ratio to the retail value of inventories.

At any one time, inventories include items that have been written down to the Company’s best estimate of their realizable value.

Judgment is required in estimating realizable value and factors considered are the age of merchandise and anticipated demand.

Actual realizable value could differ materially from this estimate based upon future customer demand or economic conditions.

The Company estimates its reserve for shrinkage throughout the year, based on historical shrinkage. Actual shrinkage is recorded

at year-end based upon the results of the Company’s physical inventory count. Historically, the Company’s shrinkage has not been

volatile.

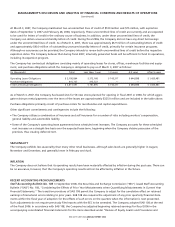

Impairment of Long-Lived Assets: The Company reviews long-lived assets for impairment annually or when events or changes

in circumstances indicate the carrying value of these assets may exceed their current fair values. Recoverability of assets to be held

and used is measured by a comparison of the carrying amount of an asset to the estimated undiscounted future cash flows

expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment

charge is recognized for the amount by which the carrying amount of the asset exceeds the fair value of the assets. Assets to be

disposed of would be separately presented in the balance sheet and reported at the lower of the carrying amount or fair value

less costs to sell, and are no longer depreciated. The assets and liabilities of a disposal group classified as held for sale would be

presented separately in the appropriate asset and liability sections of the balance sheet.

Goodwill and Other Indefinitely Lived Intangible Assets: The Company reviews goodwill and other intangibles that have

indefinite lives for impairment annually or when events or changes in circumstances indicate the carrying value of these assets

might exceed their current fair values. Impairment testing is based upon the best information available including estimates of fair

value which incorporate assumptions marketplace participants would use in making their estimates of fair value. The Company

has not historically recorded an impairment to its goodwill and other indefinitely lived intangible assets. In the future, if events or

market conditions affect the estimated fair value to the extent that an asset is impaired, the Company will adjust the carrying

value of these assets in the period in which the impairment occurs.

Self Insurance: The Company utilizes a combination of insurance and self insurance for a number of risks including workers’

compensation, general liability, automobile liability and employee related health care benefits (a portion of which is paid by its

employees). Liabilities associated with the risks that the Company retains are estimated by considering historical claims experience,

demographic factors, severity factors and other actuarial assumptions. Although the Company’s claims experience has not dis-

played substantial volatility in the past, actual experience could materially vary from its historical experience in the future. Factors

that affect these estimates include but are not limited to: inflation, the number and severity of claims and regulatory changes. In

the future, if the Company concludes an adjustment to self insurance accruals is required, the liability will be adjusted accordingly.

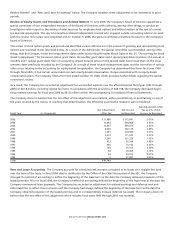

Litigation: The Company records an estimated liability related to various claims and legal actions arising in the ordinary course of

business which is based on available information and advice from outside counsel, where appropriate. As additional information

becomes available, the Company reassesses the potential liability related to its pending litigation and revises its estimates, as

appropriate. The ultimate resolution of these ongoing matters as a result of future developments could have a material impact

on the Company’s earnings. The Company cannot predict the nature and validity of claims which could be asserted in the future,

and future claims could have a material impact on its earnings.

Store Opening, Expansion, Relocation and Closing Costs: Store opening, expansion, relocation and closing costs, including

markdowns, asset residual values and projected occupancy costs, are charged to earnings as incurred.

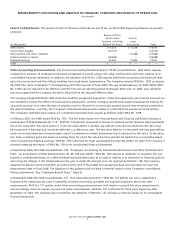

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)

BED BATH& BEYOND ANNUAL REPORT 2006

10